Forex And Cryptocurrency Forecast For May 31 - June 4

First, a review of last week’s events:

EUR/USD

If you look at the chart of this pair on D1, it is safe to talk about the uptrend in the last eight weeks. But if you switch to lower timeframes, H4 or H1, it becomes clear that it has been in the "sideways" for the last two weeks, being squeezed in the range 1.2125-1.2265. The last chord of the five-day period sounded in the area of the Pivot Point of this channel as well, at the level of 1.2194, without giving any guidance for the future.

The macro statistics of the past week looks diversified, and therefore hasn't managed to become a driver for the movement of the pair either to the north or to the south. The number of applications for unemployment benefits in the United States continues to decline, but the indicator of pending sales in the real estate market is falling. Orders for capital goods (excluding defense and aviation) have risen, while orders for durable goods have fallen. And the annual data on US GDP (Q1) has remained at the same level. So investors don't know what to do.

Last spring, when the Fed flooded the market with cheap money, its policy was perfectly understandable: to pull the economy out of the crisis and support the purchasing power of the population. A year has passed, the recession is over, stock indices are mushrooming, unemployment is declining, inflation is gaining momentum. But the Fed continues to insist that the set targets have not yet been achieved and therefore it is too early to wind down the fiscal stimulus (QE) programs. So what should investors do with their spare money?

Some of these funds have gone to the long-overbought stock market, bringing the S&P 500 back above 4200 and the Dow Jones above 3450. And another part, $485.3 billion, sits idle on central bank accounts at zero interest rates. And it should be noted that due to QE programs, this happens not only in the United States, but also in other countries, including Europe. As a result, a huge amount of both dollars and European and other currencies have settled in hands of not only American, but also foreign investors. And the market plunged into doubts, which is clearly visible on the EUR/USD chart.

GBP/USD

The dynamics of GBP/USD is influenced by the same factors as the previous pair. And just like the euro, the British currency paired with the dollar has been in a sideways trend for two weeks, fluctuating within the range of 1.4075-1.4220. However, unlike the European currency, the activity of the bulls on the pound was significantly higher. This was facilitated by expectations of a faster than forecast increase in interest rates by the Bank of England.

One of the managers of the Bank of England, Gertjan Vlieghe, announced on Thursday, May 27 that rates could rise in the first half of 2022. At the same time, the official stipulated that this would happen only if the labor market recovers faster than expected.

Investors' optimism was added by the comment of Prime Minister Boris Johnson that the latest statistics on COVID-19 does not require adjusting plans to lift quarantine restrictions on June 21. After both of these statements, the pair approached the 36-month high again, where, at 1.4188, it completed the trading session.

USD/JPY

Only 25% of experts voted for the growth of the dollar in this pair in the past forecast. But in the battle between bulls and bears, they were strongly supported by the growth in the yield of the 10-year US Treasury bonds, which rose from 1.57% to 1.62% on Thursday June 27. Given that the yen is a safe haven currency, such changes always put strong pressure on it, especially when you consider that the yield on 10-year Japanese bonds is only 0.25%.

The yen was also pressured by fears of a delay in Japan's economic recovery. They were caused by media reports that the country's authorities plan to extend the state of emergency in Tokyo and some other regions for three weeks, until June 20. Additional support to the dollar was provided by the US budget proposed by the administration of President Joe Biden in the amount of $6 trillion.

As a result, the USD/JPY pair broke out of the range 108.55-109.75 and, having gone up, reached the height of 110.20, updating the high of the last seven weeks. As for the week's finish, it was slightly lower: at the level of 109.83.

Cryptocurrencies

You can currently find a lot of similarities with the beginning of the crypto winter in 2014 and 2018. However, there are also many differences. Therefore, it is not worth yet to firmly assert that we are now witnessing the entry into winter 2021. Rather, the past month can be called late autumn, after which, bypassing winter, spring can start straight away.

The market is under pressure of the ongoing struggle against mining and trading in virtual currencies in China. For example, the eight paragraphs of the document published by the Inner Mongolia Reform and Development Commission can help understand how this is happening. (According to the University of Cambridge, this region is China's third in terms of computing capacity of bitcoin).

So, Industrial parks and data centers are ordered to reduce energy consumption, and telecommunications companies are prohibited from working with miners under the threat of license revocation. The authorities also promise to prosecute illegal miners. The same applies to money laundering attempts and illegal fundraising using cryptocurrencies. In addition, the list mentions Internet cafes that will be closed if mining on their territory is revealed. Companies whose activities are related to cryptocurrencies mining, and their senior employees are subject to inclusion in the list of unreliable persons, and officials supporting the miners will be subject to disciplinary responsibility.

According to Reuters, the major mining companies BTC.TOP and HashCow are winding down their operations in China amid such tightening legislation. HashCow has not yet stopped the current capacity but has refused to buy new farms.

As for BTC.TOP, this company announced a complete cessation of work in the PRC.

