EUR/USD Weekly Forecast: Bulls To Take Double Top, ECB Meeting Eyed

Image Source: Pixabay

- The EUR/USD pair remains bullish as it broke above the 1.1900 area after a month.

- Dismal US NFP data helped the Euro bulls to resume the rally.

- The ECB’s stance is cautious while the Fed’s tapering speculation is getting thin.

- Investors will be looking at the ECB meeting and German data next week.

The EUR/USD weekly forecast is bullish as the US dollar maintains a low tone after the dismal US jobs data. Therefore, the probability of jumping higher is quite eminent. The EUR/USD pair tested a high of July 30 at the 1.1910 area on Friday, but then slightly pared off the gains. However, the positive tone still surrounds the euro.

Fed Chairman Jerome Powell’s indecision and disappointing data on local job markets suggest that the pace of tapering will be delayed, making the US dollar more unattractive this week.

US NFP and Fed Tapering

According to Powell, employment is slowly recovering but the path is difficult. Moreover, recent macroeconomic indicators have confirmed his words, pouring cold water on the market’s hopes.

ADP’s survey assumed low employment levels as 374,000 new private-sector jobs were created, well below the expected 613,000. Also, the sub-component of manufacturing employment dropped to 49 from 52.9. In summary, the number of non-farm jobs created is below expectations, at 235,000 compared to 750,000. However, with the unemployment rate falling to 5.2% and employment remaining at 61.7%, this is exactly what economists expected.

ECB Temporarily On Hold

ECB members are likely to suspend monetary policy at their meeting on Sept. 9. As a result, Europe has a cautious atmosphere regarding changing existing policies, and most of the attention has been focused on the pandemic.

Aside from central banks, recent economic data has been very discouraging. For example, economic sentiment in the EU fell to 117.5 in August, while consumer confidence slumped to 113.8 in the same month. August’s final Markit PMI reading has also been released, which shows modest growth otherwise, based on preliminary estimates.

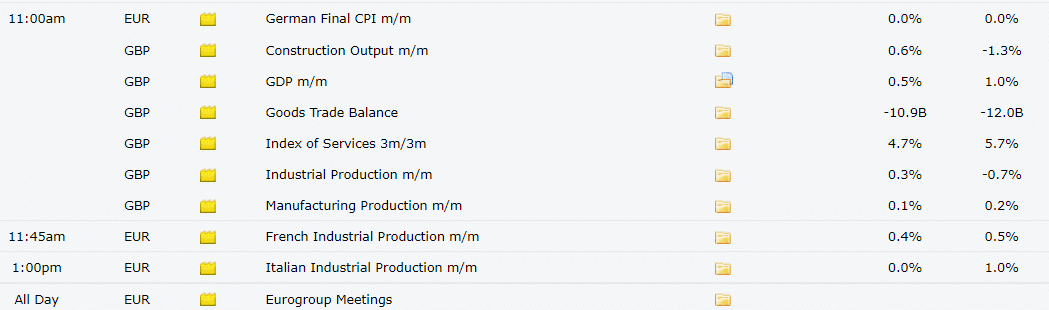

Key Events in the Eurozone during the Week of Sept. 6-10

![]()

![]()

Next week is going to be a busy week for macroeconomic events in the EU. Germany is also expected to publish data on manufacturing orders, industrial production, and trade balance next Thursday in addition to the ECB meeting.

The country will also release a ZEW survey in September. August’s final inflation data will be released as well. The EU will publish its revised version of gross domestic product this week.

Key Events from the US during the Week of Sept. 6–10

![]()

![]()

![]()

The important events next week include the JOLTS job opening due on Wednesday ahead of Fed William’s speech in the US. Moreover, weekly unemployment claims are also important to note. Other than that, US PPI month-over-month data may also trigger volatility on Friday. The figure is expected to slide to 0.6% against the previous month’s reading at 1.0%.

