Faster Tapering Means Less Strength In Credit’s Technical Picture

The European Central Bank has announced that APP purchases will slow down, after a small increase, to ease the discontinuation of PEPP and will likely end in the third quarter. This faster taper and an end to the Corporate Sector Purchase Programme in Q3 will reduce the technical strength in European credit markets.

The timing on this is bearish for credit markets

The fact that the taper comes in the quiet summer months, at a time where we see very little in the terms of redemptions to CSPP holdings is a bearish signal for credit markets. Not just primary (orders in primary stand at 40% of issue size) but also secondary markets will feel the pain, CSPP holds €324bn or some 16% of the Euro corporate credit market and no less than 32% of the eligible universe. The absence of the single biggest buyer at an illiquid time of the year and during low reinvestment months will be hard to swallow for a market that, in the case of a prolonged conflict in Ukraine will also see fundamental pressure, continued mutual fund outflows (YTD at 5% of AUM) and a higher rates backdrop.

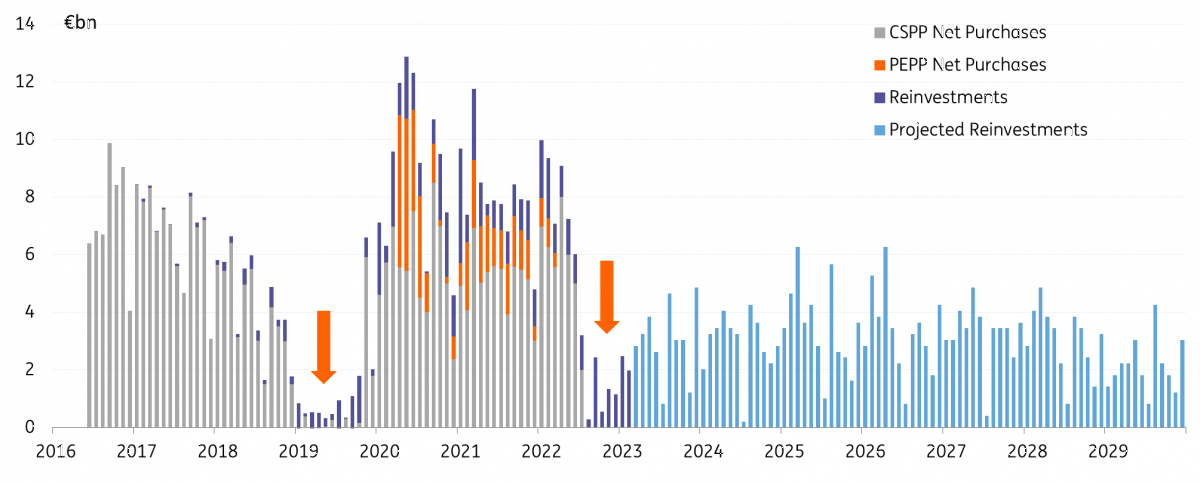

APP net purchases will total €40bn in April (up from the normal €20bn per month), then they will pencil in €30bn in May, and finally back down to €20bn in June. Thereafter, APP will likely end in Q3 and just continue with reinvestments. For the rest of 2022, reinvestment levels are not so high, averaging around €1bn per month. However, this increases in 2023 to an average of €2-3bn per month.

ECB net purchases under CSPP & PEPP and reinvestments

(Click on image to enlarge)

Source: ING, ECB

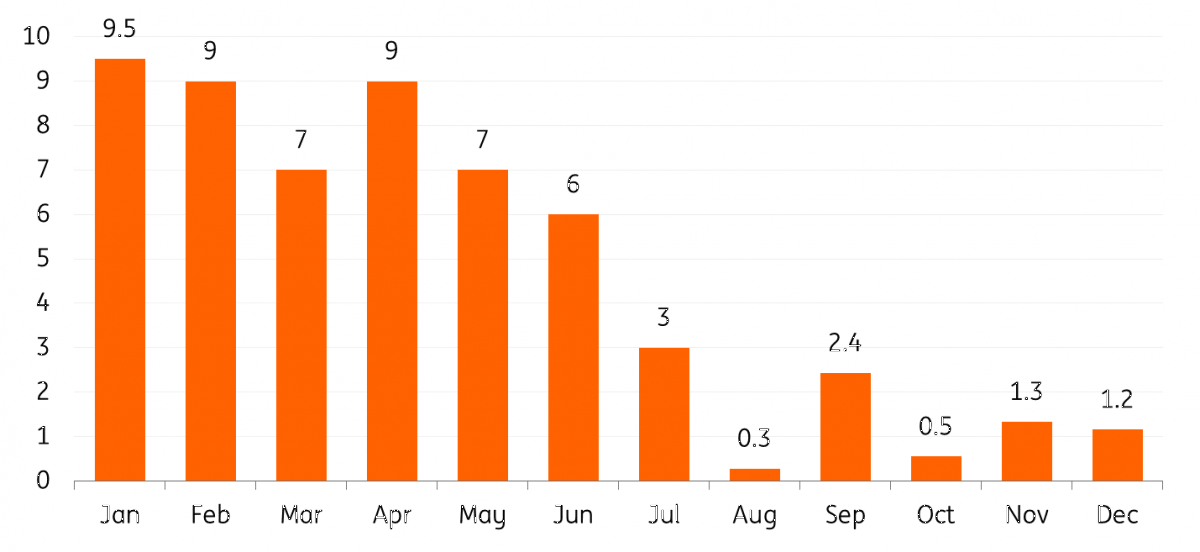

We expect monthly net purchases under CSPP to be around 20% of APP net purchases in April, May and June. Down from the usual 25%, as more of the increase is expected to go into PSPP, as that was the majority of PEPP. Therefore, we revise our monthly CSPP gross purchases forecast for the coming year.

Forecast monthly CSPP (& PEPP) gross purchases (€bn)

Source: ING

Weaker technicals for the second half of the year

Naturally, this is less supportive for credit markets, with the drop of gross purchases to €56bn for the year. This indeed weakens the technical strength of the EUR IG corporate credit space. This will leave a substantially large gap in demand for the market come Q3, particularly for new issues which would normally see around 40% of the books covered by the ECB. Therefore, we expect to see supply front-loaded into the next three to four months.

As such Q2 will still see CSPP kicking around at close to €9bn a month to fall off the edge of a cliff come the third quarter. This technical picture will really change in the second half of this year, as Q3 sees below €1bn in reinvestments per month.

We continue to expect supply to drop this year to between €250-290bn, whilst redemptions are penciled in higher at €223bn; therefore net supply will drop considerably to just €27-67bn. This should, with a reasonable new issue premium, be easy to absorb for the market, but spreads will not be as technically strong in the second half of this year.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more