Evolution Of Investment Preferences And Implications

Image Source: DKosig-iStockPhoto

Investment preferences and choices often evolve over time based on several factors, including nature of investment products, technology in delivery, socio-economic status of society, and performance of investment products, to name a few.

Generational mindsets change based on upbringing, and thus individuals in a select country across time can be different. Likewise, investment preferences of similar-aged people in different countries are different, and the old adage of emerging markets walking the footsteps of developed markets is an overkill of generalization.

(Click on image to enlarge)

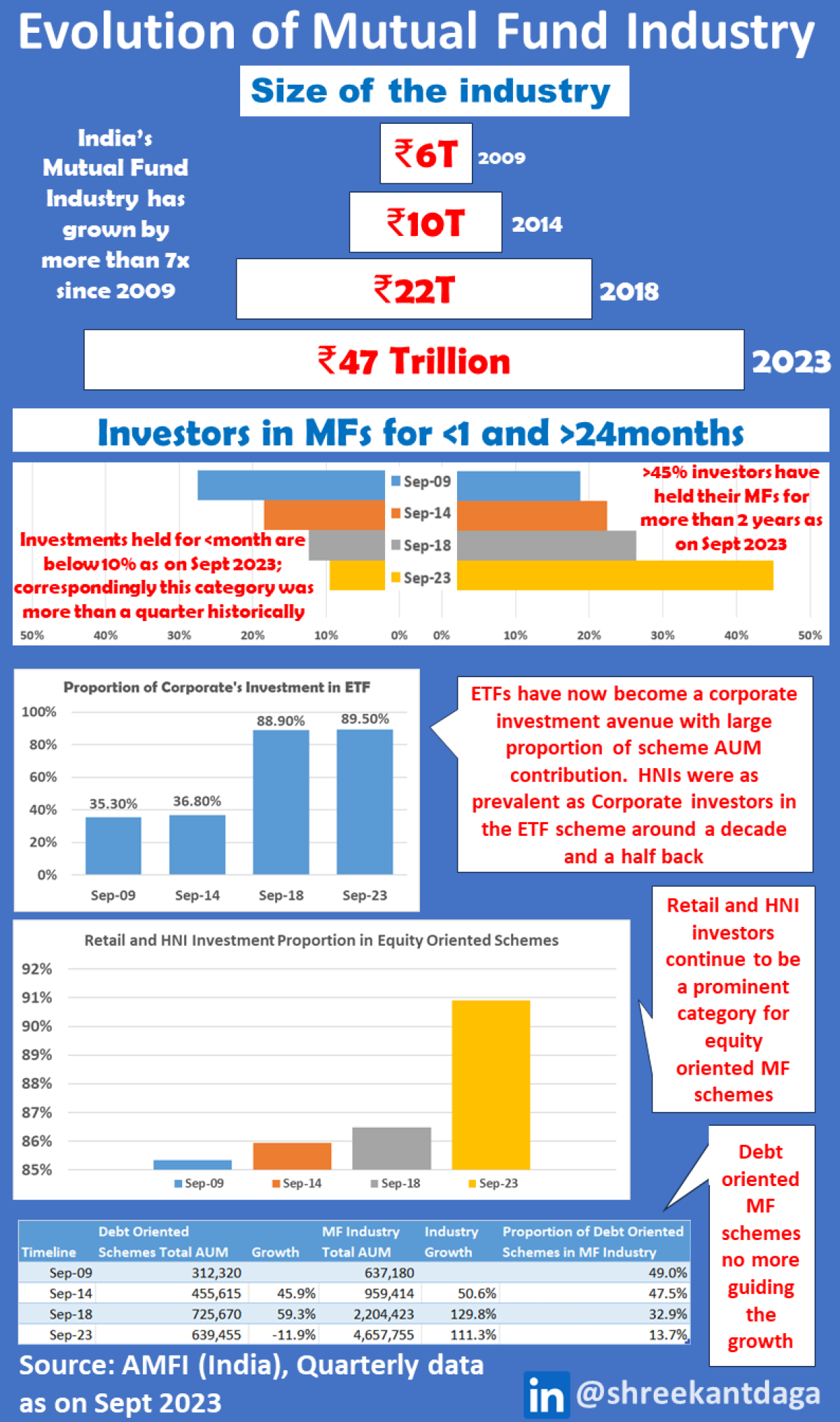

India’s mutual fund industry has grown by more than 7 times in the last 15 years. This growth has largely been on the back of investments in equity-backed schemes and growing participation. The participation is much stickier over a period of time now versus a decade and a half back.

Investors staying invested for less than a month are now down to less than 10% of the industry size vis-à-vis being more than 25% a decade and a half back. 'Longtermism' is seen to have grown as an investor preference. More than 45% AUM has now been held for more than two years, up from 20% a decade and a half ago.

