FTSE Supported As Metals Bid Supports Miners

Image Source: Pexels

On Thursday, UK stocks slightly increased with support from a rise in mining and automobile shares. However, there was a sense of caution as investors awaited a significant amount of domestic and global economic data that could offer insights into the future interest rate direction. The automotive and parts sector saw significant gains, rising by 1.6% following reports of a 10% increase in new car sales in Britain for March. Additionally, industrial metal miners also experienced a 1.6% increase, driven by rising copper prices due to a weaker dollar, expectations of global interest rate cuts, and better-than-expected manufacturing data from China earlier in the week. In the mining sector, companies such as Anglo American and Antofagasta saw gains amidst a surge in metal prices. This increase in metal prices has contributed to the positive performance of these mining companies.

Entain, a prominent sports betting and gambling group, recently witnessed a rise in its stock following the announcement of the impending departure of chair Barry Gibson, who has served a four-year term. Stella David, a non-executive director who previously acted as interim CEO, has been appointed as Gibson's successor. The market responded positively to this leadership transition. AstraZeneca witnessed a significant uptick in its stock value following JPMorgan’s reaffirmation of its 'overweight' rating on the shares and placing them on 'positive catalyst watch' leading up to the Q124 results. The bank expressed optimism about a projected seven percentage point increase in sequential top-line growth and an 11 percentage point increase in sequential core EBIT margin, aiming to allay market concerns stemming from Q4’23.

Conversely, Ocado faced a decline as it announced chairman Rick Haythornthwaite's intention to step down at the annual general meeting in April next year. Haythornthwaite cited his expanding commitments as the newly-appointed chair of NatWest as the reason for his decision, leading to some downward pressure on Ocado's stock.

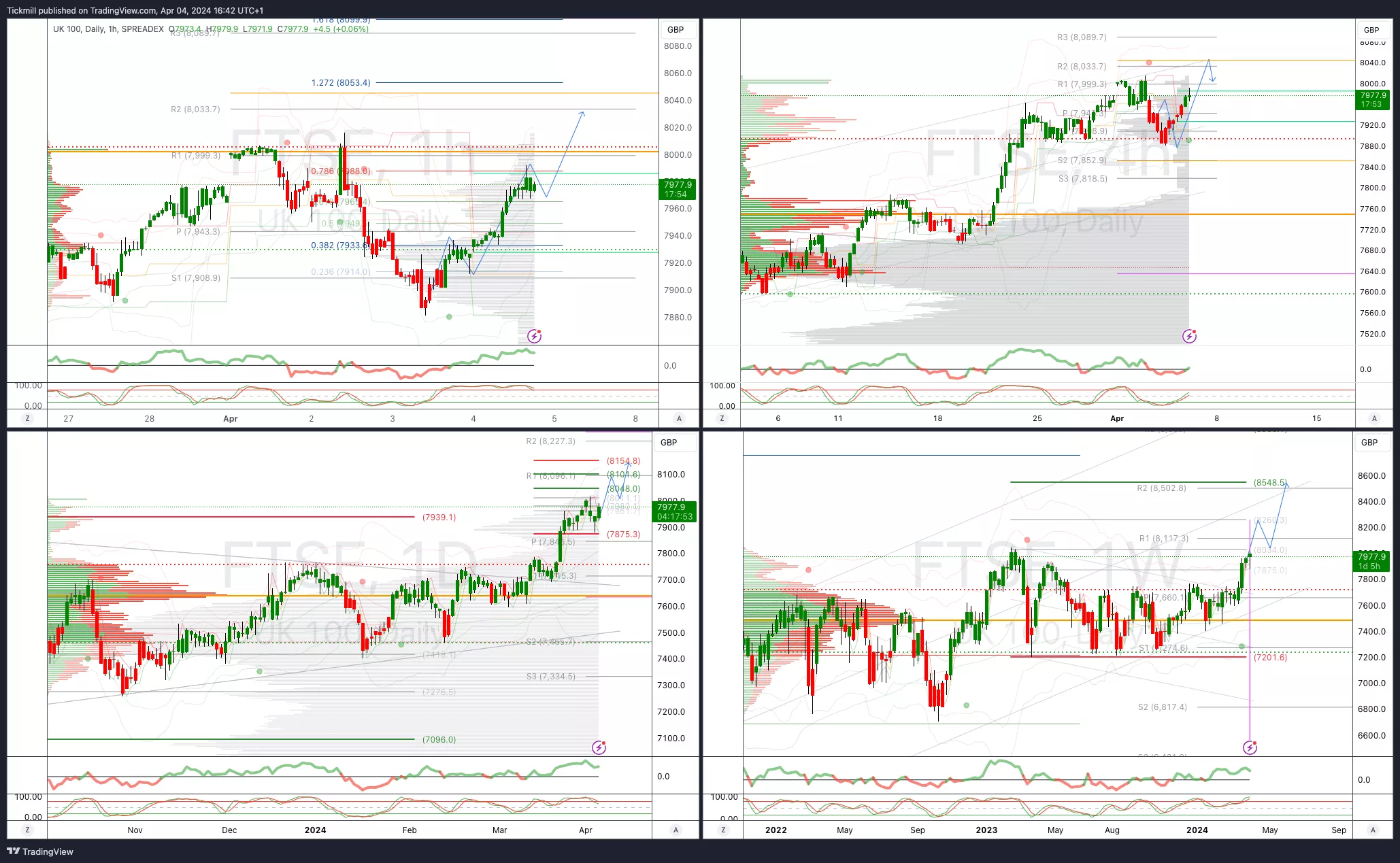

FTSE Bias: Bullish Above Bearish below 7900

- Below 7890 opens 7850

- Primary support 7775

- Primary objective 8000 Target Achieved New Pattern Emerging

- 5 Day VWAP bullish

- 20 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, April 4

FTSE Hovers Around The Flatline Ahead Of Powell Speech

Daily Market Outlook - Wednesday, April 3