Four Canadian Mineral Drilling Companies, And All Of Them Are Cheap

TM Editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

The Canadian market currently lists four mineral drilling companies, and all of them are cheap, cheap, cheap. This is not too surprising. Gold hasn't always been the most desired. It is only natural that the drillers, which all trade along with the gold price (even though they drill for all metals), would be dirt-cheap.

What is surprising, however, is that the cheapest of the bunch is the driller with some of the best operating metrics, some of the best profitability, and some of the best diversification. I’m talking about Foraco International (FRACF).

All of this – and a big gold rally – make the company worth a look. This won’t take long. Foraco operates a rather simple business, which makes this simple.

Quick Facts

- Trading Symbols: FRACF

- Share Price: CAD $2.70

- Shares Outstanding: 99.2 million

- Market Cap: CAD $267 million

- Cash: US $25.6 million

- Debt: US $98.7 million

- Enterprise Value: CAD $366 million

If we are finally on our way to a legitimate gold bull market, drillers like Foraco will be along for the ride. There are two reasons for this. First, investor sentiment. These stocks aren’t cheap because their businesses are suffering. They are cheap because no one cares. These stocks move when interest returns to the sector.

Second, the return of the junior explorer. The main thing holding back even better driller profitability is the fact that many junior mining exploration businesses have been struggling to keep the lights on for the last five years. Explorers have been operating on shoestring budgets, spending only enough to keep shareholders from calling it quits and to not lose their property rights.

In a gold bull market, this would change. Juniors would get access to the capital markets again. They would then spend that capital on drilling.

What makes Foraco so interesting is that none of this is present in the stock. The stock trades at a depressed multiple on depressed earnings. In fact, Foraco is just about as cheap as a stock can get.

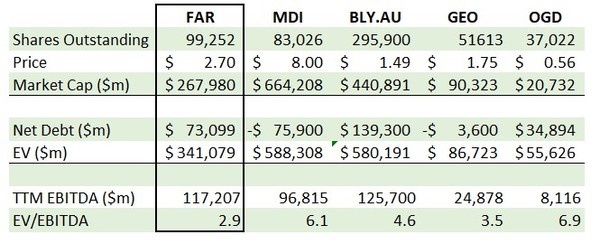

Foraco trades at 3x EV/EBITDA. When a company trades at a 3x turn on EBITDA, it is usually because something isn’t sustainable. Because you are at the top of the cycle and the market is looking for a return to earth. With Foraco, it is the opposite. While drilling is off the bottom, it is a long way from the top. We haven’t had participation from junior explorers for so long that most investors have forgotten that can happen.

Well, it can. Mining exploration can boom, and we are due for another boom. Foraco makes for a solid bet for if that boom is happening now. At this depressed valuation, the stock is a multi-bagger in such an outcome.

Not Operating on All Cylinders

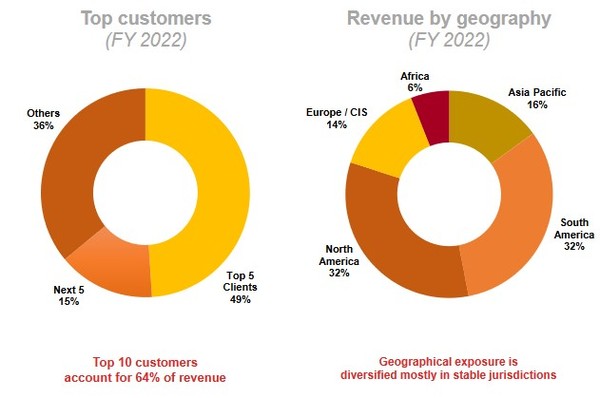

Foraco operates a fleet of 302 drilling rigs for minerals and water. They operate in Canada, Australia, Chile, Brazil, and West Africa. This is a diversified business in every way but one. To no fault of their own, Foraco’s contracts are with major mining companies. 85% of revenue comes from the top mining companies.

Source: Foraco Investor Presentation

64% of Foraco’s revenue comes from their top 10 clients.

