France To Sell €300 Billion In Bonds For 2025 Budget Amid Fiscal Pressure And Investor Scrutiny

Image Source: Pixabay

- The budget deficit is projected to fall by €31 billion next year.

- Rising borrowing costs have heightened market concerns.

- Volume of bond redemptions next year should mitigate the impact of the large issuance, analysts say.

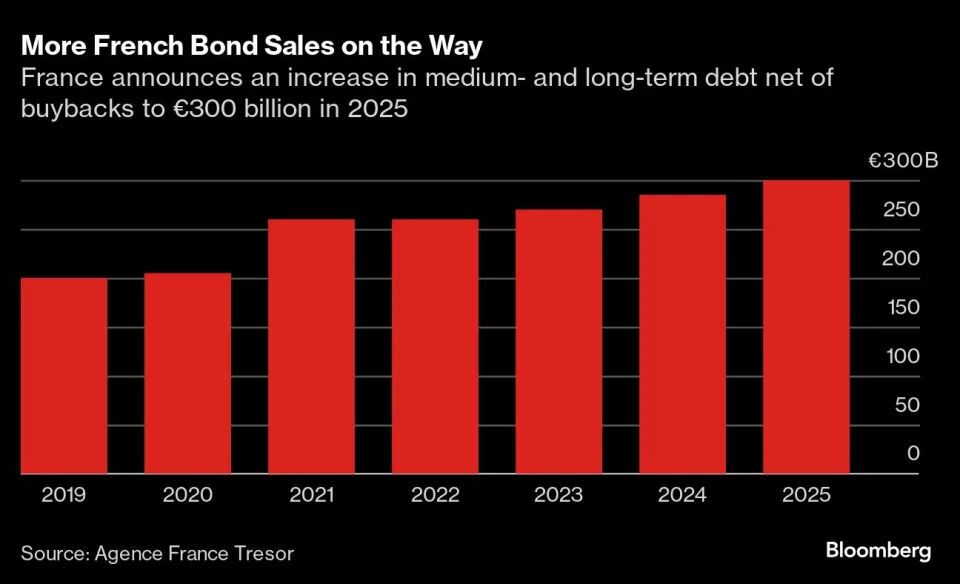

France has announced plans to sell €300 billion ($328 billion) in government bonds next year, surpassing the €285 billion sold this year.

The move comes as the country grapples with fiscal pressures and political instability following months of turmoil.

The proceeds from the bond issuance will help finance a projected budget deficit of €136 billion in 2025, which is €31 billion lower than this year’s shortfall.

This bond issuance target aligns with expectations from financial analysts, who had anticipated an increase in borrowing due to the large volume of maturing bonds and ongoing fiscal challenges.

The French government faces growing pressure to stabilize its public finances and restore investor confidence after a period of political uncertainty that has shaken the markets.

Market demand remains steady despite France’s political instability

Despite the political unrest earlier this year, France has continued to sell bonds without major disruptions.

Investor demand for French government debt has remained robust, with recent bond auctions receiving interest levels comparable to those seen before President Emmanuel Macron’s call for snap elections in June.

Source: Bloomberg

In 2025, approximately €175 billion of bonds will mature, up from €155 billion this year, according to a statement from the French Treasury.

As a result, total financing requirements will reach €307 billion next year, slightly below the €319 billion needed in 2024.

Debt servicing costs are expected to rise to €55 billion, adding to the fiscal burden.

France’s rising deficits and borrowing costs

France’s budget deficit as a percentage of GDP is expected to rise to 6.1% this year before decreasing to 5% in 2025.

The country plans to bring its deficit within the European Union’s 3% limit by 2029, two years later than initially planned.

The widening deficit has led to increased market concerns, with French borrowing costs climbing sharply.

French debt yields now sit 77 basis points higher than Germany’s, aligning more closely with lower-rated Spain.

Despite these challenges, analysts believe the bond market will remain resilient.

Reinout De Bock, head of European rates strategy at UBS Group AG, noted that while the larger debt issuance might raise concerns, the volume of bond redemptions next year should mitigate the impact.

“We expect the France-Germany 10-year yield spread to settle at 75 basis points by year-end,” De Bock said in a Bloomberg report.

In the coming weeks, France’s creditworthiness will be evaluated by Fitch Ratings, Moody’s, and S&P Global Ratings.

Fitch, which downgraded France last year, is set to release its latest assessment on Friday, with Moody’s and S&P following in October and November, respectively.

More By This Author:

Tesla Bets On ‘Black Box’ AI For Robotaxis: What Is It And Why It Matters For Self-Driving Tech?Bayer Shares Fall 7% As US Court Reconsiders Monsanto PCB Exposure Case

It’s All About Jobs Now

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more