FTSE Finishing In The Green

Image Source: Unsplash

On Friday, the UK's FTSE 100 index continued its upward trajectory, registering a gain of 0.32%. This rise was primarily driven by the performance of mining stocks, which benefited from better-than-expected economic data coming out of China. Additionally, the growing belief that global central banks are nearing the conclusion of their monetary tightening cycles contributed to improved market sentiment. Mining companies saw their stocks rise by 0.9% following the release of positive data from China, the world's largest consumer of metals. The data indicated that China's factory output and retail sales had experienced accelerated growth in August. However, concerns loom over declining investment in the property sector, which has been grappling with a crisis. This situation threatens to undermine the effectiveness of various support measures aimed at stabilizing the Chinese economy.

Shares of Burberry Group have seen a 2.9% ending the week top of the blue-chip index, supported by positive economic news from China, a significant market for luxury goods. This surge in share price comes ahead of the first fashion show from the company's new chief designer scheduled for September 18. Broker Stifel has highlighted the arrival of the long-awaited new Spring-Summer collections and products designed by Daniel Lee in stores earlier this month. This launch is accompanied by a heightened marketing campaign, which is expected to gain momentum with the upcoming fashion show. Stifel also commends Burberry's marketing efforts in effectively conveying its new brand aesthetics. This includes the introduction of new brand elements across products, the initiation of the Burberry Streets project in London (with plans to expand to Seoul and Shanghai), a revamped website, and the recent reopening of the flagship Bond Street store. The broker believes that Burberry is well-positioned to catch up in terms of sales momentum with industry leaders. It notes that the company's price structure now aligns with its targeted competitors and that the fundamentals of the brand appear stronger than they did five years ago. Stifel has given Burberry a buy rating and set a price target of 2,500p, reflecting confidence in the company's outlook and potential for growth.

On the negative side of the ledger, BT Group sits at the bottom of the table as investors showed little excitement for the business steps to minimize the environmental impact of energy consumption in its data centers by testing various innovative technologies. The company has partnered with hardware vendors to implement liquid cooling systems for its IT and network equipment. At a sustainability event in Ipswich, BT Group offered insights into several liquid cooling technologies it is actively exploring. These initiatives are part of the company's efforts to transition away from the traditional systems currently in use, aligning with its commitment to environmental sustainability.

Investors are now closely monitoring upcoming interest rate decisions from both the U.S. Federal Reserve and the Bank of England, scheduled for next week. Meanwhile, the European Central Bank hiked its key interest rate to a record 4% yesterday but signaled that this move is likely to be its last in the current cycle.

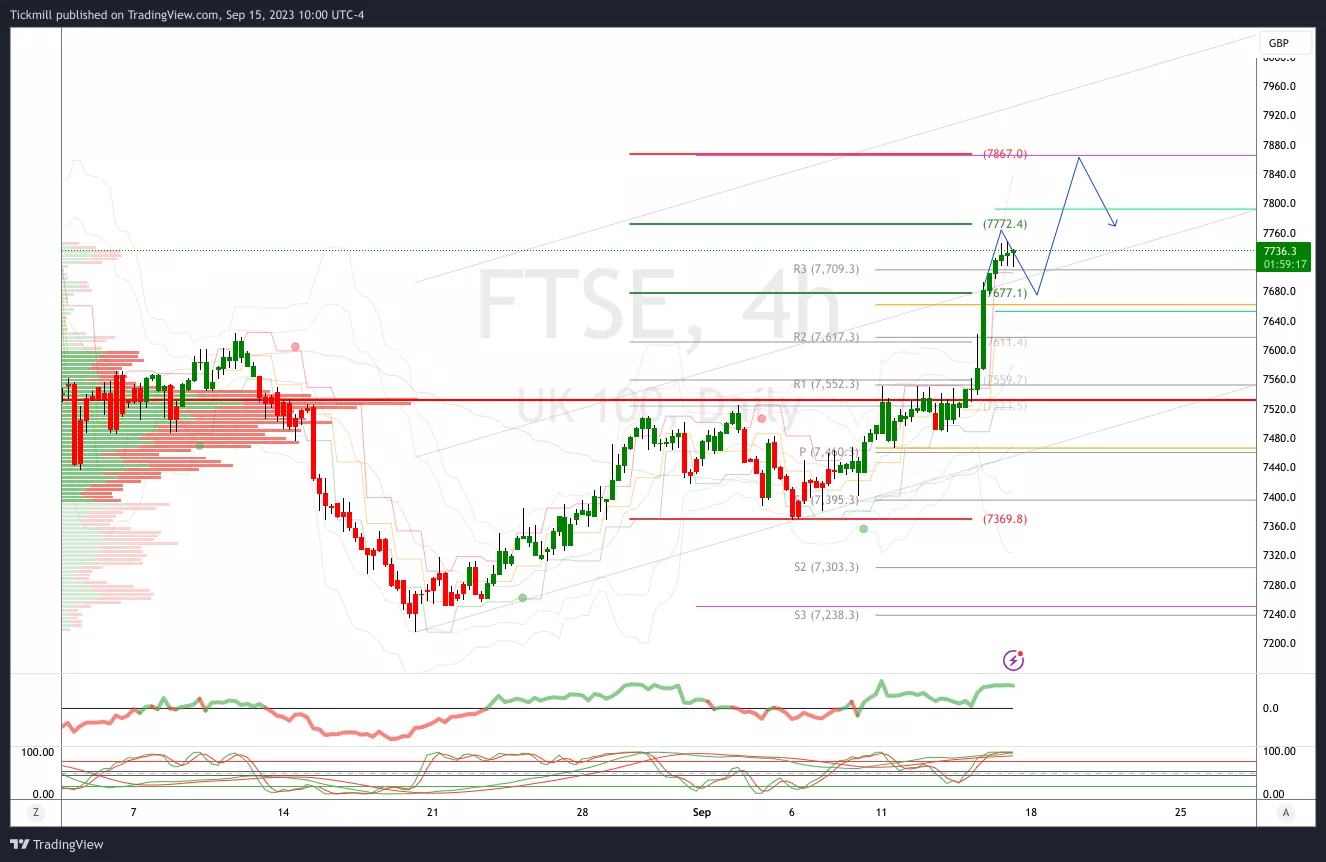

FTSE Bias: Bullish Above Bearish below 7620

- Above 7725 opens 7800

- Primary resistance is 7625

- Primary objective 7858

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Sept. 15FTSE Flying Into The Close

ETHUSD Trading The Correction

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to ...

more