France: Stock Market Trade Opportunity From Annual Fiscal Flows

The purpose of this article is to assess the macro-fiscal flows for France and determine what effect these flows will have on the stock market and the economy.

Macro fiscal flows impact investment markets with a lagged effect of typically one month. A flow of funds now from government spending or bank credit creation will lead to a boost in investment markets one month later.

To understand the fiscal flows, one has to look at the balance of sectoral flows within the French economy using stock flow-consistent sectoral flow analysis.

Professor Wynne Godley first comprehended the strategic importance of the accounting identity, which says that measured at current prices, the government's budget balance, less the current account balance, by definition is equal to the private sector balance.

GDP = Federal Spending [G] + Non-Federal spending [P] + Net Exports [X].

As a percentage of GDP, all three sectors sum to zero and balance each other out.

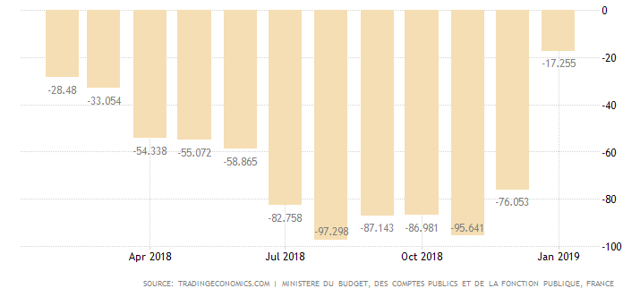

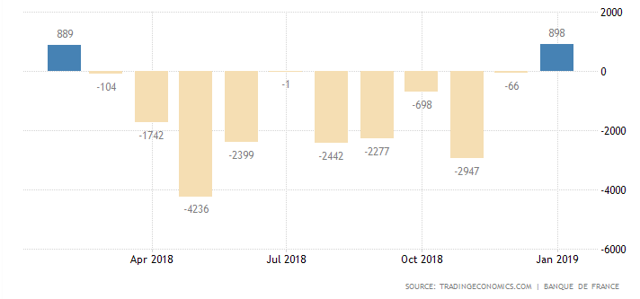

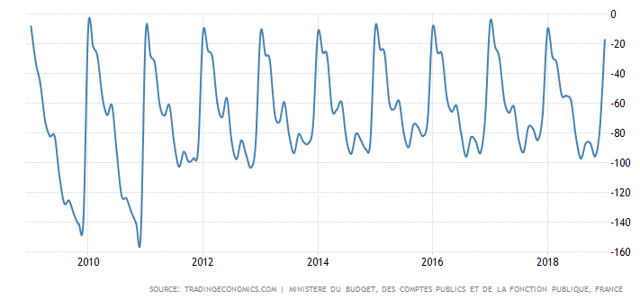

The chart below shows the national budget information to January 2019.

France is not sovereign in the currency that it uses; it has no legal right to put more Euros into circulation if it so chose. France uses the currency of the European Union [EU] and borrows Euros at interest from the European Central Bank [ECB]. In effect, France operates on a fixed exchange rate system similar to a gold standard.

In the case of France, and the other EU members, a federal government deficit means that the government is in effect indebting itself to a foreign power and if it were to have trouble paying its national debt it could find itself treated like Greece and Cyprus were in the last sovereign debt crisis following the GFC boom-bust.

Today’s neoliberal Washington Consensus reverses classical liberalism by favoring predatory rent extraction, regressive tax policy and deregulation. “Reform” now means undoing what in the 20th century was considered to be reform. Anti-labor policies to reduce union power and workplace protection are labeled reform, as is the rewriting of bankruptcy laws reversing the long trend of more humanitarian treatment of debtors. Nowhere is the Doublethink vocabulary more blatant than in the financial conquest of Greece by the Eurozone “troika” – the European Central Bank, European Commission and IMF. James Galbraith, an advisor to Greek finance minister Yanis Varoufakis, was asked whether “the institutions (the IMF, the EC and the ECB) will have to rescue Greece indefinitely.” He answered: There is no “rescue” going on here. There is no “rescue,” there is no “bailout,” there is no “reform” going on. I really need to insist on this, because these words creep into our discourse. They are placed there by the creditors in order for unwary people to use them, but there is nothing of the kind taking place. What is going on is a seizure of the assets owned by the Greek state, by Greek businesses and by Greek households. There is no sense that this has anything to do with the recovery of the Greek economy or with the welfare of the Greek people. On the contrary, the policy is utterly indifferent to those considerations. -(Source: Hudson, Michael. J IS FOR JUNK ECONOMICS: A Guide To Reality In An Age Of Deception. ISLET/Verlag. Kindle Edition.)

