Forex And Cryptocurrency Forecast For June 19-23

Image Source: Pexels

EUR/USD: The Euro's Victory Over the Dollar

The key events of the past week were the meetings of the Federal Open Market Committee (FOMC) of the US Federal Reserve on Wednesday, June 14, and the European Central Bank's Monetary Policy Committee on Thursday, June 15. The outcome of these meetings resulted in a decisive victory for the euro over the dollar.

During the COVID-19 pandemic, the Federal Reserve printed and released a large amount of cheap money into the market. This action spurred inflation, which ultimately reached its highest level in the last 40 years.

With the pandemic over, the American regulator completely reversed its monetary policy, shifting from Quantitative Easing (QE) to Quantitative Tightening (QT). Over the course of the last ten meetings, in an attempt to curb inflation, the Fed raised the key interest rate, which ultimately reached 5.25%: the highest level since 2006.

Data published on Tuesday, June 13, showed that the core inflation (CPI) in May was 5.3% (year-on-year) after 5.5% a month earlier. This is, of course, progress, but very slight, and the target value of 2.0% is still far off. However, in an effort to avoid economic problems and the continuation of the banking crisis, the Federal Reserve leaders at their meeting decided to keep the interest rate unchanged.

This was not a surprise to the market. Both the vice president of the Federal Reserve, Philip Jefferson, and the president of the Federal Reserve Bank of Philadelphia, Patrick Harker, talked about the need for a pause in the monetary tightening process.

Even the head of the Federal Reserve, Jerome Powell, mentioned the possibility of a break. As a result, on the eve of the meeting, the likelihood of the rate remaining at the previous level was estimated by market participants at 95%.

Moreover, data published on Thursday, June 15, showed that industrial production in the US fell by 0.2% in May, and the number of unemployment benefit claims stubbornly remains at the previous level of 262,000. This weak statistic increased the market's expectations that the current Fed pause might be extended for a longer period.

As for the long-term forecasts published by the FOMC, the peak rate is seen by the committee members at 5.60%, after which a decrease should follow: in a one-year perspective to 4.60%, in a two-year perspective to 3.40%, and then further down to 2.50%.

So, while the Federal Reserve left borrowing costs unchanged at its June meeting, the European Central Bank raised it by 25 basis points - from 3.75% to 4.00%. Furthermore, ECB President Christine Lagarde noted that the tightening of monetary policy will continue in July. Additionally, inflation forecasts were revised upwards due to rising wages and high energy prices.

Based on this, the market expects a 25 bp rate hike not only next month, but also in September. The ECB's hawkish stance caused a surge in German government bond yields, while US security yields conversely dropped.

As a result, the Dollar Index (DXY) continued its decline, and the EUR/USD currency pair continued to build on its bullish impulse formed earlier in the week. If on Monday, June 12, it was trading at 1.0732, by June 16 it had reached 1.0970, closely approaching the psychologically important level of 1.1000.

The EUR/USD pair concluded the five-day period at 1.0940. As for near-term prospects, most analysts (65%) expect the continuation of its upward trend, 25% voted for the pair's fall, and 10% took a neutral position. Among trend indicators on D1, 100% are in favor of the bulls, and among oscillators, 90% are in the green, although a third of them are signalling overbought conditions. The remaining 10% are in the red.

The pair's nearest support is located around 1.0895-1.0925, then 1.0865, 1.0790-1.0800, 1.0745, 1.0670, and finally, the May 31 low of 1.0635. The bulls will encounter resistance in the area of 1.0970-1.0985, then 1.1045, and 1.1090-1.1110.

Notable dates on the calendar for the upcoming week include June 21 and 22, which are set for the testimony of Federal Reserve Chairman Jerome Powell before Congress. Fresh unemployment data from the US will also be released on Thursday.

At the end of the work week, preliminary Purchasing Managers' Index (PMI) figures for both Germany and the Eurozone as a whole, as well as for the US services sector, will be revealed. In addition, traders should note that Monday, June 19, is a public holiday in the United States: Juneteenth.

