EUR/USD Steadies Near 1.1720 As Trader Shrugs Off Venezuela Jitters

Image Source: Pixabay

The EUR/USD recovered some ground on Monday even though it bounced off daily lows near 1.1710 and finished the session unchanged at around 1.1718 as risk appetite improved, despite rising geopolitical tensions.

Euro trims losses as weaker US data offsets geopolitical tensions, Kashkari stance

Geopolitical developments surprised the world as the US military captured the Venezuelan President Nicolas Maduro and his wife, on January 3, to face US justice. Maduro faces charges of drug trafficking and alliances with the Sinaloa Cartel and the Tren of Aragua organization.

Aside from this, US economic data showed that business manufacturing activity contracted for the tenth straight month, yet it remains above a level seen by the Institute for Supply Management (ISM) as a floor which indicates the economy could continue to expand at a slow pace.

The data weakened the Greenback, which was slightly underpinned by hawkish comments of Minneapolis Fed President Neel Kashkari, who reaffirmed that inflation remains high.

Across the pond, the Eurozone docket was scarce, yet it would gain traction on Tuesday January 6. HCOB Composite and Services PMIs would be revealed for the bloc and most countries, along with the release of German and Eurozone inflation figures.

In the US, the economic schedule would feature the release of the ISM Services PMI, Initial Jobless Claims for the week ending January 3 and December’s Nonfarm Payrolls.

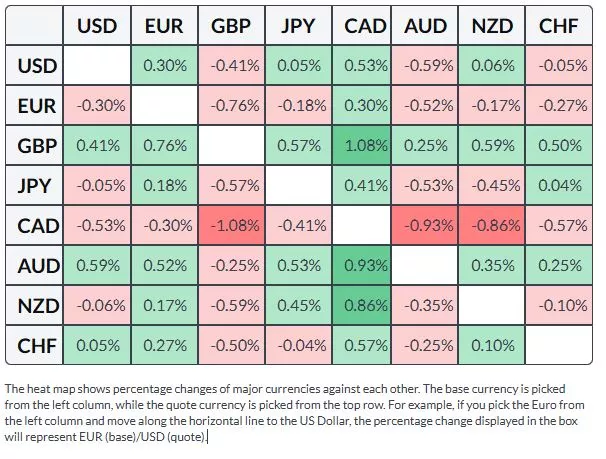

Euro Price This Month

The table below shows the percentage change of Euro (EUR) against listed major currencies this month. Euro was the strongest against the Canadian Dollar.

Daily digest market movers: EUR/USD aims higher as US PMI contracts

- The US ISM Manufacturing PMI slipped to 47.9 in December 2025, missing expectations of 48.4 and signaling a further deterioration in factory activity. The reading marked the tenth consecutive month in contraction, easing from 48.2 in November and highlighting persistent weakness across the sector.

- Within the report, the Employment Index edged higher to 44.9 from 44.0, though it remained firmly in contractionary territory. The New Orders Index also stayed below the expansion threshold, contracting for a fourth straight month despite a modest uptick to 47.7 from 47.4.

- The Minneapolis Fed President Neel Kashkari said inflation remains too high, noting that monetary policy is now closer to neutral. He described the labor market as a “low-hiring, low-firing” environment, pointing to limited churn rather than a sharp deterioration.

- The Eurozone HCOB Composite PMI reading in November was 51.9. A reading below the latter would indicate that the economy is deteriorating in the bloc. The last print for the EU’s largest economy was 51.5, but for the Services PMI was 52.6.

- The Consumer Price Index (CPI) in Germany on an annual basis in November was 2.3%. Meanwhile, the Harmonized Index of Consumer Prices (HICP) expected for December is expected to rise from -0.5% MoM to 0.4%. For the 12 months to December reading, the HICP is projected to dip from 2.6% to 2.2%.

- If the Eurozone inflation data comes aligned with the previous month’s reading, or estimates, it could reaffirm the European Central Bank (ECB) stance of keeping interest rates unchanged. Money markets expect the ECB to hold rates unchanged, yet traders are pricing in 4.7 basis points of rate hikes towards the end of 2026.