The Greek and Cyprus experience is no doubt what prompted the Brexit decision in Britain. An example of another democratic referendum, like the one that Greece held and said no to austerity, that will not be allowed to be implemented.

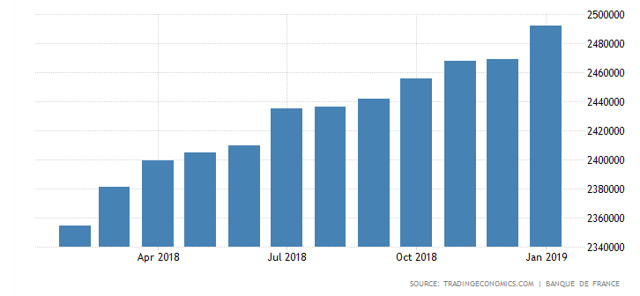

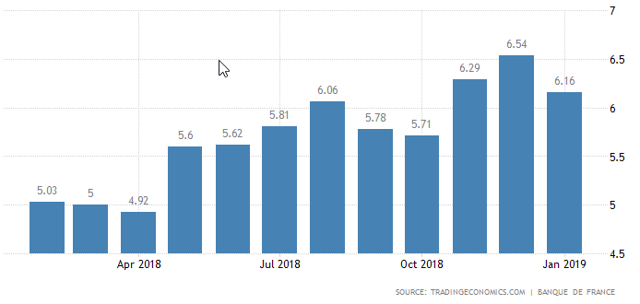

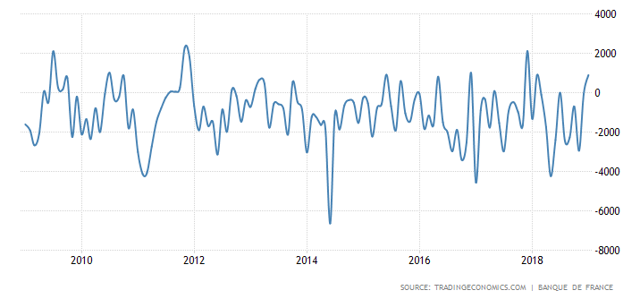

The two charts below show credit creation and loan growth by commercial banks over the last year.

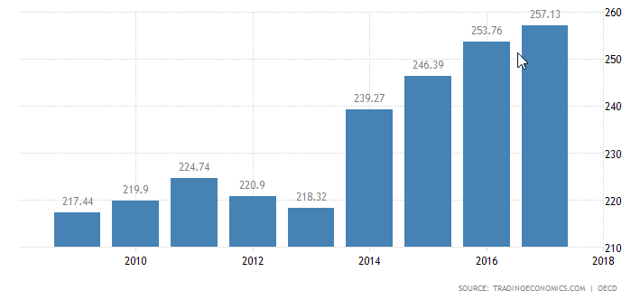

Over the past calendar year, credit creation has been constructive and has consistently grown at over 4%-6%. This comes off a large base in terms of percentage of GDP as the chart below shows and represents the private domestic sector deficit. The stock of private debt is over 257% of GDP. That is a lot and is more now that after the GFC.

The following chart shows the current account over a similar period:

France's current account is in deficit, meaning that it is swapping Euro credits, which as a foreign currency it has to borrow or earn, for real goods and services, and it's trading partners are content to save in Euros.

Not being sovereign in its currency, France is not able to create Euros at its central bank to meet its balance of payments deficit in the way that the USA does. The latter is a good situation to be in. Few understand the concept of the privilege that a coveted sovereign currency provides. It is essentially a free lunch earned from the quality and good standing of the currency. The stronger the currency, the more resources one can obtain with it.

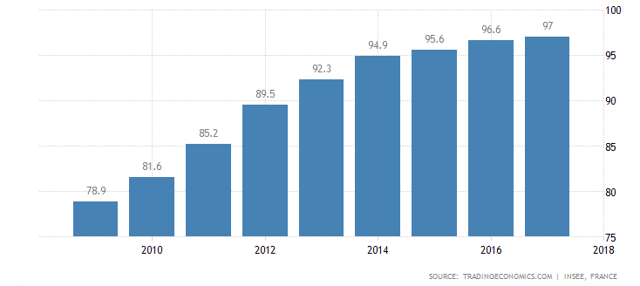

What becomes relevant for a nation not sovereign in its currency is to what level it has been loaded up with foreign debt, and this is shown in the chart below. France's national government debt is in effect its stock of external debt owed to the ECB at interest and if not paid Greece and Cyprus type economic solutions are applied.