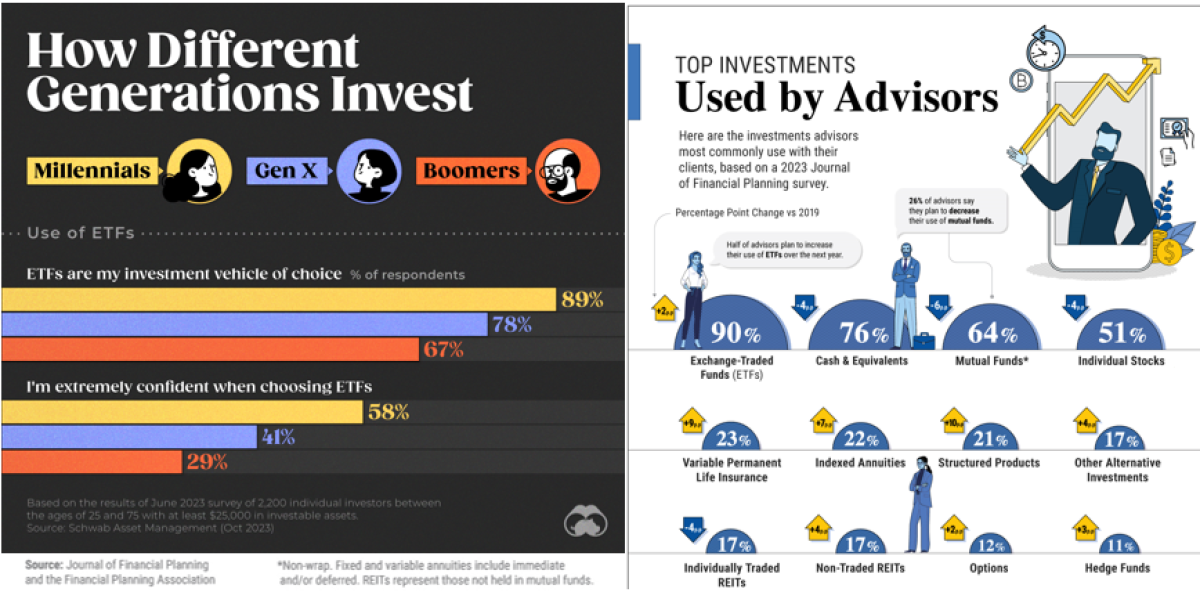

ETFs as a product, which had HNIs and corporates as major participants, do not lure in HNIs and retail investors anymore. This, in contrast, is very different from what is observed in US where the go-to investment product for an advisor or a millennial investor is an ETF.

This can be attributed to the fact that several Indian equity fund managers have outperformed indices by substantial margins. This makes an ETF a participant investment avenue, but not a preferred one in India.

Furthermore, an Indian financial advisor cannot charge distribution fees, and most advisors register themselves as distributors. Thus, an ETF distribution incentive is much smaller and incomparable to an incentive to distribute/sell a mutual fund unit.

(Click on image to enlarge)

The US anecdote of companies moving private is not true for India, as more and more private companies get listed on the stock exchange. The reason for this is the maturity and depth of public and private markets. A growing number of advisors are now pitching alternative products to their clients in the US. There has also been a wave to democratize alternative investments given their current chunkier form of investments.

In contrast, India has also seen a growth of alternative investments which can be attributed to incentives offered for its distribution. The general retail/HNI preference of an investor in India has a bit of 'gambler psychology,' which over-simplifies making a huge return multiple of investing in startups compared to participation in the asset class.

Globally, household (non-institutional) capital has now gained focus as wealth AUM is now equally split between the two. This is expected to pave the way for larger number of products being created and offered, since individual preferences are far more diverse than institutional preferences.

Indian stock markets, which are now the 5th largest in the world, have a close proxy with the mutual fund industry. In India, the surge of the mutual fund industry is also on the back of growing retail participation in equity-oriented schemes. An interesting observation is that the number of folios (investing accounts) far lags the huge growth of the industry. This indicates that investments have grown chunkier, with lower growth seen in participation.

Investment technology platforms which provide ease of distribution, access to digitization, and convenience, along with numerous investment choices with varied outcomes adjusted for risks, seem to be a safe harbor for future investment products. Financial service firms are quickly adapting to these investor preferences, and are developing stronger social and digital footprints.

As markets adapt to technological developments, it is important to mark that evolution may not always be gradual and on a predicted path, but can leap frog and arrive straight to the preferences of the current set of investors.

About the Author:

Shreekant is a CAIA, CFA and FRM charter holder. Shreekant pursued Bachelor’s in Management from Narsee Monjee College and later did his Master’s in Management from Jamnalal Bajaj Institute of Management Studies (JBIMS).

He also holds a Master’s in Commerce from Mumbai University. He is an alumnus of Bombay Stock Exchange Training Institute, having completed the certificate programme on capital markets. He has also acquired several certificates from the National Stock Exchange in Financial Markets.

Prior to joining CAIA Association, Shreekant had gathered experience in Structured Finance. His experience encompasses investment banking in debt capital markets, handling stressed assets, global RMBS deal evaluation, securitization, stress assets rating, and mutual fund rating.

Shreekant has worked with organizations such as ICICI Bank, Deutsche Bank Group and India Ratings and Research (Fitch Ratings). In mid-2018, he joined the Chartered Alternative Investment Analyst (CAIA) Association, the international leader in alternative investment education and provider of the CAIA designation, as Associate Director at India liaison office wherein he looks after India operations.

Shreekant has been a visiting faculty at JBIMS and has taught subjects such as Fixed Income, Global Markets & Financial Institutions and Structured Finance. He has been involved in mentoring students at his alma mater for their year-long projects. He has also graded final year MSc students of Mumbai University on their year-long projects.

He has also featured in newspapers, magazines, press releases, and articles on the web. His name also features on the list of educational professionals on the MHRD website. True to the cross function that he maintains with education and industry, Shreekant has 4 research papers presented and published at international forums and journals.

More By This Author:

Top Hedge Fund Industry Trends For 2024The Top-3 Reasons You Should Blow Up Your Invesment Committee

Risk Parity Not Performing? Blame The Weather