FTSE Rebounds From Friday’s Lows As Rentokil Surges On Buyout Chatter

Image Source: Pexels

London stocks bounced back on Monday, with broader gains as investors processed corporate updates and evaluated the potential impact of U.S. President Joe Biden dropping out of the reelection race. Rentokil saw a surge after reports of takeover interest, driving the FTSE 100 index up by 0.5% and the FTSE 250 ticked higher.

Rentokil Initial, experienced a surge in its stock price following reports that former BT CEO, Phillip Jansen, is reportedly in discussions with private equity firms to acquire the British pest control and hygiene firm. It is said that Jansen aims to become the executive chairman of Rentokil Initial. Additionally, it is rumored that CVC is one of the firms interested in Rentokil, although it is unclear if they are part of Jansen's consortium. This news has propelled Rentokil's shares to their highest level since October 19, 2023, marking a significant increase compared to its performance earlier this year.

Entain, a global sports betting and gaming group based in the UK, saw a 2.7% rise in shares to 662 pence after appointing Gavin Isaacs, the former chief of U.S.-based lottery games and betting firm Scientific Games Corp, as their new CEO. Isaacs brings over 25 years of experience in the global sports betting, gaming, and lottery industries, with previous roles at companies such as DraftKings. This announcement caused Entain's stock to be among the top gainers on the FTSE 100 index. Despite this positive development, the stock is still down 35.2% year-to-date as of the last close.

On the flip side, travel and leisure stocks slipped 1%, with airlines like Wizz Air and IAG Group falling between 3%-5% after Ryanair missed quarterly profit estimates.

In other news, U.S. President Joe Biden withdrew from the reelection bid on Sunday and endorsed Vice President Kamala Harris as the party's candidate to face Republican Donald Trump in the November election. This led to a slight increase in the S&P 500 and Nasdaq futures. All attention is now focused on the upcoming gross domestic product and crucial inflation data from the U.S., which could provide insight into the Federal Reserve's monetary policy path. Investors will also be closely monitoring corporate earnings in both the U.S. and the UK, with companies like Alphabet and EV maker Tesla in focus.

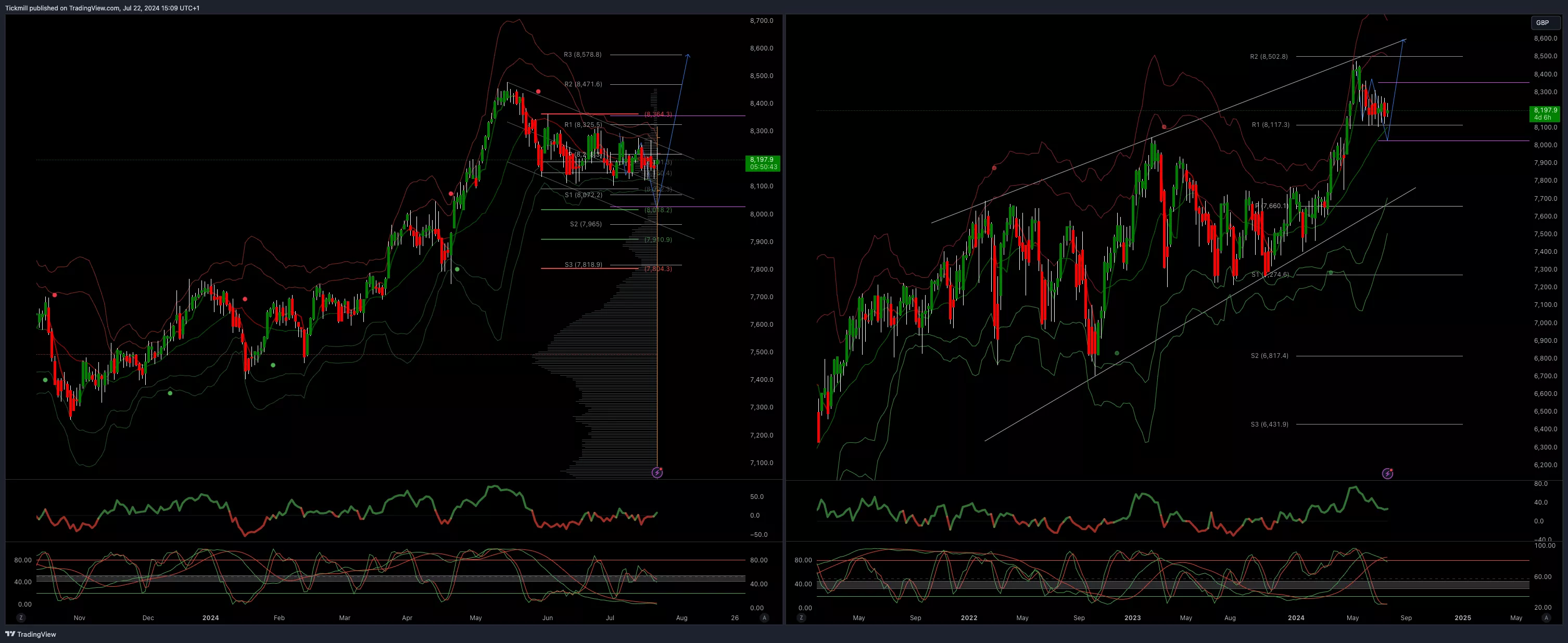

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

- Above 8363 opens 8500

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bearish

- 20 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Monday, July 22FTSE Closing The Week In The Red Amidst Global Tech Outage

Daily Market Outlook - Friday, July 19