GBP/USD: The Pair's Growth May Continue

Taking advantage of the weakening dollar, the pound actively strengthened its position throughout the past week. Having bounced off the local low of 1.2486 on Monday, the GBP/USD pair soared by 362 points on Friday and reached a high of 1.2848. The week ended slightly lower: at the level of 1.2822. The British currency last felt this good over a year ago, in April 2022.

Bullish investor sentiment was also supported by the expectation that the Bank of England will raise its rate from 4.50% to 4.75% at its meeting on Thursday, June 22, accompanying this decision with hawkish rhetoric and promises to continue tightening its monetary policy.

As a result, economists at Scotiabank expect that the GBP/USD pair may soon rise to 1.3000. They are joined in this prediction by their colleagues from ING, the largest banking group in the Netherlands. "Looking at the charts," they write, "it seems that there are no significant levels between current levels and 1.3000, which suggests that the latter is not far off."

Overall, the median forecast from analysts appears more neutral. Bullish sentiment is supported by 50% of experts, 40% favor bears, and 10% prefer to refrain from comments. As for technical analysis, 100% of both trend indicators and oscillators point north, but a quarter of the oscillators are in the overbought zone.

If the pair moves south, support levels and zones await it at 1.2685-1.2700, 1.2570, 1.2480-1.2510, 1.2330-1.2350, 1.2275, and 1.2200-1.2210. In case of the pair's growth, it will meet resistance at levels 1.2940, 1.3000, 1.3050, and 1.3185-1.3210.

Next week, on the eve of the aforementioned meeting of the Bank of England, on Wednesday, June 21, inflation statistics will be released in the United Kingdom. It is expected that it will show a decrease in the Consumer Price Index from 8.7% to 8.5%. However, such a slight drop will likely not deter the BoE in its hawkish stance.

In addition, attention should be paid to Friday, June 23, when the preliminary Manufacturing Purchasing Managers Index value will be published in the UK. Since the PMI for Germany, the Eurozone, and the US will also be announced on this day, it will vividly illustrate and allow a comparison of the state of their economies.

USD/JPY: The Pair Yearns to Return to Earth, But Can't

It would have been logical to assume that as a result of the fall in the US Dollar Index and US Treasury bond yields, the Japanese currency would strengthen its position and the USD/JPY pair would finally change course; instead of flying to the moon, it would start landing on Earth.

Such a movement even appeared on Thursday, June 15. But it only lasted one day: until the meeting of the Bank of Japan (BoJ), at which it again maintained the policy rate at the negative level of -0.1%. We recall that the Japanese Central Bank has not changed this rate since January 2016.

In addition, as part of the new decision, the regulator announced that it also plans to buy a "necessary" amount of government bonds and continue to target the yield of 10-year securities at a level close to zero.

Economists at MUFG Bank believe that the increasing divergence in monetary policy between the Bank of Japan and other major central banks is a recipe for further yen weakening. "The expansion of yield spreads between Japan and foreign countries, coupled with the decrease in currency exchange rate volatility and rates... contributes to the yen becoming more undervalued," write MUFG analysts.

Their colleagues at Commerzbank believe that if the Federal Reserve signals two potential new dollar rate increases, the yen's decline will continue. According to specialists from the French financial conglomerate Societe Generale, if another rate hike occurs in the US in July, the USD/JPY pair could rise to 145.00.

Only hopes that the BоJ will eventually take the first step towards ending its ultra-loose monetary policy can alleviate pressure on the Japanese currency. For example, economists at BNP Paribas write that "although we have revised our USD/JPY forecasts upwards considering the higher terminal rate of the Fed and a later expansion of the Bank of Japan's YCC, we continue to forecast a downward trend in USD/JPY".

They target levels of 130.00 by the end of this year and 123.00 by the end of 2024.

Having fixed a local high at 141.89, the pair ended the past five-day period at 141.82. 70% of analysts expect that the weakening DXY will soon cause a correction of the pair to the south, while the remaining 30% set their goal to reach the height of 143.00. 100% of trend indicators on D1 also look up. Among the oscillators, 90% are also pointing up (a third signals the pair's overbought condition), the remaining 10% are painted in a neutral grey color.

