EUR/USD Gains Ground, But Recovery Remains Limited

Image Source: Pixabay

- EUR/USD bounced back toward the 1.0600 handle on Wednesday.

- Markets have stepped away from broad Greenback bidding pressure.

- Volumes and trading flows set to be crimped through the rest of the week.

EUR/USD caught a broad-market bid on Wednesday, taking a new run at the 1.0600 handle during the midweek market session. Fiber’s bullish rebound was due mostly to investors broadly taking a step out of recent Greenback buying pressure, rather than any instrinsic strength within the Euro itself.

Wednesday’s data docket was entirely one-sided, delivering a wide chunk of US economic figures before US markets shutter exchanges for the Thanksgiving holiday on Thursday, to be followed by shortened trading hours on Friday. Annualized US Gross Domestic Product (GDP) grew by the expected 2.8% through the third quarter, to no one's surprise and barely moving the needle on investor pulses. Core Personal Consumption Expenditure Price Index (PCEPI) accelerated to 2.8% for the year ended in October, also meeting expectations. While upticks in inflation metrics generally bode poorly for market expectations of future rate cuts, the move upward was widely expected, and a hold in monthly figures at 0.3% MoM helped to frame the bump in the data as being in the rear-view mirror.

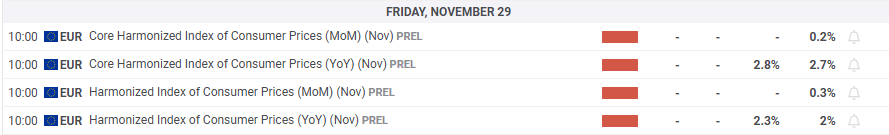

Fiber traders will be looking toward Friday’s preliminary pan-EU Harmonized Index of Consumer Prices (HICP) inflation data, with equal parts hope and despair. Pan-EU inflation is broadly forecast to tick higher in the near term, which will further cripple the European Central Bank (ECB) even further as ECB policymakers struggle to find the words to bolster investor confidence in the lopsided European economy.

EUR/USD price forecast

The Euro’s much-needed bullish reprieve on Wednesday gave Fiber bulls a chance to put more distance between themselves and the pair’s latest swing low below the 1.0400, but not by much. EUR/USD is poised for a battle with the 1.0600 handle, and even a victory on the key technical level still sees further topside momentum running aground of a quickly-descending 50-day Exponential Moving Average (EMA) falling through 1.0750.

EUR/USD daily chart

More By This Author:

EUR/USD Flattens Near 1.05 In The Run-Up To EU Inflation FiguresDow Jones Industrial Average Squeezes Out Another 400 Point Gain On Friday

EUR/USD Looks For Higher Ground Above 1.06