EUR/USD Weekly Forecast: Slowing Eurozone Economy Fuels Recession

The EUR/USD (FXE) weekly forecast is bearish as the Eurozone economy heads for recession amid rising interest rates.

Ups And Downs Of EUR/USD

ECB president Christine Lagarde spoke on Wednesday. She stated that the euro area’s financial stability was in jeopardy due to a slowing economy and inflation spreading to more sectors. The pair barely reacted to this statement.

According to the minutes from the Federal Reserve’s September meeting, officials expressed astonishment at the pace of inflation. They said they expected higher interest rates to be in place until prices declined.

Last month, US consumer prices increased more than anticipated, showing that the struggle against inflation in the biggest economy in the world is far from complete. In the twelve months ending in September, inflation, which measures how quickly prices rise, was 8.2%, down from 8.3% in August. Despite the decline, the number still exceeded expectations. This saw the pair ending Friday lower as investors expect the Fed to respond aggressively.

Next Week’s Key Events For EUR/USD

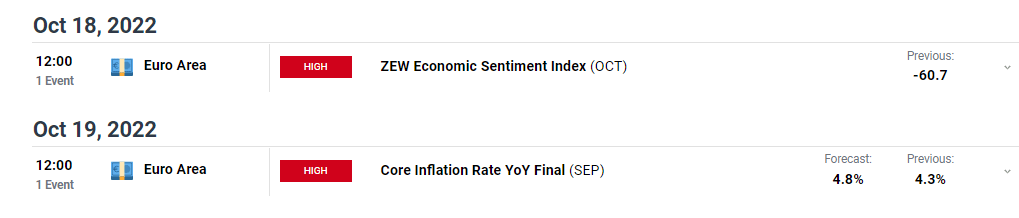

In the coming week, investors will see the state of eurozone inflation. To lower prices and curb demand, the ECB has raised interest rates alongside central banks worldwide, raising the possibility of an economic slowdown. In September, the 19-nation eurozone’s inflation rate reached a new high of 10%.

This new high has markets expecting a 75bps rate hike at the next meeting. However, this might change with next week’s inflation reading.

EUR/USD Weekly Technical Forecast: Bears Eyeing 0.9584

Looking at the daily chart, we see the price trading below the 22-SMA and RSI below 50, showing bears are in charge. The 22-SMA has offered resistance on many occasions, showing a strong downtrend.

Buyers made a good attempt at taking over at the 0.9584 support level. They could take the price to parity, offering too strong a resistance. At this point, bears returned, pushing the price back below the 22-SMA. In the coming week, the price might retest the SMA as resistance before retesting and possibly making a new low below 0.9584.

More By This Author:

USD/CHF Weekly Forecast: Fed Ready to Do More to Curb InflationUSD/CAD Price Prone To Further Gains Amid Recession, Eying US NFP

EUR/USD Outlook: ECB’s Growing Concerns Over Broadening Inflation

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more