EUR/USD Backslides In Runup To Key Midweek Data Prints

Image Source: Pixabay

- EUR/USD grinds down back to 1.0850 as investors huddle ahead of key data prints.

- EU and US PMI figures are due on Wednesday.

- US GDP update and PCE inflation figures due on Thursday and Friday, respectively.

EUR/USD dipped one-third of one percent on Tuesday as investors knuckle down for the wait to a double-header of Purchasing Managers Index (PMI) figures due from both the EU and the US on Wednesday.

Pan-EU PMI figures will kick things off during the early European market session on Wednesday, and markets anticipate a slight uptick in EU Services PMI figures to 53.0 in July after June’s 52.8.

In the US, the Services PMI for July is anticipated to ease slightly to 54.4 from June's 55.3. Global markets are widely anticipating a rate cut from the Federal Reserve (Fed) in September, and investors are closely monitoring US economic indicators for further signs of softening to affirm the rate outlook. Rate traders are currently pricing in nearly 100% odds of at least a quarter-point rate cut from the Federal Open Market Committee (FOMC) during the September 18 rate call.

As the week progresses, the quarterly US Gross Domestic Product figures are scheduled for Thursday, and the US Personal Consumption Expenditure Price Index (PCE) inflation is on the agenda for Friday. It is forecasted that the annualized Q2 US GDP will rise to 1.9% from 1.4%, and Core PCE inflation on Friday is expected to further decrease to 2.5% year-over-year for the year ended in June, compared to the previous month's 2.6%.

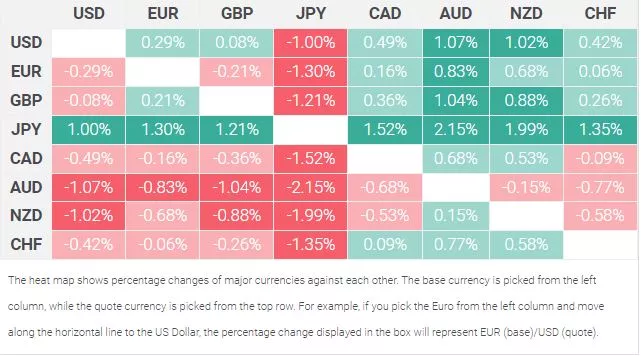

EURO PRICE THIS WEEK

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Australian Dollar.

EUR/USD technical outlook

The Euro’s early decline on Tuesday has sent EUR/USD into fresh lows near 1.0850, and the pair is scrambling to find a foothold ahead of Wednesday’s meaningful trading window. The Fiber has declined nearly a full percent since getting turned around from a near-term high of 1.0948.

Fiber remains on the north side of the 200-day Exponential Moving Average (EMA) at 1.0804, but this week’s downturn leaves the pair exposed to further downside as bids dip back into the wrong side of a rough descending channel.

EUR/USD hourly chart

EUR/USD daily chart

More By This Author:

EUR/USD Trapped Below 1.09 As Quiet Monday Markets Churn

EUR/USD Gets Dragged Down By Greenback Recovery As ECB Stands Pat Once More

GBP/JPY Declines Amid Speculation Of Ongoing ‘Yenterventions’ From BoJ