FTSE Finish Line - Friday, Feb.28

Image Source: Pexels

The FTSE 100 in Britain bucked the global downturn on Friday, driven by earnings-related movements in stocks like IAG. International Consolidated Airlines Group, the airline holding company, has seen a 5.3% increase in its stock value following a 38% rise in fourth-quarter profits, reaching 608 million euros, compared to 441 million euros in the previous year. The blue-chip index climbed 0.76%. On the economic front, UK house prices saw a sharper-than-expected rise in February, as buyers rushed to complete purchases ahead of the upcoming stamp duty changes in April, according to the Nationwide Building Society. House prices increased by 0.4% month-on-month in February, up from a 0.1% rise in January, marking the sixth consecutive monthly gain and surpassing the forecast of 0.2%. However, year-on-year growth in house prices slowed to 3.9% from 4.1% in January, though it still outperformed expectations of a decline to 3.4%..

Single Stock Stories & Broker Updates:

-

Shares of Pearson rise 2.9%, making it a top gainer on the FTSE 100, which is up 0.28%. The company reports FY adjusted operating profit of 600 mln pounds ($755.1 mln), a 10% increase from 2023. Pearson plans a 350 mln pounds share buyback and has a positive outlook for 2025, aligning with market expectations. They also announced a strategic partnership with Amazon's AWS to advance AI and enterprise initiatives. The stock rose ~33.0% in 2024.

-

Shares of Rightmove rose 3.4%, making it one of the top gainers on the FTSE 100. The company forecasts an 8%-10% revenue growth in 2025, surpassing last year's 7%. In 2024, revenue is projected at £389.9 million after 2.3 billion platform visits. Peel Hunt noted solid core business growth despite market challenges. The stock is up ~16% over the past year.

-

Shares of IMI rose 2%, making it a top gainer on the FTSE 100, which fell 0.36%. The board recommended a final dividend of 21.1p per share, a 10% increase from 2023. The company announced a £200 million share buyback and reported an adjusted operating profit of £436 million, up from £411 million in 2023. IMI expects continued margin progression in 2025, with stock up ~8% in 2024.

-

Shares of Weir Group rose 4.3%, marking a potential best day since March 2023. Adjusted operating profit is expected to grow 9% to 472 million pounds in 2024. JPM analysts favor Weir in mining equipment, while the company announced the acquisition of Micromine for 657 million pounds, which Jefferies views positively. The stock is up 9.3% year-to-date.

-

Shares of Morgan Advanced Materials Plc dropped 14%, marking their lowest since November 2023, making them the top loser on the FTSE 250 index. The semiconductor parts supplier predicts a mid-single-digit organic revenue decline for 2025 due to demand uncertainty, particularly in semiconductor production. They are reducing investment in semiconductor capacity from 100 million pounds to 60 million pounds. FY24 adjusted operating profit increased 6.7% to 128.4 million pounds, aided by fewer reporting segments and plant consolidations, while FY24 revenue fell 6.7% to 1.1 billion pounds. The stock is down approximately 11% over the past 12 months.

Technical & Trade View

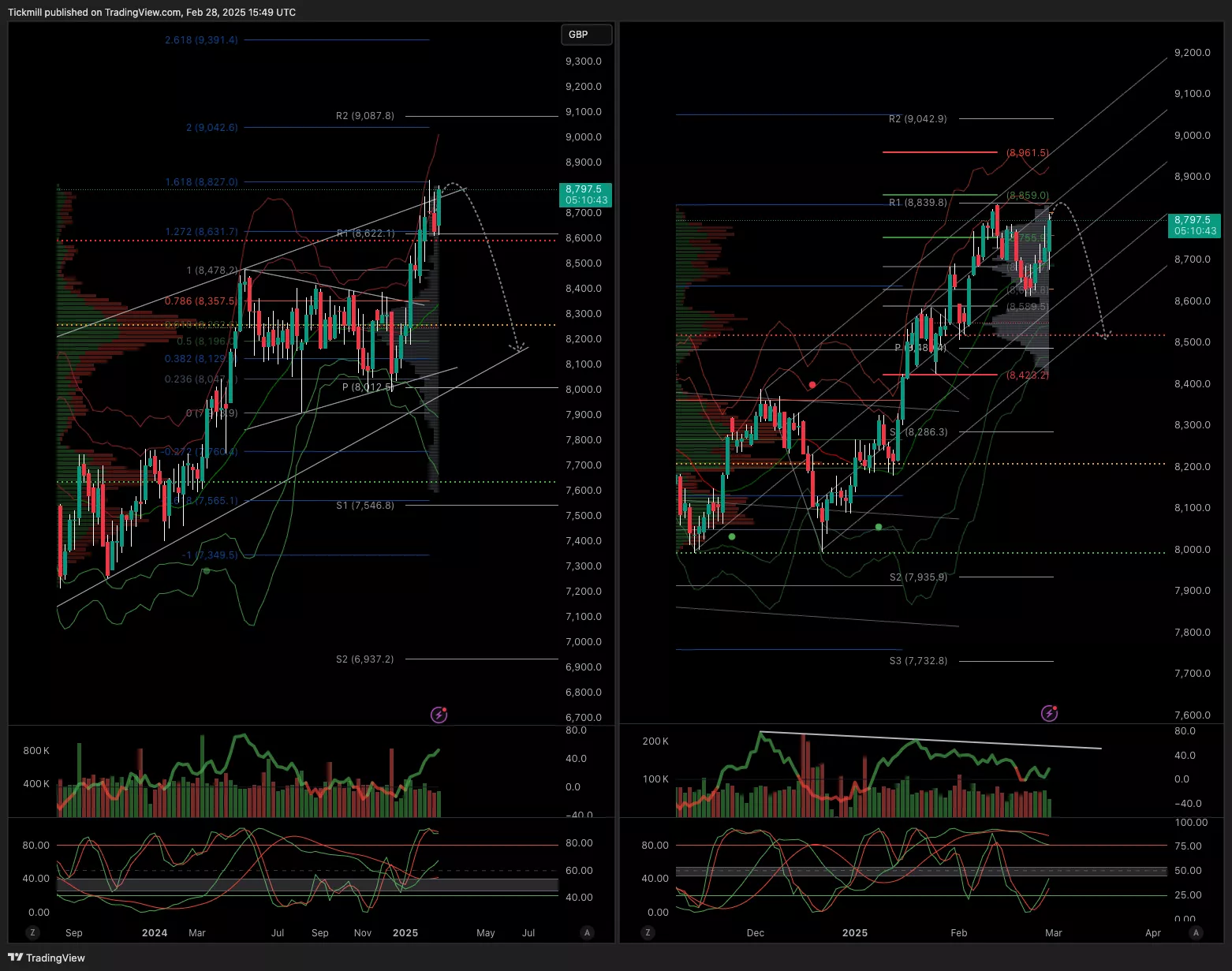

FTSE Bias: Bullish Above Bearish below 8850

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8500

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Feb. 28The FTSE Finish Line - Thursday, Feb. 27

Daily Market Outlook - Thursday, Feb. 27