The nearest support level is located in the 1.4140 zone, followed by 140.90-141.00, 1.4060, 139.45,1.3875-1.3905, and 137.50. The nearest resistance is 142.20, then the bulls will need to overcome barriers at levels 1.4300, 143.50, and 144.90-145.10. And from there it's not far to the October 2022 high of 151.95.

No significant economic information related to the Japanese economy is expected to be released in the upcoming week. The release of the report on the last Bank of Japan meeting on Wednesday, June 21, could be an exception, but market participants are unlikely to find anything new in it: everything has already been said at the press conference on June 16.

Cryptocurrencies: The Fed and ECB Prevent Bitcoin Catastrophe

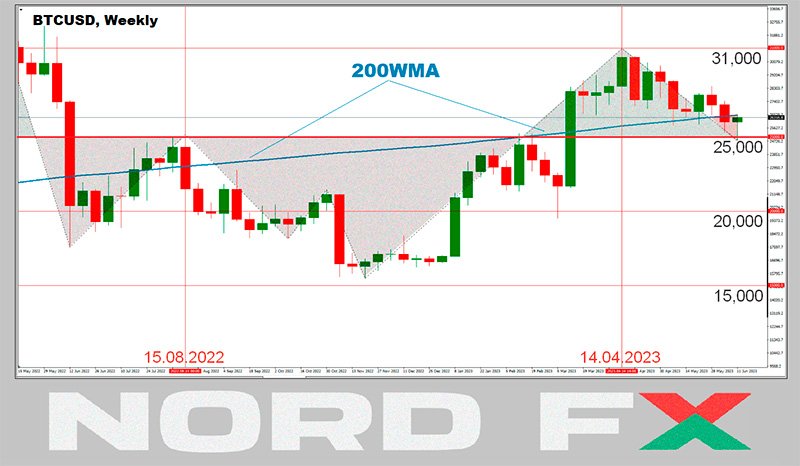

The BTC/USD pair climbed to the $30,989 mark on April 14, its highest value since June 2022. Since then, the market has been dominated by bearish sentiment for nine weeks in a row. The past week was no exception and did not bring joy to investors.

As noted by Michael Van De Poppe, founder of venture company Eight, "this is not the situation you would want to see." The expert noted that breaking support in the form of the 200-week moving average (200-WMA) indicates a continuation of the downtrend.

This scenario seemed obvious after the US Securities and Exchange Commission (SEC) filed lawsuits against Binance and Coinbase, accusing the platforms of selling unregistered assets.

Meanwhile, in court documents, the SEC named more than a dozen tokens as securities. According to experts, a victory for the regulator could lead to the delisting of these coins and limit the potential development of their blockchains. In total, over 60 coins have already made it onto the regulator's blacklist.

The court rejected the SEC's request to freeze the assets of Binance's American division last week. However, as some observers believe, the battle is far from over. It's worth noting that Gary Gensler, the head of the regulator, has recently stated that cryptocurrencies, in essence, are not needed at all. Quote: "We don't need more digital currency. We already have digital currency. It's called the US dollar. It's called the euro or the yen. Now they are all digital."

According to strategists at JPMorgan, US Bitcoin exchanges are highly likely to be forced to register with the SEC as brokers, and all cryptocurrencies will be classified as securities. While many see this as the beginning of the end for the entire industry, there are optimists.

For instance, JPMorgan believes that new rules "will free the industry from bad practices and dishonest players, which in turn is necessary for the industry to mature and see more active institutional participation."

Adam Back, the CEO of Blockstream, tried to calm market participants. Considered one of the leading figures in modern cryptography and the crypto industry, his argument was directly opposed to JPMorgan's. This prominent expert stated that the crypto market is like water, flowing and finding detours when encountering obstacles.

So, if any major crypto exchange operating in the US stops servicing its clients due to regulatory pressure, the industry will ultimately find a way out. Bitcoin traders will simply move to other jurisdictions and start trading in other currencies. And it seems that Adam Back is right: the exodus from the US is already underway.

According to data from the analytical platform Glassnode, the share of American players has dropped by 11% since mid-2022. At the same time, it has grown by 9.9% in the Asian region.