On the other hand, there is good news as well. Elon Musk, because of whom the market experienced two serious falls in May, has now helped it grow again. A number of North American mining companies had a meeting with him, which was organized by the head of MicroStrategy Michael Saylor and decided to form the Bitcoin Mining Council, which aims to reduce the industry's greenhouse gas emissions.

One of the first bitcoin miners, Marshal Long, criticized the move, saying that Musk was talking to the wrong companies because they control "a very, very small network hashrate." According to Long, if the billionaire wants to change the situation, he should negotiate with Coinmint and members of the non-profit Texas Blockchain Association, which control about 15% of the hashrate.

However, be that as it may, but the decision to create the Bitcoin Mining Council gave its positive result: according to the CoinGecko service, the crypto market capitalization increased by about 14%, and bitcoin rose in price by almost 12% against its background. The BTC/USD pair was trading at $40.865 at the high of the week, on May 26. It did not manage to overcome the $41,000 mark and dropped to the $35,000 area by the end of Friday once again.

The Crypto Fear & Greed Index fell to its 12-month low on May 24 at just 10 points, which is in line with the “Extreme Fear” of the market. However, along with the decline in the index, the likelihood of new purchases from investors expecting a large discount is growing as well. That was what happened this time as well. Bouncing off the bottom, the quotes went up. The indicator is in the "Fear" zone at around 21 points on Friday afternoon, May 28. So, the potential for further growth of the main cryptocurrency has not yet been exhausted.

The total crypto market capitalization peaked on May 12, reaching $2.560 trillion. But then a collapse followed, and the market had lost more than 40% by the time of writing this review, on May 28, shrinking to $1.529 trillion. About 1 million leveraged transactions were liquidated during this short period.

The lowest value in May for the bitcoin dominance index was 39.22%. It is slightly higher now at 43.11%. And it is possible that growth will continue further, thanks to the sale of less stable altcoins.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

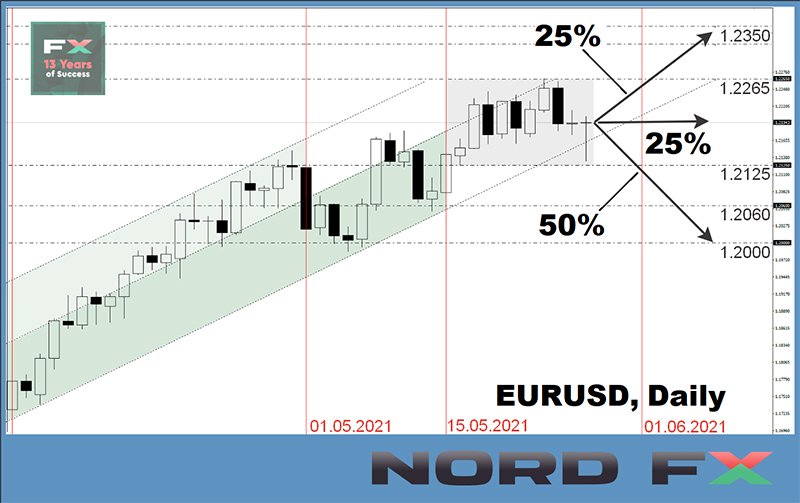

EUR/USD

Goldman Sachs and Deutsche Bank believe that the current situation resembles 2002-2007, when the USD index was going down. According to their analysts, investors will start looking for more attractive international assets over time, and the upward trend of the EUR/USD pair will gain new strength.

But Morgan Stanley experts have the opposite opinion. They believe that current events are more like the 1980s and 1990s, when the dollar strengthened in the face of a large current account deficit. And now this deficit in relation to GDP is the highest since 2008. This is due to the fact that, due to the QE programs, imports to the United States are growing faster than exports. But the DXY dollar index bulls hope that the outpacing dynamics of the US economy compared to the European and global ones will stir up investor interest in the US currency and other assets.

50% of analysts agree with this point of view in the short term, expecting the dollar to strengthen and the EUR/USD pair to fall to the 1.1985-1.2000 zone. The nearest support is 1.2130 and 1.2060. 30% of experts vote for the continuation of the sideways trend in channel 1.2125-1.2265, and another 20% support the breakdown of the upper border of this channel and the growth of the pair to this year's high 1.2350.

It should be noted that when moving from a weekly to medium-term forecast, the number of supporters of strengthening the dollar and the decline of the pair increases from 50% to 70%.

There is a complete discord among the oscillators on H4. D1 is still dominated by green. There are 50% of such oscillators, another 25% are colored red and the remaining 25% are colored neutral gray. Most trend indicators on D1 (75%) point north.

A lot of important economic information is expected in the coming week. We are expecting the publication of data on the consumer market in Germany on Monday, May 31, and there will be similar statistics for the Eurozone as a whole the next day, on Tuesday. Also, there will be information on ISM's business activity in the US manufacturing sector on June 1.

