EUR/USD Jumps As Growing Fed-Cut Bets And Risk-On Mood Lift Euro

Image Source: Pixabay

The EUR/USD registers modest gains of 0.12% late on Tuesday during the North American session, as risk-appetite improves. Expectations for another Fed rate cut in December and Eurozone’s elevated inflation reading, keep the shared currency bid. The EUR/USD trades at 1.1625 after bouncing off daily lows of 1.1591.

Euro edges higher as markets price an 87% chance of a December Fed cut while US data momentum softens

Wall Street finished the session in the green, while the crypto space showed signs of recovery. The Dollar dipped late as US President Donald Trump at a press conference, referred Kevin Hassett as a “potential” Fed Chair.

A scarce economic docket in the US kept traders digesting Monday’s ISM Manufacturing PMI report, which showed that business activity slowed in November, while prices rose and the jobs market cooled down.

Money markets are pricing an 87% probability for a Fed 25 basis points rate cut at the December meeting, a tailwind for the Euro.

Across the pond, inflation data in the Eurozone was mixed, though it had little impact on the EUR/USD.

Downside risks for the Euro is the continuation of hostilities in Eastern Europe. The Russian President Vladimir Putin said that Europe’s demands are unacceptable and added that if they want to fight a war, “we are ready now.”

Ahead this week, the Eurozone docket will feature HCOB Flash PMIs for November, the Producer Price Index (PPI) for the bloc and speeches by European Central Bank (ECB) policymakers. In the US, the schedule will feature S&P and ISM Services PMIs, ahead of Challenger Job Cuts and Initial Jobless Claims on Thursday.

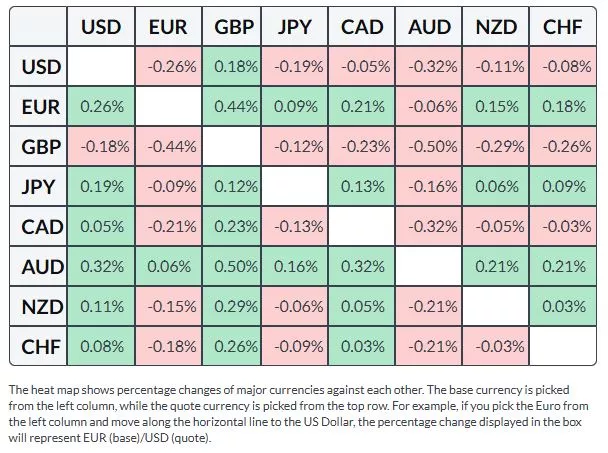

Euro Price This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the British Pound.

Daily market movers: EUR/USD surges as inflation jumps

- Data in the Eurozone, the preliminary reading of the Harmonized Index of Consumer Prices (HICP) rose 2.2% YoY in November from 2.1% in October, defying expectations for unchanged reading. Core HICP held steady at 2.4% YoY, undershooting forecasts of a rise to 2.5%.

- The ISM Manufacturing PMI slipped to 48.2 in November from 48.7 in October, marking the ninth consecutive month of contraction. The employment sub-index deteriorated further, dropping from 46 to 44, while the Prices Paid component rose to 58.5 from 58, slightly below expectations of 59.5.

- US President Trump announced he would name Powell's successor in early 2026, which led to a brief Dollar strength. However, Trump later announced he had narrowed his choice down to one, and then introduced Hassett as the "potential" next Fed Chair, which in turn saw the Dollar move to lows.

Technical analysis: EUR/USD subdued waiting for fresh catalyst

EUR/USD consolidated for the third straight day, despite posting minimal gains but stir resistance at the confluence of the 50- and 100-day Simple Moving Averages (SMAs) at 1.1610/1.1643, caps the pair’s advance towards 1.1700.

Although the pair sits near 1.1650, buyers seem to be losing momentum as depicted by the Relative Strength Index (RSI), which has flattened during the last two trading days, suggesting that they are losing strength.

If EUR/USD drops below 1.1600, the first support would be the 20-day SMA at 1.1576, followed by 1.1500 and the 200-day SMA at 1.1448.

EUR/USD daily chart

More By This Author:

Gold Retreats Below $4,200 As Traders Cash Out Before Fed MeetingGBP/USD Steadies Near 1.3200 As Traders Bet On Dual Fed–BoE Dovish Pivot

Euro Clings Above 1.1600 As Dollar Softens Amid Quiet Data Lull