EUR/USD Slides After ECB Hold As Risk-Off Flows Lift US Dollar

Image Source: Pixabay

The Euro extends its losses on Thursday as the European Central Bank held rates unchanged in an uneventful monetary policy decision. Jobs data in the United States was softer than expected fueling speculation for rate cuts by the Federal Reserve. The EUR/USD trades at 1.1777, down 0.25%.

Euro weakens below 1.1800 as an uneventful ECB decision meets risk aversion and softer US jobs data

Risk aversion pushed investors’ attention on the US Dollar in the FX space. Wall Street plunge dragged by nine out of the eleven sectors that compose the S&P 500, which lost 1.2%, the Nasdaq sank over 1.59%, while other assets like Bitcoin plummeted by over 13%.

Aside from this, US jobs data revealed that private companies are slashing job posts, remaining reluctant to hire. Consequently, the number of Americans filling for unemployment benefits, rose. Given the backdrop, expectations that the Fed would need to reduce interest rates had risen, with money markets expecting 60 basis points of easing, revealed Prime Market Terminal data.

Earlier the ECB kept interest rates unchanged and reiterated that it does not have a pre-committed path and that it would remain data-dependent on a meeting-by-meeting basis. At the press conference, ECB’s President Lagarde, struck a neutral tone and affirmed that monetary policy was “in a good place.”

After the ECB’s decision and the US data, the EUR/USD failed to gain traction, remaining below 1.1800, but its losses were capped as well amid growing expectations for a dovish Fed.

What’s in the calendar in Europe and the US on February 6?

In Europe, the docket will feature speeches by ECB Cipollone and Kocher. In the US, the University of Michigan will release the Consumer Sentiment. This and a speech by the Vice Chair Philip Jefferson, would be the market moving events.

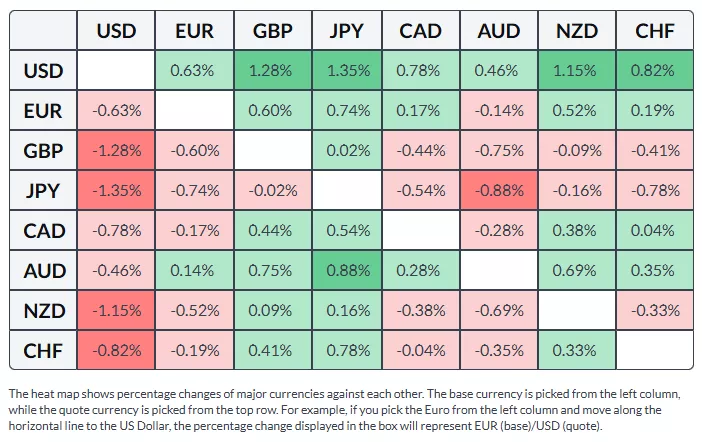

Euro Price This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Japanese Yen.

Daily market movers: Euro treads water despite lackluster US data

- On Thursday, US jobs data was poor. Challenger, Gray and Christmas revealed that US employers cut 108,435 people of the workforce, with Amazon, UPS and Dow, Inc accounting for almost 50% of the total in December.

- This and the jump on Initial Jobless Claims for the week ending January 31 can prompt the Fed to consider rate cuts rather sooner than later. Jobless claims rose by 231K, exceeding estimates of 212K, up from the previous print 209K.

- The Job Openings and Labor Turnover Survey (JOLTS) for December reinforced signs of a cooling labor market, with vacancies falling to 6.542 million from 6.928 million in November, well below the 7.2 million forecasts.

- Nevertheless, the Greenback rose. The US Dollar Index (DXY), which tracks the greenback against a basket of six currencies, edged up 0.31% to 97.95.

- Money markets have since increased expectations for Fed easing by year-end, pricing in 56 basis points of cuts, up from 50 bps previously, according to Prime Market Terminal data.

- In the press conference, Lagarde struck a neutral tone and spent time speaking about exchange rate moves. She said the ECB is keeping a close eye on markets but concluded that no big change has taken place in recent months. Lagarde’s added that the central bank has taken to their baseline, moves in the FX markets, disregarding any intentions of intervention.

Technical outlook: EUR/USD to trade sideways within 1.1750-1.1800

The bullish bias remains intact as prices sit above the 50-, 100- and 200-day Simple Moving Averages (SMAs). The EUR/USD first support is the 50-day SMA at 1.1732. The Relative Strength Index RSI) although neutral, suggests consolidation while the pair remains above the 50-day SMA.

The rising trendline from 1.1469 underpins the bullish tone, with support seen at 1.1632. Holding above keeps the higher-low structure intact, keeping risks skewed to the upside.

Conversely, for a bullish continuation, traders need to regain the 1.1800 figure, which could exacerbate an upward move towards the 1.1900 figure.

EUR/USD Daily Chart

More By This Author:

Gold Slides Nearly 2% As U.S. Dollar Strength Triggers Fresh LiquidationEUR/USD Slips As Firm U.S. Services Data, Soft Eurozone Inflation Weigh

EUR/USD Slips Under 1.1800 On Strong PMI Data, Fed Bets Boost Dollar