Forex Forecast: Pairs In Focus - Sunday, August 18

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture August 18

In my previous piece last week, I forecast that the best trades would be short of GBP/JPY and long of XAU/USD (Gold in USD terms) following a daily close above $1503.

This did not work out very well. The GBP/JPY currency cross rose by 1.68% while Gold in USD terms closed above $1503 on Monday and then rose by 0.17% over the rest of the week. These trades add up to an averaged loss for the week of 0.76%.

Last week’s Forex market saw the strongest rise in the relative value of the British Pound, and the strongest fall in the relative value of the Euro.

Last week’s market was dominated by the release of stronger than expected British inflation data.

The Forex market continued to be quite active last week, with some directional movement and a few trends persisting though mostly weakening.

This week has a similar amount of high impact news releases due compared to last week, but there are some important items due from central banks concerning the Australian and U.S. Dollars.

Fundamental Analysis & Market Sentiment

Fundamental analysis now sees the Federal Reserve as taking a balanced approach following the recent rate cut – however, another cut of 0.25% is widely expected later this year, with Goldman Sachs giving an 80% probability to this scenario. The U.S. economy is still growing quite strongly, but the new tariffs on Chinese goods have caused stock markets to fall and the Dollar to give up most of its earlier gains, with a general flight to safety taking place. Despite that, the safety flow weakened somewhat as the U.S. announced the imposition of the new tariffs would be delayed.

The British economy showed surprisingly strong inflation last week and this, coupled with long-term buyers stepping in as the GBP/USD currency pair came to within just a few pips of the crucial $1.2000 level, sent the Pound notably higher over the week.

The dominant risk-off sentiment in the market has faded somewhat or at least is not the main driver of price, which seems to be taking each currency individually. There is more confused picture overall. The Euro has sold off quite strongly, and so has the Yen, with precious metals also falling from their highs. The New Zealand Dollar also looks very bearish.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index moved little, printing a small bullish engulfing candlestick. The price is up over both 3 months and over six months, indicating a bullish trend. The week’s price action, which was bullish, has also based off new support at 12375, which is a bullish sign which suggests that we are a little more likely to again see a further rise next week than a fall.

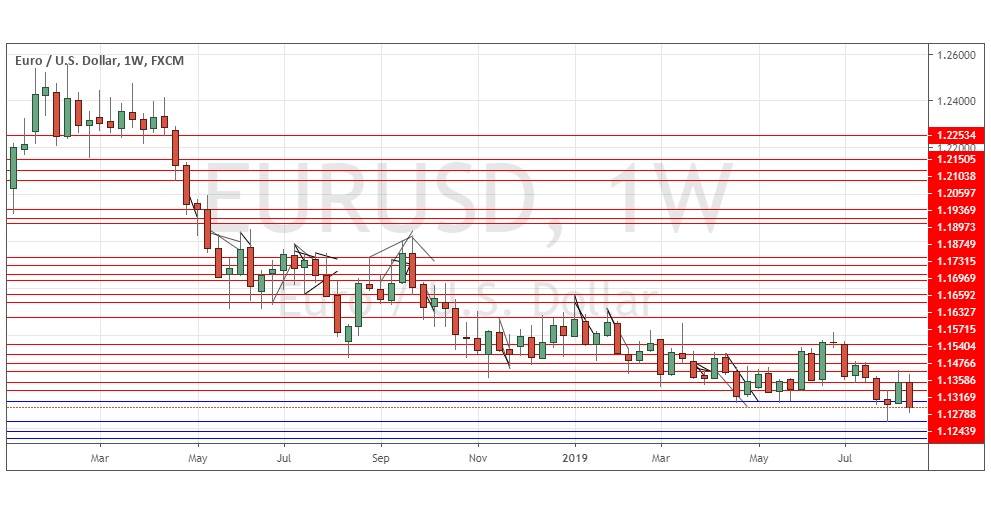

EUR/USD

This currency cross printed a strongly bearish engulfing candlestick last week, which closed near its low, at a two-year low price. These are all bearish signs. The Euro is weak, while as we have already seen, the USD looks somewhat likely to move higher. However, keep in mind that this bearish trend while persistent is slow and prone to retracements.

NZD/USD

This currency pair printed a bearish inside candlestick at the end of last week, making its lowest weekly close in almost four years. The candlestick closed right on its low which is a bearish sign, and the NZD is more bearish than the AUD. These are all signs that next week is likely to produce still lower prices in this pair.

Conclusion

This week I forecast the best trades will be short of EUR/USD and NZD/USD.

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more