It's worth noting that many influencers, while predicting a dismal end for cryptocurrencies, often exclude Bitcoin from their projections. For instance, Into The Cryptoverse founder Benjamin Cowen stated that liquidity in the crypto market has long since dried up, and altcoins are "due for a reckoning, while Bitcoin's dominance will continue to grow."

A similar sentiment was expressed by well-known trader Gareth Soloway, who said he has always compared the crypto market to the dotcom bubble. According to him, the collapse that occurred in the early 2000s will repeat in this industry. He assured that "the system needs to be cleared of trash" to flourish, stating that 95% of all tokens "will be striving towards zero."

Peter Brandt, often called the "Mysterious Wizard of the Market," also joined the chorus praising Bitcoin. This trader and analyst also metaphorically "buried" all coins, with the exception of Bitcoin. "Bitcoin is the only cryptocurrency that will manage to finish this marathon. All others, including Ethereum, are fakes or scams," he wrote.

Many members of the crypto community were unsettled by the respected analyst's grouping of Ethereum, the second-largest cryptocurrency by capitalization, together with fraudulent projects. In response, Brandt stated that "ETH will likely survive, but the true legacy is BTC."

ARK Invest CEO Cathie Wood has doubled down on her Bitcoin forecast, stating that the target of $1 million per coin will be realized. According to Wood, the current global economic environment increases her confidence in the flagship cryptocurrency. She stated, "The more uncertainty and volatility there is in the global economy, the more our confidence in Bitcoin grows, which has been and remains a hedge against inflation."

CEO and founder of Galaxy Digital, Mike Novogratz, also expects support from the global economy. Specifically, the billionaire predicts that the Federal Reserve will begin lowering interest rates in October, leading to a sharp increase in liquidity inflows into the crypto market.

Dan Tapiero, co-founder of 10T Holdings and Gold Bullion International, expressed a more specific outlook, forecasting an "explosive" rally. He stated, "We will likely see new highs in the second half of 2024 and in 2025. And I think during this bull phase, the overall market capitalization of the crypto market will reach $6-8 trillion."

Despite optimistic long-term forecasts, the outlook for the near future does not inspire investors. Bloomberg strategist Mike McGlone does not rule out a significant decline in the Bloomberg Galaxy Crypto Composite Index, which reflects the performance of leading digital currencies.

In an analytical note prepared for investors, he warned of a dominant bearish trend for at least the next few months. Fiona Cincotta, a strategist at City Bank, also cautioned that a drop in the price of Bitcoin below the strong support level of $25,000 could further activate sellers and trigger a more pronounced decline in prices.

PlanB, an analyst and the author of the well-known Stock-to-Flow (S2F) forecasting model, asked his followers to provide their Bitcoin price predictions for the end of June. Many responded that Bitcoin would close the first month of summer near the $24,000-25,000 levels. Only a small portion of respondents indicated the potential for further growth above $30,000.

Another expert with the username PROFIT BLUE believes that BTC will not be able to sustain itself in the $25,000 range, and the next target for the cryptocurrency will be the $23,700 level.

The most pessimistic forecast came from analyst WhaleWire, who did not rule out the coin revisiting its cyclical low. According to WhaleWire, BTC is preparing for a move towards $12,000. The breakthrough of the $15,000 level, WhaleWire is confident, will occur during this summer.

The minimum for the past seven days and the last three months was recorded at $24,791. The main cryptocurrency was saved from further decline by the weakening US dollar, following the decisions of the Federal Reserve and the European Central Bank regarding interest rates.

BTC/USD seemingly recovered all of its losses for the week on Friday, and it has recently been seen trading at around $26,400. The total market capitalization of the crypto market stands at approximately $1.064 trillion ($1.102 trillion a week ago). The Crypto Fear & Greed Index has remained in the Neutral zone, although it has decreased from 50 to 47 points over the past seven days.

More By This Author:

XAU/USD: Historical Overview and Forecast Until 2027Forex And Cryptocurrency Forecast For June 5-9

Forex and Cryptocurrency Forecast for May 29 – June 2

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

more