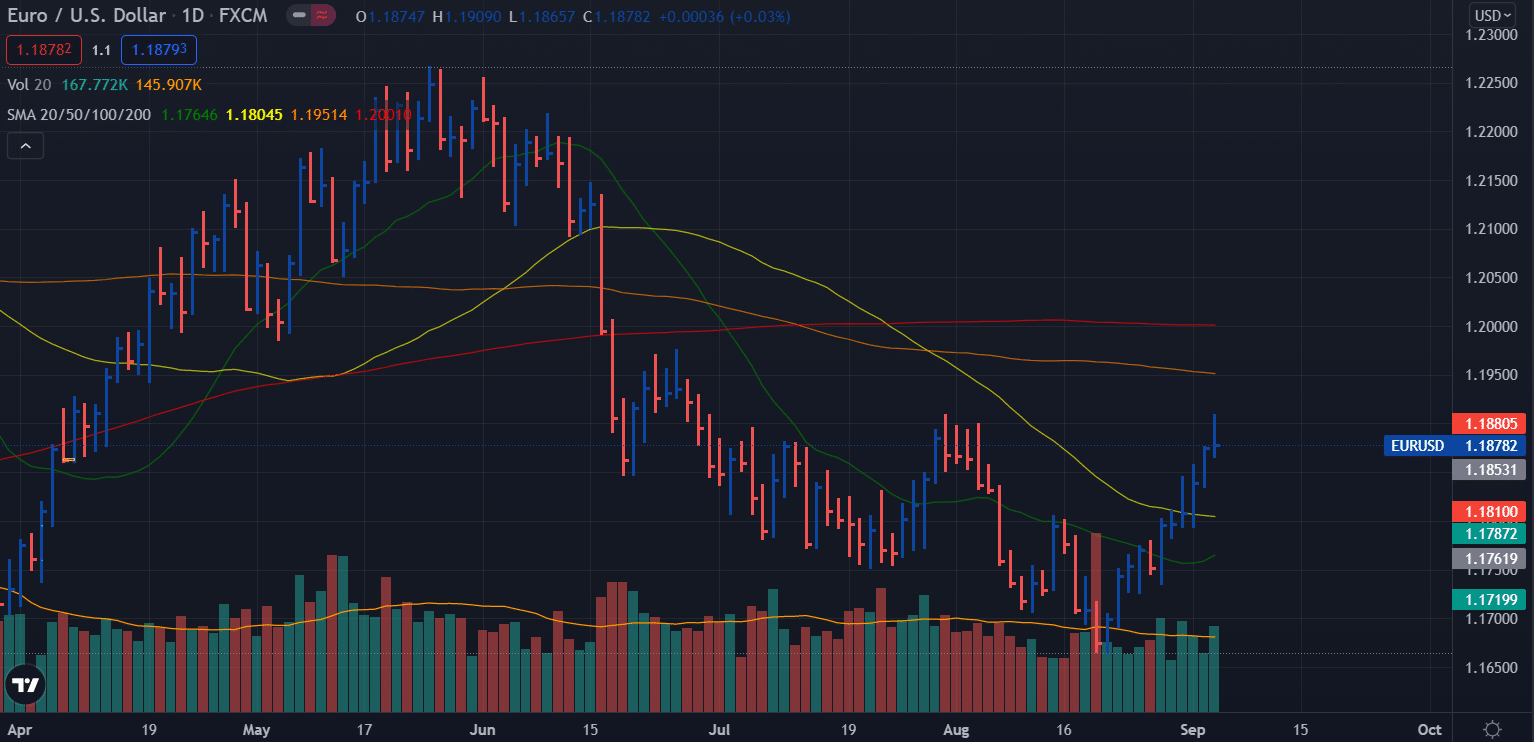

EUR/USD Weekly Forecast – Daily Chart

EUR/USD Weekly Technical Forecast: Double Top to Cap Gains

After posting a double bottom at 1.1910, the EUR/USD price retraced back below the 1.1900 level. Friday’s bar closed off the highs, below the middle, with a very high volume. The previous few bars have a declining volume. This indicates that the pair may observe a pullback to 1.1850 or even lower to 1.1800 area. On the upside, breaking the double top may lead to 1.1950 ahead of psychological resistance of 1.2000.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more