France's external debt is 97% of GDP and makes France vulnerable to outside influence.

Under today's global linkages this foreign debt is the main lever to turn democracies into oligarchies. The 2012-2015 crises in Argentina and Greece showed how little sovereignty debtor countries have in the face of the absence of an international court recognizing the ultimate need to write down sovereign debts. Threats by bondholders to cut off credit cause banking chaos and seize public assets to pay vulture funds and other creditors enable the IMF, the European Central Bank and even vulture funds to override democratic regimes and public referendums. The upshot is that it doesn't matter what voters want or whom they elect. Economic policy is dictated by the bondholders, and they are rapacious in demanding austerity and kindred IMF conditions. - (Source: Hudson, Michael. J IS FOR JUNK ECONOMICS: A Guide To Reality In An Age Of Deception. ISLET/Verlag. Kindle Edition)

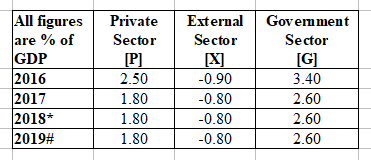

Sectoral Balances

Taking the above information for international and national macro-fiscal flows, one can calculate the sectoral balances, and these are shown in the table below.

(Source: Trading Economics dot com plus author calculations)

*Estimate to be updated when the end-of-year numbers are known.

#Forecast based on existing flow rates and plans.

The table shows that the private domestic sector is in positive territory, which allows it to accumulate net financial assets. The drain from the external sector is offset by the positive flow of funds from the government sector.

France's membership of the EU means that it will be commanded by the EU and ECB to reduce its deficit spending because it has a stock of government debt larger than the guideline of 60% of GDP and even then only allowed a maximum of a 3% deficit budget per year. Like Italy, France is expected to reduce its deficit spending and lower its stock of debt to below 60% of GDP, that is regardless of the actual need to have a deficit larger than 3% of GDP to advance or maintain the public purpose.

The famous yellow vests have emerged to show what happens when a government cuts into the public realm too much to obey Brussels and its neoliberal policy agenda and shows the danger of giving up one's currency sovereignty: it is not long before one has lost ones national sovereignty too.

Impact on the Stock Market

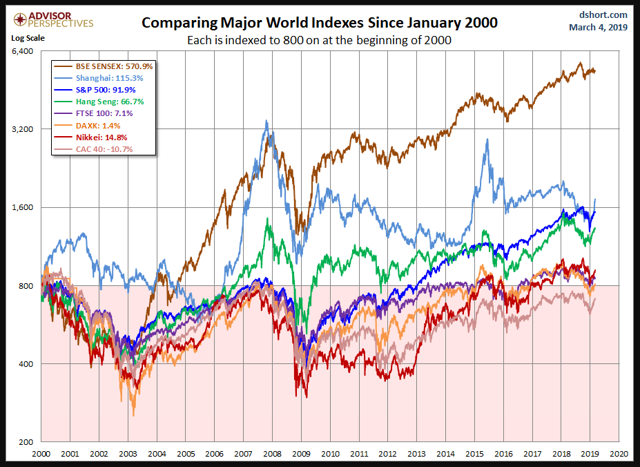

France has had the worst-performing stock market since the 2000 dot com, and 2008 GFC boom-busts as the chart below shows.

The question is how and why has this occurred?

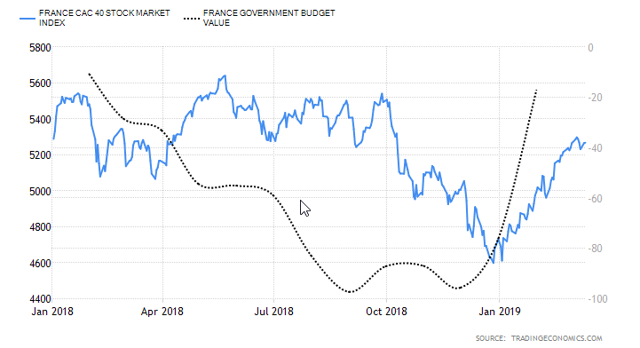

Below is a chart of the stock market over the last 10 years set above a chart of the national government budget and the current account balance over the same period.

The steadily decreasing government budget is the reason why private sector assets such as the stock market are performing worse as compared to others.

The French government presents its national budget in September each year. The fiscal year and calendar year are the same in France. From the chart above one can see that this makes a distinctive impact on government fiscal flows. Taxes are paid at the end of the year, and there is a massive drain in liquidity at this time, and the stock market tends to drop at the juncture of the new year.

