EUR/USD Weekly Forecast: Mixed Data Leaves Market Directionless

Image Source: Pixabay

The EUR/USD weekly forecast reflects a modest downtrend as the price closed around 1.1500 handle. The pair struggled to find direction earlier as markets were on edge, awaiting delayed US economic releases following the government shutdown. After the data release, the EUR/USD found little respite near familiar levels.

The US labor markets revealed mixed data, as the 4-week ADP average showed a loss of 2,500 jobs in the private sector, indicating a cooling of hiring momentum in October. Weekly jobless claims stayed between the range of 220k and 232k, signaling mild pressure.

Meanwhile, the September NFP data rose by 119k, well above expectations, but the unemployment rate ticked slightly up to 4.4%. The dollar reaction was limited, as markets are more interested in seeing the October data, which will be partially reflected in the November data. Meanwhile, the US PMI showed a slight improvement, but it was not enough to impress the buyers.

Across Europe, economic signals stay muted as Eurozone inflation came at 2.1% YoY, with core CPI at 2.4%, reinforcing the ECB to hold rates unchanged in December. Meanwhile, Eurozone consumer sentiment slipped to -14.2. The PMI data also shows a loss of momentum in manufacturing, with the Composite PMI easing to 52.4.

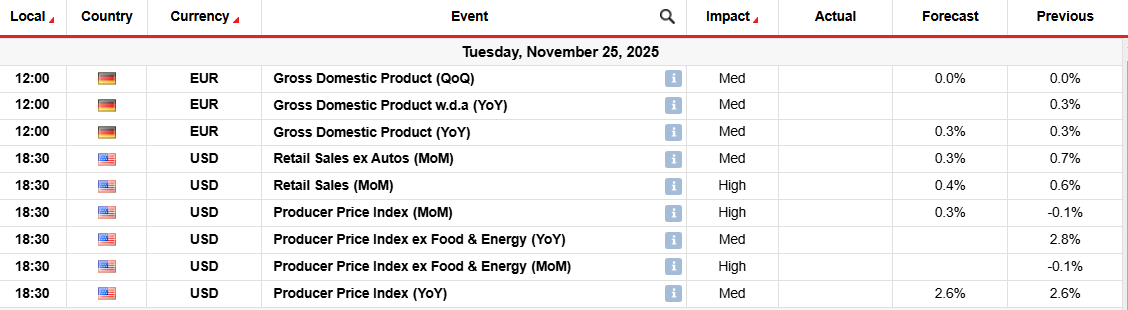

EUR/USD Key Events Next Week

(Click on image to enlarge)

Looking ahead, the EUR/USD will take cues from the packed European calendar:

- Eurozone Q3 GDP data

- Retail Sales

- HICP

- Unemployment Rate

On the other hand, the US calendar is also heavy:

- Retail Sales

- Durable Goods

- Weekly Jobless Claims

- Core PCE Index

- Produce Price Index

Since both sides are awaiting clearer economic signals, EUR/USD is likely to remain range-bound, with modest downside risks if US data reasserts dollar strength.

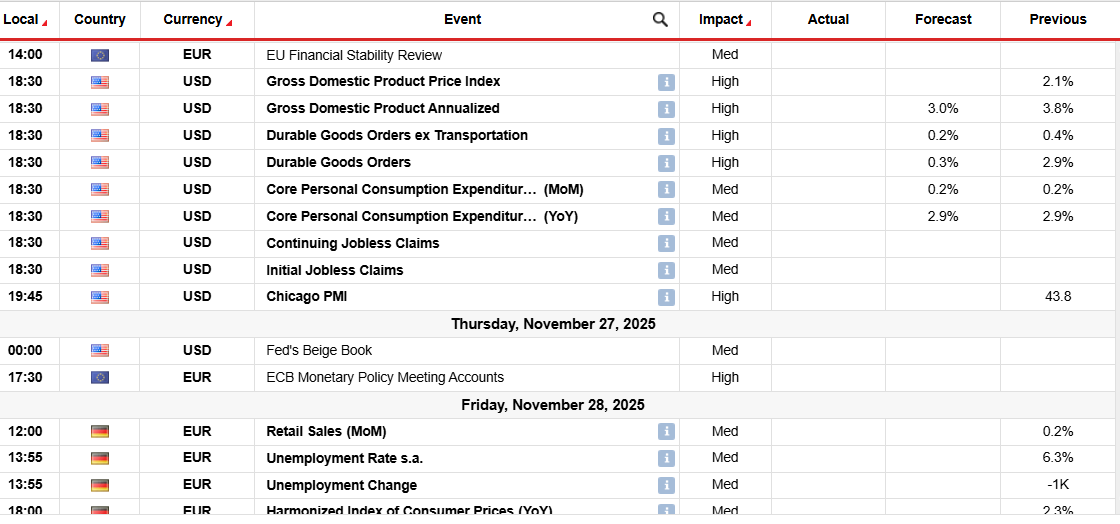

EUR/USD Weekly Forecast: 200-MA to Protect Downside

(Click on image to enlarge)

EUR/USD daily chart

The EUR/USD daily chart reveals a gloomy picture as it stays well below the key MAs like 20-, 50-, and 100-day MAs. However, the 200-day MA, around 1.1400, could provide solid support, coinciding with a horizontal level. Still, the current price is more than 100 pips above this support level, indicating bearish dominance. The RSI is currently around 40, moving downwards, and also shows a downtrend bias.

On the other hand, the pair needs to close above the 20-day MA, currently at 1.1565, to alleviate bearish pressure. In that case, buying pressure could emerge and push to test the 1.1600 round number ahead of a 50-

More By This Author:

USD/JPY Outlook: BoJ Signals Lift Yen Despite Downbeat Data

GBP/USD Forecast: Weak UK Retail Sales Reinforce BoE Dovish Shift

GBP/USD Outlook: Dovish BoE Expectations And Stronger Dollar Fuel A Bearish Shift

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more