EUR/USD Weekly Forecast: Investors Await Fed, ECB Rate Hikes

The EUR/USD (FXE) weekly forecast is flat as investors expect rate hikes from the ECB and the Fed. However, the greenback seems likely to hold strong.

Ups And Downs Of EUR/USD

Although the economy of the Eurozone (EZU) is barely expanding, the level of inflation in the region is still high. It leaves the European Central Bank with no choice but to lift rates to reduce prices further.

In the first quarter of the year, economic output in the Eurozone increased by just 0.1%. Many economies’ domestic consumption stagnated.

On May 4, it is widely anticipated that the ECB will hike rates for a seventh consecutive meeting.

The Fed is expected to boost interest rates next week. This is despite the US economy growing less than anticipated in the first quarter. However, the GDP report showed rising quarterly inflation figures. In Q1, prices for core personal consumption expenditures increased by 4.9%.

Core PCE data indicated that inflation rose in March. However, it was slower than in February.

Next Week’s Key Events For EUR/USD

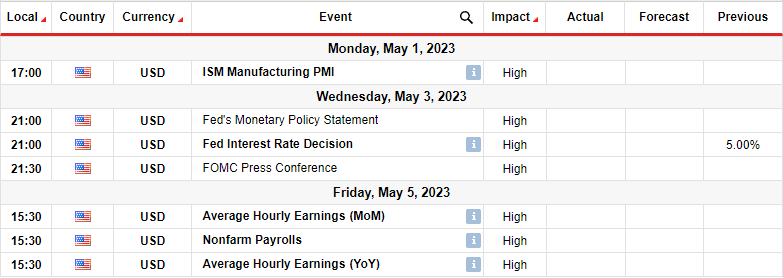

EUR/USD weekly key events

Investors will focus on the FOMC meeting and the nonfarm payrolls. At the meeting, the Fed is expected to lift rates by 25bps. It is still fighting to tame inflation and bring it down to its 2% target.

The nonfarm payrolls will show whether high-interest rates are having an impact on the heated labor market.

EUR/USD Weekly Technical Forecast: Bulls Weakening

EUR/USD weekly forecast chart

The bias for EUR/USD in the daily chart is bullish. The price is trading above the 22-SMA and using it as support. At the same time, the RSI is trading above 50, supporting bullish momentum. The price has paused at the 1.1052 resistance level.

It has pulled back to retest the SMA and looks ready to take out the resistance. A break above would make a higher high and continue the uptrend.

However, the bullish bias is weak. The price stays close to the SMA, indicating that bulls are not fully committed. At the same time, the RSI is moving sideways as the price moves up. If this does not change, we might see bears return to reverse the trend. A reversal would also see the price break below the 1.0925 support level.

More By This Author:

USD/JPY Price Analysis: Dollar Falls On Rate Cut ExpectationsGold Price Rebounds Ahead Of The CB Consumer Confidence

USD/JPY Price Analysis: Japan’s CPI Continues Rise In March