Source: Foraco Investor Day Presentation

Foraco, and nearly all drillers, play up their exposure to the major mining companies. “All the big miners use us,” “we are signed on with long-term contracts,” and so on. I get it, they have to spin this as a positive: ‘see, the revenue is safe, it won’t go away.’ But the truth is that having a large miner weighting often occurs out of necessity. There simply isn’t enough business from the juniors, and there hasn’t been for years.

Foraco has a drill fleet that was approximately 60% utilized in Q3. This is higher than peers – Geodrill (GEODF) was 55%, while Major Drilling (MJDLF) was 49%. At this level of utilization, Foraco has a profitable business. But it also means there is room to grow, which is what the bet is will happen if the juniors find themselves flush with cash.

This is a paid for performance business. Foraco provides drilling services for mining companies. Revenue comes from the long-term contracts, charging a fee for the meters drilled in combination with an hourly rate. Overtime is extra. The more hours drilled, the more Foraco gets paid. Which will work in their favor in a gold bull market.

A High Capex Business

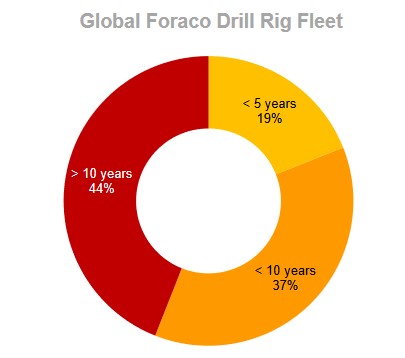

The downside is that the business requires a lot of capital. Foraco is continually investing a portion of cash flow into refurbishing and renewing the fleet. The market value of their 302-drill fleet is about US $150 million. To maintain that fleet, Foraco spends about 8% of revenue on capex.

During lean times, that is barely adequate. I expect that number to climb as Foraco gets more comfortable with the sustainability of their operating cash flow. Foraco’s fleet of rigs of more than 10 years is 44%. Rig life is typically 15-20 years.

Source: Foraco Investor Day Presentation

Fortunately, the business generates plenty of cash flow to pay for that expense even today, and it will do even better as conditions improve. Foraco’s funds flow (cash flow before working capital changes) was $58 million in the trailing twelve months. They spent $26.7 million in capital expenditures, leaving over $30 million of free cash flow.

What Matters is Sentiment

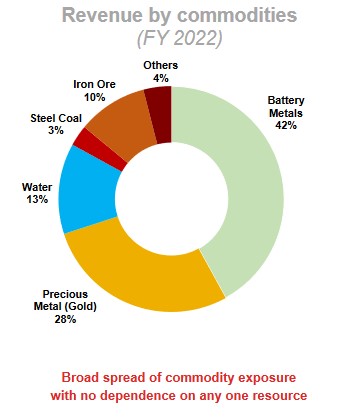

One thing that separates Foraco from other drillers is their exposure to gold.

Source: Foraco Investor Day Presentation

Gold drilling is 28% of total revenue. Compare that to Major Drilling, where it makes up 46% of revenue. It is even more for Orbit Garant (OBGRF), at 66%. For Geodrill, it is almost 100%. Now you might say, wait, don’t I want a driller with big exposure to gold if this is a story about a bull market in the precious metal?

The short answer is, it won’t matter. Just like it didn’t matter that Foraco had low exposure to gold on the way down, and it won’t on the way up. If the juniors get access to capital, it would drive utilization and lift all boats. Remember, there is nothing unique about drilling for gold. A drill is a drill – it can be used for gold, copper, or iron ore. Increased demand can come from any of the above.

Wishing For a Buyback

If I have a quibble with Foraco, it is what they plan to do with their free cash flow. At the company’s special investor call at the beginning of November, management outlined three uses for their excess cash:

- Pay down debt

- Raise capital expenditures and pursue acquisitions into new areas

- Dividend

What I wish was that buying back shares topped the list. But I understand why it’s not. Foraco is not a liquid stock. Volume rarely exceeds 100,000, and it often is less than 20,000 per day. The rules around buybacks are strict, and low volume leaves little room to buy back significant shares.

