EUR/USD Falls On French Political Shock And Shutdown Lift Dollar

Image Source: Pixabay

EUR/USD retreats during the North American session sponsored by political turmoil in France and US Dollar strength, amid the sixth day of government shutdown in the US. The pair trades at 1.1714, down 0.24%.

Euro weakens toward 1.17 as Lecomu’s resignation and prolonged US fiscal gridlock bolster safe-haven demand for the Greenback

Market mood remains positive, as portrayed by Wall Street, but the shared currency depreciates on news that the French Prime Minister Sebastien Lecomu submitted his resignation. The lack of news about negotiations regarding the re-opening of the US government leaves traders leaning on economic data from Europe and speeches by central bank officials.

The US economic docket will feature the University of Michigan (UoM) Consumer Sentiment survey on Friday. This and the tone of discussions between the White House and Democrats, could set the stage to the release of delayed data in the US.

Recently, US President Donald Trump said that layoffs could be triggered if the Senate vote on the shutdown fails, adds negotiations are ongoing with Democrats.

The Financial Times reported that the European Commission intends to propose tariffs of 50% on steel imports worldwide above a quota set at 2013 levels.

Earlier, economic data in the Eurozone revealed that Retail Sales slowed in August on year-over-year figures. At the same time, the Eurozone Sentix index in October improved slightly, compared to September’s excessive pessimism.

Euro Price This week

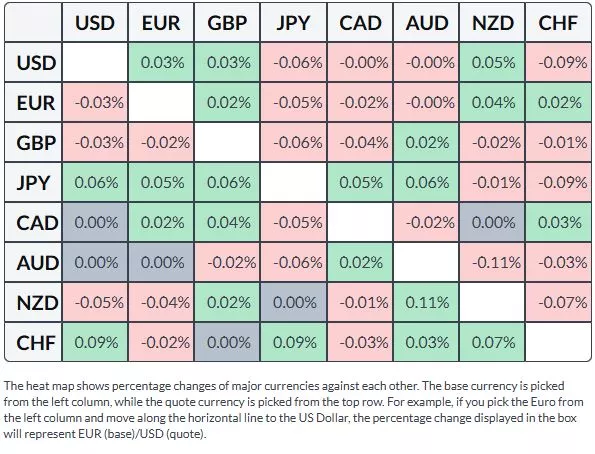

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

Daily digest market movers: The Euro hovers around 1.1700

- As of writing, the Kansas City Fed President Jeffrey Schmid said that the Fed must maintain inflation credibility and that inflation is too high. He added that monetary policy is appropriately calibrated.

- Eurozone Retail Sales in August rose by 1% YoY down from 2.2% in July yet mostly aligned with estimates of the previous twelve months. On a monthly basis, figures rose as expected 0.1%, up from August’s -0.5% MoM contraction.

- The Sentix Index in EZ improved from -9.2 to -5.4, better than the expected -8.5

- Money markets are fully pricing a 25-basis-point Fed cut at the October 29 meeting, with odds standing at 94%, according to Prime Market Terminal’s interest rate probability tool.

Technical outlook: EUR/USD holds firm waiting for a fresh catalyst

The EUR/USD remains subdued at around the 1.1700 mark for the sixth consecutive day, capped on the upside by the 20-day Simple Moving Average (SMA) at 1.1745 and on the downside by the 50-day SMA at 1.1683. Nevertheless, it should be noted that for two straight trading days, the pair achieved successive series of lower highs and hit a two-week low of 1.1651.

For a bullish continuation, the EUR/USD must clear 1.1760 before testing 1.1800. Once cleared the next resistance would be the July 1 high of 1.1830 ahead of testing the yearly peak at 1.1918.

Contrarily, the EUR/USD first support would be 1.1700, the 50-day SMA and the 100-day SMA at 1.1625.

More By This Author:

Gold Blasts Past $3,950 As Shutdown, Uncertainty Fuels Haven RushGBP/USD Flat As US Shutdown Drags Into Sixth Day

EUR/USD Steadied As Fed Divide Offset Shutdown Drag