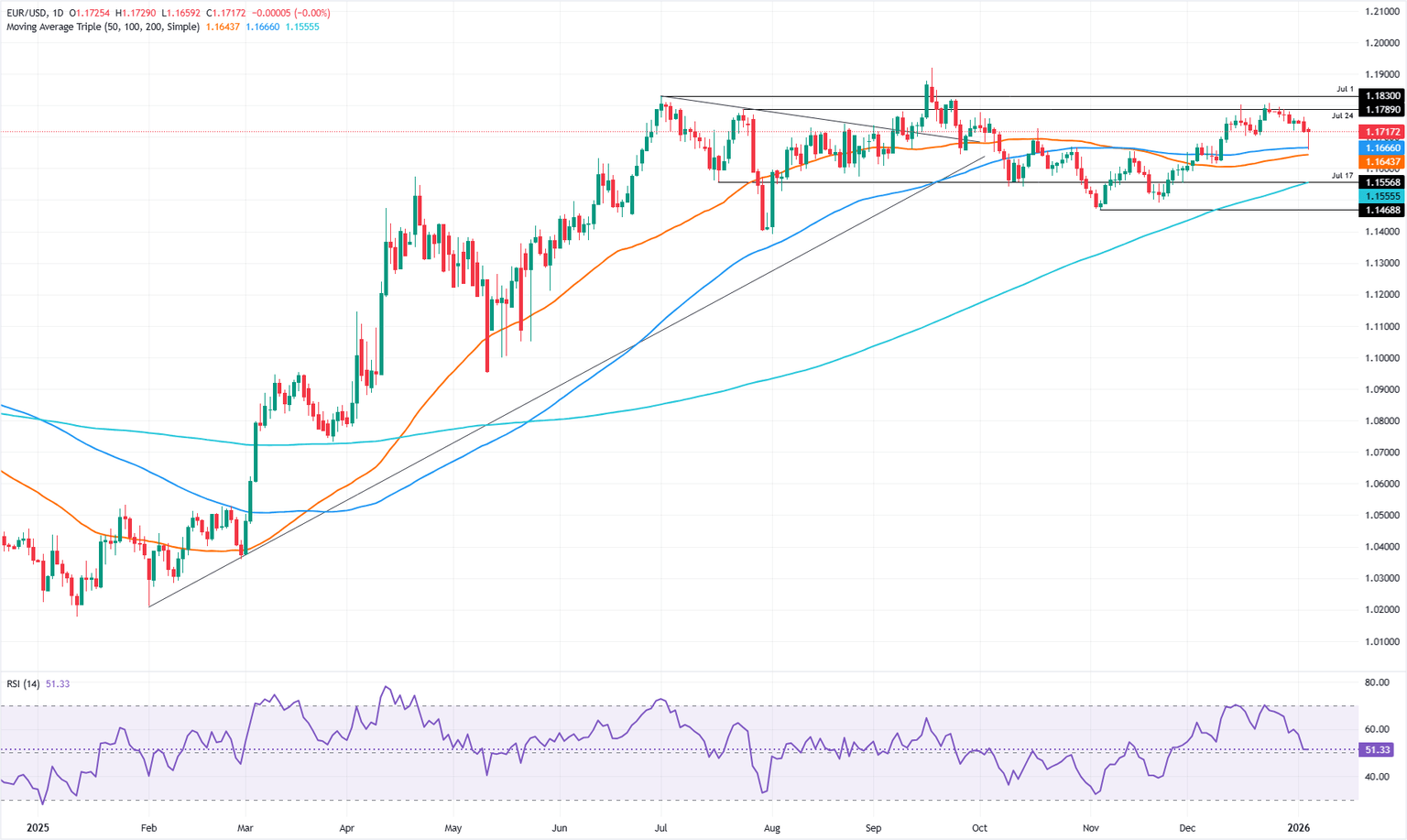

Technical outlook: Euro bulls forced to clear 1.1750 to extend the trend

The technical picture for the EUR/USD remains neutral to upward biased, after forming a ‘dragonfly doji,’ an indication that traders bought the dip to 1.1713, pushing the pair to close above 1.1715. Nevertheless, bulls are not out of the woods as they must clear the 20-day Simple Moving Average (SMA) at 1.1731, ahead of 1.1750, which would clear the path towards 1.1800.

Conversely, if EUR/USD dives below 1.1700 it will expose key support levels like the 100-day SMA at 1.1668, followed by the 50-day SMA at 1.1640 and the 200-day SMA at 1.1553.

EUR/USD daily chart - Source: FXStreet

More By This Author:

Gold Surges Past $4,440 As Venezuela Strikes Fuel Geopolitical BidGBP/USD Reclaims 1.3500 As Dollar Falters On Geopolitical Shock, Weak US Data

Gold Jumps Above $4,440 As Geopolitical Flare, Fed Cut Bets Mount