The new budget is approved in September and spending gets underway soon after, and the stock market tends to rise in the second and third quarter of each year. Then December comes around, and a large part of what was spent into the economy is taxed out again. The difference is the government's deficit which by mathematical definition is the private sector's surplus. Private sector assets can rise by the amount of this private sector surplus plus how much the banks can leverage this small increase.

The chart below for this last year shows this flow of funds impact to good effect. One notices the lagged effect of the flow of funds. The tax cash drain peaking in December caused the stock market to fall, and then the stock market rose again in tandem with government expenditure.

While the government flow of funds has a steady identifiable budget based heartbeat pattern to it, the same cannot be said of the current account. The current account flow of funds appears random, and because it is a small percentage of GDP, it has little or any influence on the stock market on a consistent tradeable basis.

When one contrasts this phenomenon with the stock market, in the chart above, one sees that generally speaking, each calendar year begins with a dip and then a recovery - money extraction followed by money injection.

One must also observe the current account flow of funds and the global macro influences as well.

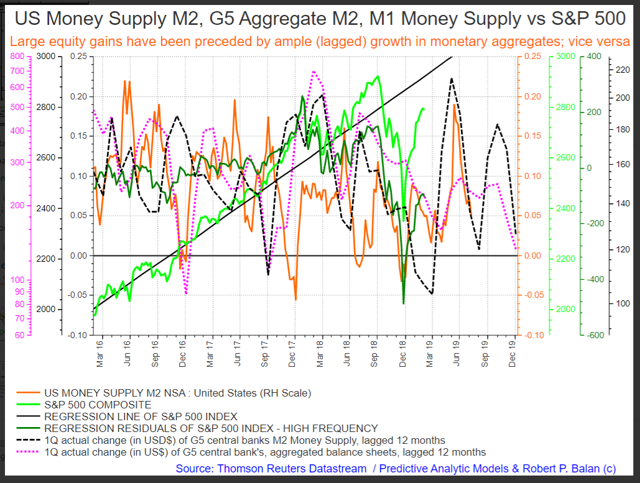

The chart above was kindly produced for me by Mr. Robert P. Balan as part of his PAM service and shows global financial flows for the five largest developed economies in the world. I recommend the PAM service for its advanced fiscal flow analytical capabilities.

The chart shows that global G5 bank balances are bottoming at present and will rise sharply into June 2019. French national liquidity each monthly is generally better than the last until peaking in September/October. This will be taking place against a background climate of higher world fiscal flows until June/July and means that the French stock market is likely to perform well into summer and then sag into the end of the year as both national and international fiscal flows peter out. The French stock market may outperform others after June given the strong national flow of funds and then sink into December of 2020.

There are three broad fiscal flows to watch:

1. National - that tend to have a lag one-month lagged impact on the stock market.

2. US M2 flows - lag 6 months.

3. G5 M2 flows - lag 12 months.

The last two flows in the chart above have been 'advanced' to represent the lagged impact on the market and in this role are a leading indicator for the stock market.

The chart uses a rate of change calculation as experience has shown that it is not the size of the flows that matter but their rate of change.

An investor wishing to trade these stock market movements could do so using the following French ETF funds that mirror the broad stock market index:

|

(EWQ) |

iShares MSCI France ETF |

|

(FLFR) |

Franklin FTSE France ETF |

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Unfortunately, France is going down the tubes. Yellow jackets are tearing up the place, the economy is collapsing, and nobody wants to work because of all the free handouts. The few that do have no incentive to do well since it's impossible to get fired. I have nothing against the French (heck, my sister married a French guy). This is just the way it is over there.

I undetstand that since France uses the Euro as its currency instead of its own sovereign currency, it can't simply print up more money to solve its debt problem. But wouldn't that just cause a whole different problem of inflation? Think Germany after World War I.

On Limits to National Government Spending

1. An inflation rate that cannot be controlled by an interest rate.

2. The amount of real resources in an economy that one can buy in the unit of account.

Any sort of currency creation and spending can be inflationary whether it is commercial bank created money or national government created money. National government spending is no more inflationary than credit money, however, the later is celebrated and the former bemoaned.

National government spending on productive public assets that advance the public purpose such as healthcare, education, and infrastructure are inherently deflationary in that they lower the cost of business and living but in a good way that allows income to be spent on more real goods and services.

Thank you for the very thorough answer!

"Macro fiscal flows impact investment markets with a lagged effect of typically one month. A flow of funds now from government spending or bank credit creation will lead to a boost in investment markets one month later." Interesting, I haven't heard that this could be tracked with such precision. Is it truly so accurate? Where did you get this delay duration from?

From the research of Robert P Balan.