EUR/USD Price Pauses Downside By 0.99, Bearish Before Jackson Hole

The EUR/USD price plunged as the Dollar Index resumed its upwards movement (FXE, UUP). The bias is strongly bearish. Hence, the price could approach fresh lows.

Still, after its massive drop, the price may try to rebound. It could come back to test the near-term resistance levels before resuming its sell-off. Don’t forget that the pressure is high, so the EUR/USD pair could drop deeper anytime despite temporary rebounds.

Fundamentally, the greenback dominated the currency market after the FOMC Meeting Minutes. As you already know, the Federal Reserve is expected to continue hiking rates. A 50-bps rate hike is expected in September as inflation is expected to stay high.

Today, the Eurozone economic data came in mixed today. The German Flash Services PMI came in at 48.2 points below 49.0 expected, while the German Flash Manufacturing PMI was reported at 49.8 points above the 48.0 points estimated. Still, the economic data reported contraction in both sectors.

Furthermore, The Eurozone Flash Services PMI dropped from 51.2 points to 50.2 points below 50.5 forecasted, while the Flash Manufacturing PMI came in at 49.7 points above 48.9 points estimated. Later, the US Flash Services PMI, Flash Manufacturing PMI, New Home Sales, and Richmond Manufacturing Index could bring more volatility.

EUR/USD price technical analysis: Below parity

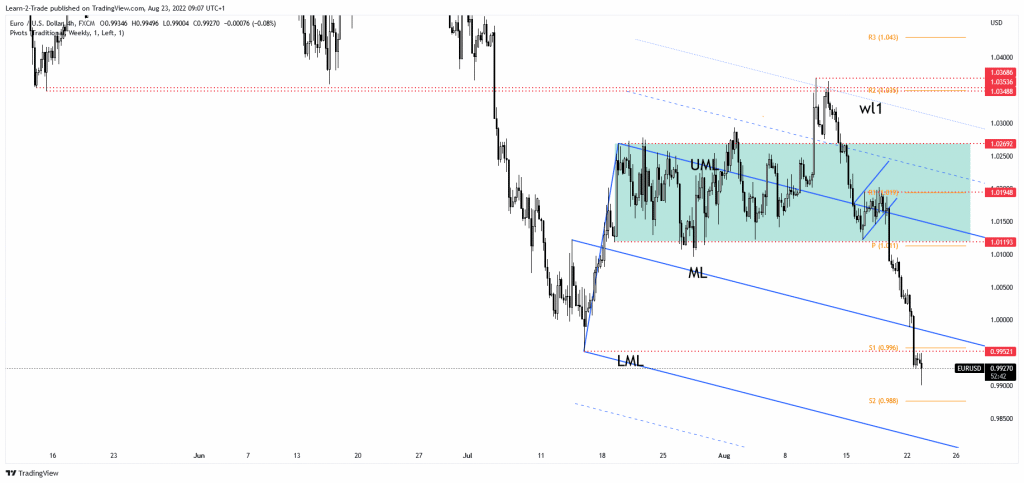

The EUR/USD pair ignored the 1.0000 psychological level. Now it has reached the 0.99 psychological level. After its massive drop, a rebound was natural. The price tried to test and retest the 0.9952 broken obstacle but failed to signal strong downside pressure.

The descending pitchfork’s median line (ml) represents a dynamic resistance. As long as it stays under this level and below 0.9952, the EUR/USD pair could resume its downside movement.

The weekly S2 (0.9880) stands as a downside obstacle as the first downside target. Also, the descending pitchfork’s lower median line (LML) represents a downside obstacle. Technically, after failing to stay above the upper median line (UML), the rate could come back down towards the LML.

More By This Author:

GBP/USD Weekly Forecast: Bullish Momentum Ahead of FOMC MinutesUSD/CAD Outlook: US Inflation To Soften Decline In Commodity Prices

AUD/USD Price Halts Rally by 0.70 Ahead Of US Inflation Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more