FTSE Sentiment Remains Subdued Ahead Of Central Bank Meetings

Image Source: Pexels

London stocks were broadly unchanged on Tuesday as investors assessed mixed corporate earnings and exercised caution ahead of interest rate decisions in the U.S. and UK. The FTSE 100 index is up 0.03%. Investors remained cautious ahead of the Federal Reserve and Bank of England policy decisions later in the week.

Croda International, a UK-based chemicals group, has trimmed its annual profit expectations, leading to a drop in its share price. The company now expects its 2024 adjusted profit before tax to be in the range of 260 million pounds to 280 million pounds, compared to its earlier expectations of 260 million to 300 million pounds. The updated forecast reflects a weaker-than-anticipated performance in the company's life sciences business. As a result, Croda's shares have fallen as much as 6.3% to 3,857 pence, the lowest level since March 2020, and are among the top losers on the FTSE 100 index. The stock has declined nearly 19% so far this year.

UK's ConvaTec reports lower-than-expected profit; maintains outlook. Shares of British medical equipment maker ConvaTec declined 4.6% the stock is among the top losers on the FTSE 100 index The company posts H1 adjusted operating profit of $222.8 million, which was 4% below JP Morgan's estimate ConvaTec reiterates its FY 2024 and medium-term outlook. The stock is down 1.6% year-to-date, including the session's losses.

Shares of BP have risen by 2.1%, reaching 462.4p, making the company one of the top gainers on the blue-chip FTSE 100 index. BP reported a Q2 profit of $2.76 billion, exceeding expectations. The company has also increased its dividend to 8 cents per share, aligning with analysts' forecasts. Additionally, BP will maintain its buyback program at $1.75 billion over the next three months, reaffirming its commitment to a $7 billion buyback for the year. CEO Murray Auchincloss stated, "We are driving focus across the business and reducing costs, all while building momentum in our drive to 2025.". Despite the recent rise, BP's stock is down 2.8% year-to-date as of the last close.

Shares of British wealth manager St James's Place surged as much as 25% to 698.8p, poised for their biggest one-day gain since January 2008. This significant rise follows the company's announcement of a strategic overhaul aimed at cutting costs and rebuilding investor confidence after facing regulatory scrutiny over its charges. St James's Place plans to reduce costs by £80 million by 2026, with an overall target of £100 million in annual savings by 2027, aiming for net savings close to £500 million by 2030. The company also reported net inflows of client cash amounting to £1.9 billion in the first half of the year, surpassing the average analyst forecasts compiled by the company. Additionally, St James's Place is in the process of revamping its fee structure.

UK's Diageo hits more than a four-year low on annual profit miss. Shares fall 6.2% to 2,388p, stock among top percentage losers on FTSE 100 index. Spirits maker reports a 4.8% decline in annual organic operating profit, just short of analyst expectations for a 4.5% decline. Maker of Johnnie Walker whisky and Tanqueray gin says decline largely due to a 21.1% fall in sales in Latin America and the Caribbean. Expects consumer environment to remain challenging in 2025. Stock down 11% YTD, as of last close.

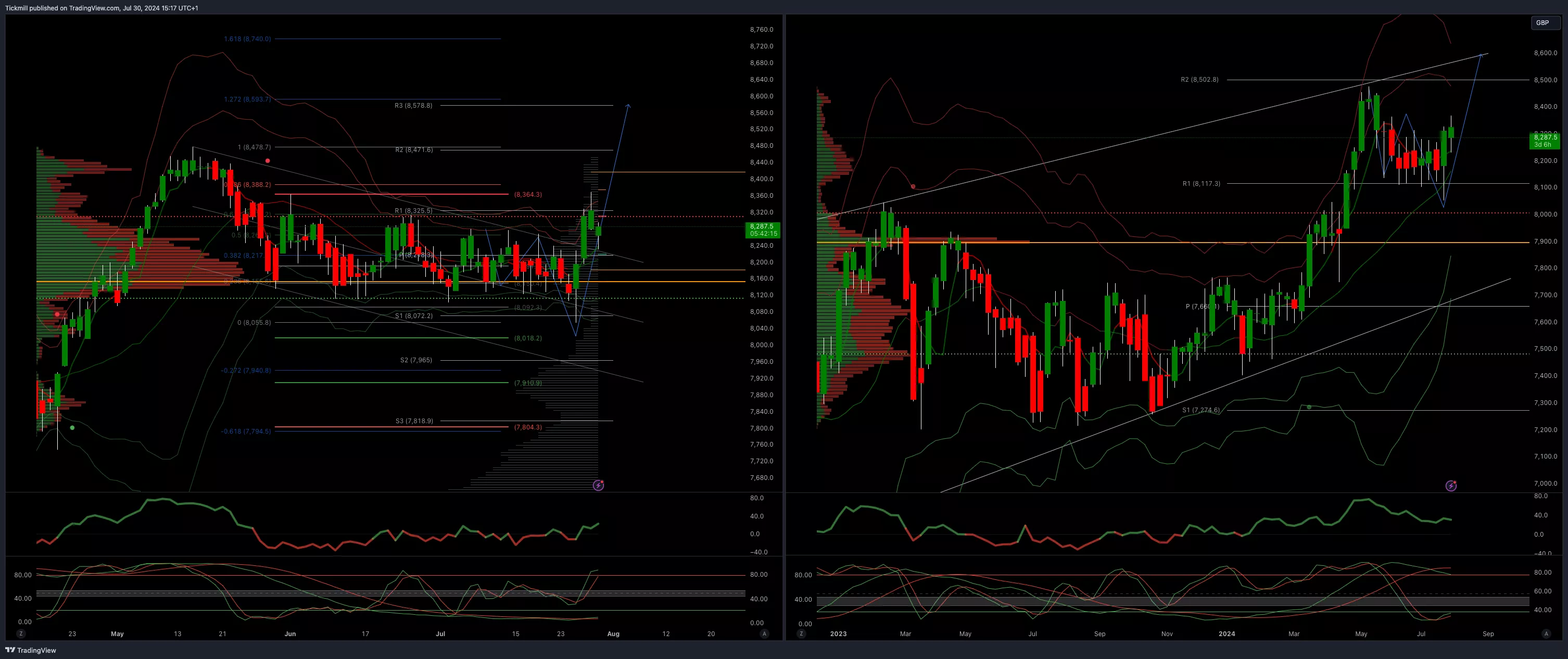

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

- Primary support 8000

- Primary objective 8593

- Daily VWAP Bullish

- Weekly VWAP bullish

(Click on image to enlarge)

More By This Author:

SP500 Daily Trade PlanDaily Market Outlook - Tuesday, July 30

FTSE In The Green, After Strong Weekly Reversal Signal