German retail sales data will be released on Wednesday June 2. The report on the level of employment in the private sector and the ISM index of business activity in the US service sector will be released on Thursday, June 3. And there will be data on retail sales in the Eurozone and, traditionally, on the number of new jobs created outside the US agricultural sector (NFP) at the very end of the working week, on June 4;

GBP/USD

Some of the experts (60% of them) have considered the statement of Gertjan Vlieghe regarding the increase in interest rates quite specific and, on this basis, expect that the pound will renew its 36-month high at 1.4240 in the near future. In support of their forecast, they remind that the Bank of England improved its forecast regarding the pace of economic recovery in early May, and that the economy should return to pre-crisis levels by the end of the year.

Other analysts (40%), on the contrary, believe that everything looks rather vague, that the first half of 2022 is still very far away, and that a lot can happen during this time. In general, it's too early to rejoice. Especially since they do not sleep overseas either. Therefore, this part of the experts stakes on the dollar and expects the GBP/USD pair to fall. The nearest support levels are 1.4175, 1.4135 and 1.4100. The target is 1.4000.

Technical indicators still side with the bulls. There are 75% of those among the oscillators on D1, 95% among the trend indicators. Graphical analysis shows a downward rebound from resistance 1.4240 and a fall to support 1.4000.

As for the events of the week, two speeches of the head of the Bank of England Andrew Bailey on June 1 and 3 can be noted, during which investors will wait for new promises to raise interest rates. Also of interest is the hearing of the UK inflation report, which is scheduled for Thursday June 3;

USD/JPY

The technical analysis readings for this pair could be called GreenPeace. 90% of oscillators and 95% of trend indicators on H4, as well as 75% of oscillators and 95% of trend indicators on D1 are colored green. The bullish sentiment is also supported by 60% of the experts. The nearest resistance is at 110.00, target No. 1 is the high of the previous week at 110.20, target No. 2 is the renewal of the 21-week high at 110.95.

40% of analysts side with the bears, who expect the pair to return to the channel 108.55-109.75. In case of a breakdown of its lower border, the next target is 107.50;

Cryptocurrencies

According to billionaire and Carlyle Group co-founder David Rubinstein, bitcoin has almost no chance of disappearing completely. Even if the asset loses most of its value, it will still be in demand in its own infrastructure. If the coin continues to rise in price, then even the central banks of the states that opposed cryptocurrencies will begin to consider it. “New asset types are not just a fleeting craze that quickly ceases to be interesting. We are already talking about hundreds of billions of dollars. The coin, which was originally a means for digital payments, has become a full-fledged asset,” the billionaire believes.

Glassnode data, which indicate a build-up of long-term positions in bitcoin by whales, as well as an outflow of large investors from OTC markets, also confirm Rubinstein’s words. This may indicate another phase of asset accumulation after a deep drawdown, which prevented bitcoin, and after it, the entire cryptocurrency market, from going into a real free fall.

Many influencers are also filled with optimism. The investment company Ark Invest general director Kathie Wood confirms her forecast once again. She is confident that, no matter what, bitcoin will still reach $500,000.

Wood says the recent correction has raised the chances of SEC (US Securities and Exchange Commission) approval for bitcoin funds. The point is, a product with a lower price tag is more likely to get the green light.

In addition, Kathie Wood spoke about the statements by Elon Musk that caused the collapse of the crypto market. She suggested that he was pressured by shareholders such as BlackRock to drop the BTC price. However, the head of Ark Invest expects Musk to return to the crypto investor community.

The future of ethereum is seen even more rosy, according to some experts. Professor of NYU Stern Business School Aswath Damodaran believes that ethereum is better suited for trading on exchanges than bitcoin. According to the expert, the ETH ecosystem is more flexible, which makes it easier to work with it in trades, especially in an environment of increased volatility.

Damodaran noted that many small assets on exchanges are trading better than bitcoin, as transactions with them are faster. The BTC network is much more involved, which means that transfers can take a fairly long period of time, even by the standards of fiat transactions. Therefore, bitcoin is more suitable as a global asset for investment, the specialist believes.

And some statistics at the end of the review. The Dogecoin meme cryptocurrency turns out to be more recognizable than ethereum among US citizens, perhaps thanks to Elon Musk. This is evidenced by the results of a joint survey conducted by Harris Poll and CouponCabin.

The study involved more than 2000 American adults, most of whom (89%) had heard of cryptocurrency at least once. It turned out that 71% of respondents know about bitcoin, 29% about Dogecoin and 21% about Ethereum. The USD Coin stablecoin has the same number, 21%. About 18% of survey participants said they are familiar with Litecoin, 10% have heard about the existence of Stellar.

Digital assets as a get-rich-quick scheme are considered by 23%, and almost a third of respondents (31%) are confident that cryptocurrencies can become the future of money.

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

more

"And just like the euro, the British currency paired with the dollar has been in a sideways trend for two weeks, fluctuating within the range of 1.4075-1.4220. However, unlike the European currency, the activity of the bulls on the pound was significantly higher."

gbp/usd will continue its sideways trend till we see some substantial changes in British exports to the EU.