Does it make sense for paying down debt to be at the top of the list? Maybe, maybe not. Foraco’s gross debt sits at just under US $100 million today. That seems like a lot. It is the most among its peers. It looks like a lot compared to the market cap of CAD $180 million.

But, really, that is more about a lack of respect from the market than an indication of their indebtedness. $100 million of debt compares to trailing EBITDA of $86 million. With cash of $25 million, Foraco’s leverage ratio is only about 0.9x. This is hardly excessive. If I had a choice, Foraco would raise the value of the equity and not worry about the debt.

A Blue Light Special

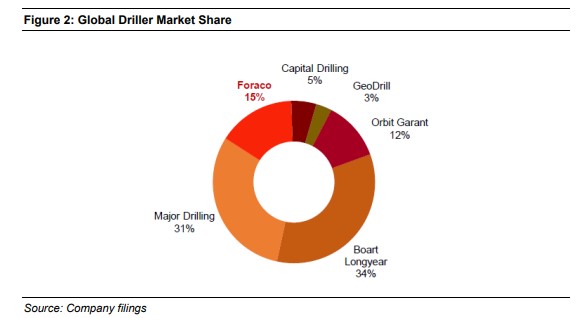

The mining driller universe is surprisingly consolidated.

Source: Paradigm Capital

There are four big names on the North American market (Foraco, Major Drilling, GeoDrill, and Orbit Garant), one in Australia (Boart Longyear), and one in London (Capital Drilling). These six drillers essentially make up the market. You would think that this sort of oligopoly would guarantee pricing power. It doesn’t. This is a commodity business.

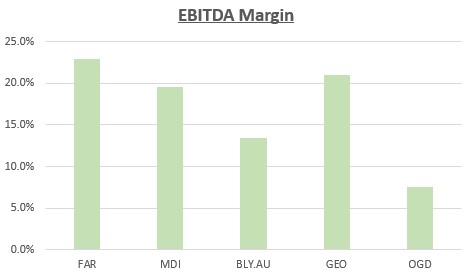

Of these six players, Foraco has the best margins of the bunch. It maintains gross margins of just under 30%, and EBITDA margins are 23-25%.

Source: Company Documents

However, Foraco often trades at a discount to peers. This is despite the fact that the group includes one perennial underperformer (Orbit Garant) and one company that operates exclusively in West Africa (Geodrill), which has extremely high political risk.

Source: Company Documents

The Biggest Risk is a False Start

The biggest risk with Foraco is the potential of the gold rally fizzling out. This isn’t a turnaround, it isn’t some sort of hidden value play, this is really a story about an undervalued play that will turn when sentiment in gold stocks manages to turn.

There have been so many false starts with gold. Recently, gold popped above $2,100 only to quickly reverse. Now you can see a lot of technicians calling that the top. If it is, then this is a rally that ended before it even got started. What is more likely is that gold is going to consolidate here. It will likely do nothing for a while before (hopefully) making another leg up.

I haven’t seen any significant money flow into the sector yet. Juniors are anything but flush with cash. That means there is no rush to buy Foraco. You can set your bid and wait for another long-term holder to get fed up and hit it.

If you start to see that money is flowing into the junior explorers, that would be the time to hit the ask because you know that some of that cash is going straight into Foraco’s bank account as juniors expand drilling budgets.

At 2x EBITDA on mid-cycle earnings, I can tell you that in the next gold bull market this stock will double – at the least. I have zero doubt about that. What I can’t tell you is whether that bull market is happening now, or whether we have to wait another five years. I’ve been disappointed by gold too many times to count on that.

But I also know that when no one believes a bull market will ever happen again, that is just when the next bull market begins.

More By This Author:

In 2024 The US Will Sell CITGO Petroleum And Pay Out Two Canadian Juniors

Inside: One Of My Top 3 Picks For 2024

StealthGas: A Sneaky Play On LPG?

Disclaimer: Under no circumstances should any material

Loading comments, please wait...