EUR/USD Price Analysis: Bidding Above 1.05 Ahead Of Lagarde’s Speech

The EUR/USD price analysis remains positive as the pair is pushing slightly higher in a relatively silent session on Monday morning as the US is on holiday. The euro was slightly stronger after the French election but was still close to last week’s lows.

The euro (FXE) was slightly stronger after the French election but was still close to last week’s lows. President Emmanuel Macron lost the National Assembly on Sunday, an unfortunate setback that could push France into a political deadlock.

The Fed remains extremely hawkish, with Fed governor Christopher Waller ready to support another 75 basis point rate hike in July.

“With rapidly slowing growth momentum and a Fed committed to restoring price stability, we believe a mild recession starting in Q4 is now more likely than not,” warned analysts at Nomura.

On the other hand, the ECB is fighting to limit the borrowing costs of its more indebted members by directing bond reinvestment and devising new instruments to lower the cost of borrowing. However, ECB policymaker Olli Rehn said on Saturday that the central bank would not be solving these countries’ debt issues and would not let budget concerns dictate monetary policy.

ECB president Lagarde, who is set to speak later in the day, is expected to give ideas on the central bank’s monetary policy and how it will support vulnerable countries like Italy, whose gross debt is around 150% of GDP.

EUR/USD Key Events Today

EUR/USD investors will be listening in on speeches in Europe. ECB president Lagarde is expected to speak later in the day, and investors will expect to get clues on monetary policy in the coming July meeting.

EUR/USD Price Technical Analysis: Bulls Could Try A Break Above 1.0600.

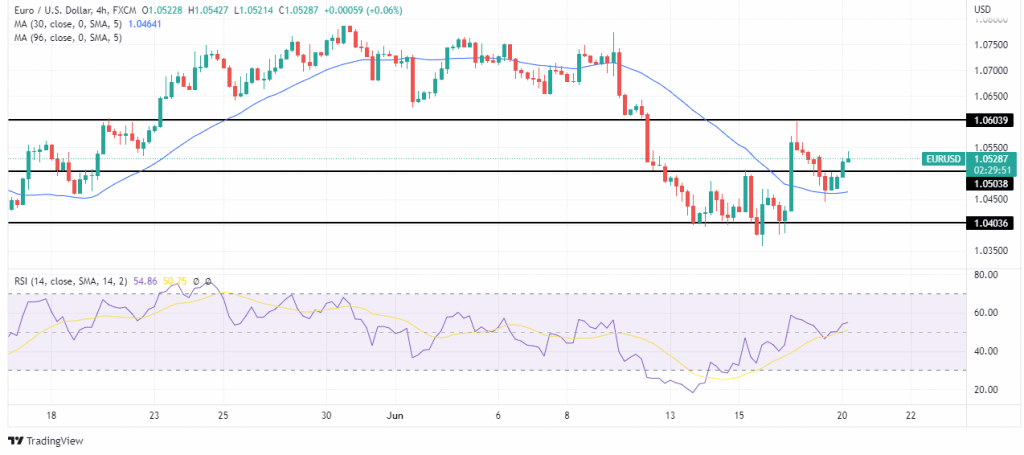

Looking at the 4-hour chart, we see the price has changed direction and is pushing higher. It is trading above the 30-SMA, which shows that bulls have taken over. The price broke above the 30-SMA with a solid bullish candle, retested it, and is now pushing higher.

The RSI is trading above 50, showing momentum favoring the bulls. The price made the first higher low when it retested the SMA, and if bulls can maintain their momentum, then we could see a new higher high above 1.06000. This new high would confirm the bullish trend.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more