France: Further Deterioration In The Business Climate

The business climate deteriorated in France in February due to the worsening situation in the services and retail sectors. At the same time, the industrial sector is struggling to become the driving force of the French economy.

France's La Defense business district

Restrictions are weighing on the business climate

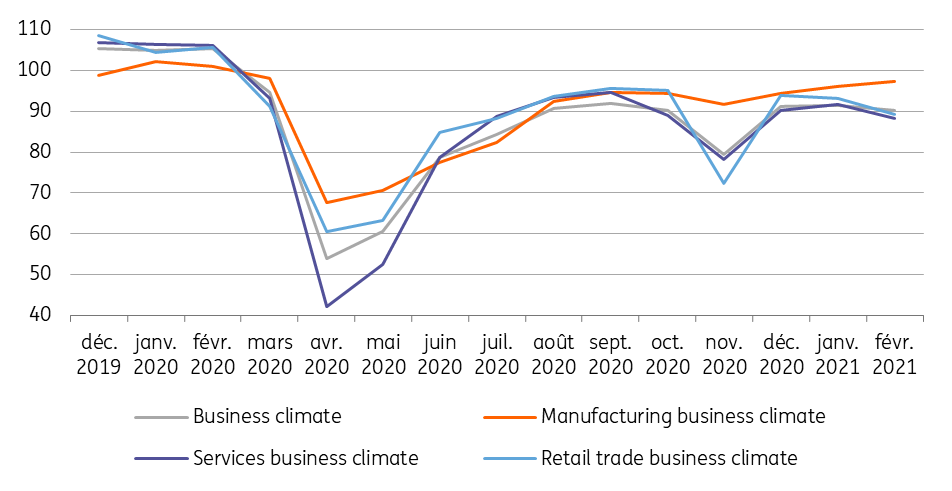

The business climate index, collected by INSEE, deteriorated in France in February, falling to 90 compared with 91 in December and January. This decrease was mainly caused by a deterioration in the business climate in services (88 against 92 in January) and in retail trade (89 against 93 in January). At the same time, the business climate improved in the manufacturing industry (97 against 96). A sharp fall in future prospects is observed in the services sector, but also in the automotive sector, probably due to the current disruptions in supply chains.

These developments are obviously to be linked to the still strong restrictions currently applied in France to combat the spread of the pandemic. Notably, the curfew at 6pm, the closure of shopping centres of 20,000m² or more and the closure of winter sports facilities. This last restriction is likely to have an even greater impact on the business climate in February than in previous months, as February is usually the high season for ski areas due to school holidays.

Graph: Services and retail trade are suffering, industry is doing better

Source: INSEE, ING Economic Research

A dichotomy that is not beneficial to France

More generally, the business climate index, like the PMI indexes, paint a dichotomous picture for France, similar to what can be observed in the rest of Europe: on the one hand the industrial sector, which continues to recover with better prospects each month, and on the other hand the services and retail sectors, which are depressed. This dichotomy was already visible in January, but it became even more pronounced in February. The problem is that, despite the improvement in the business climate and unlike other European countries, the French industrial sector is struggling to become a real economic engine for the country and to take over from a lagging service sector. Indeed, industrial production in France had fallen sharply in December and showed the worst performance among European countries. Therefore, if the recovery of the business climate in industry in January and February is good news, the industrial sector is starting from a very low level. This recovery will therefore probably not be sufficient to compensate for the weakness of the other sectors.

This rekindles fears of a new recession in France, after the one in the first part of 2020. GDP fell by 1.4% in 4Q 2020, notably due to the November lockdown. Since December, the level of activity seems to have stagnated. The Banque de France estimates that activity was 5% below its pre-crisis level in December and January, and that the same level should be reached in February. If this were to continue or deteriorate in March, GDP in 1Q 2021 could stagnate or even decline. And the latter possibility is not entirely excluded, insofar as new restrictions are being put in place due to the evolution of the health situation, including a lockdown at weekends in certain regions of France that have been particularly affected. At the same time, the vaccination campaign is proceeding too slowly to allow for much easing of the confinement measures anytime soon.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does ...

more