EUR/USD Analysis: Remains Cautious

Image Source: Pixabay

EUR/USD Analysis Summary Today

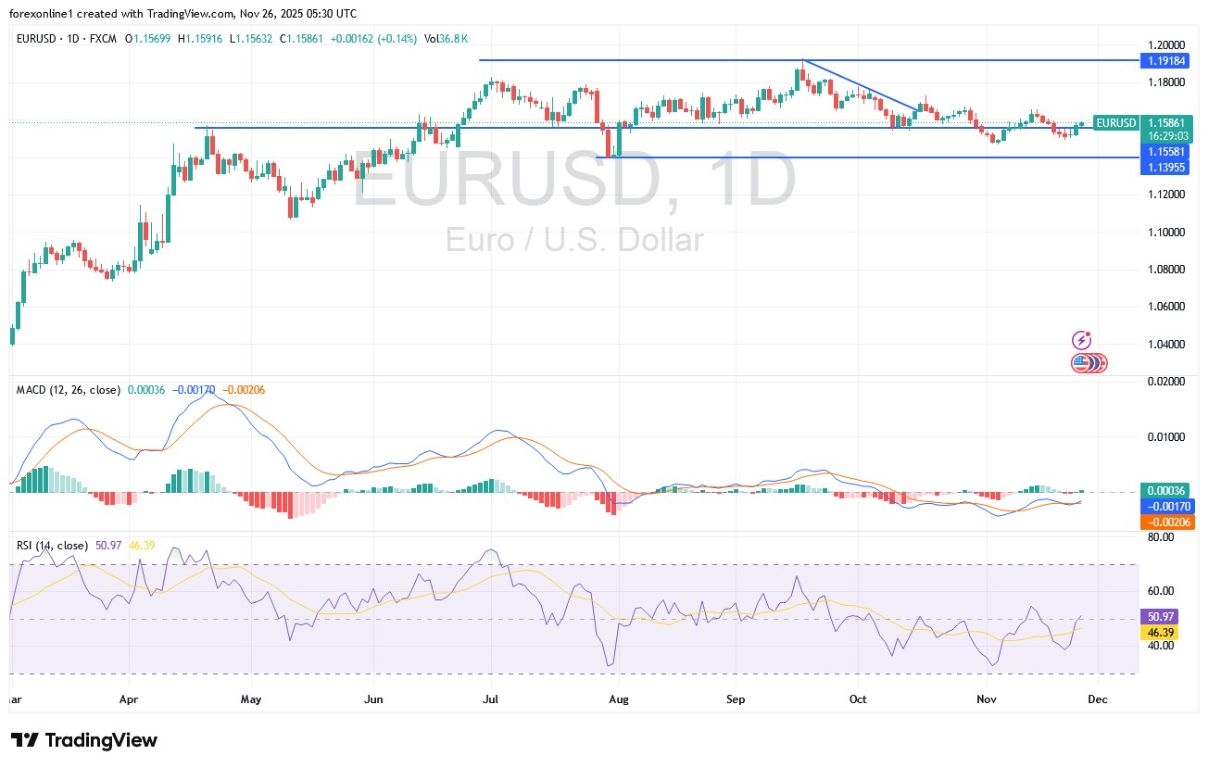

- Overall Trend: Bearish.

- EUR/USD Support Levels Today: 1.1500 – 1.1430 – 1.1350

- EUR/USD Resistance Levels Today: 1.1600 – 1.1660 – 1.1780

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1460 with a target of 1.1700 and a stop-loss at 1.1380.

- Sell EUR/USD from the resistance level of 1.1660 with a target of 1.1400 and a stop-loss at 1.1780.

Technical Analysis of EUR/USD Today:

Improved investor sentiment amid signals of a potential resolution to the Russian-Ukrainian conflict gave EUR/USD bulls enough momentum to launch gains to the 1.1568 resistance level during yesterday's trading session. The pair is stable around these gains at the time of writing this analysis, amidst mixed results from the US economic releases, led by the Producer Price Index (PPI) and Retail Sales figures. Today, the currency pair will be watching a new round of US economic releases, led by weekly unemployment claims and durable goods orders, scheduled for 03:30 PM Egypt time. Later, there will be new statements from European Central Bank (ECB) Governor Lagarde.

EUR/USD Forecast: Prices Remain Steady Near 1.15

According to Forex currency market trading, the EUR/USD exchange rate tested the 1.15 level, as market volatility and fading expectations for a Federal Reserve rate cut in December contributed to lifting the value of the US Dollar. Regarding the future of the EUR/USD price, global banks remain divided, with near-term pressures contrasting with medium-term expectations pointing to a recovery above the 1.20 psychological resistance level.

Now, Financial markets are focused on the uncertainty regarding Federal Reserve policy and changing interest rate differentials to assess the next move. Following initial currency weakness, Danske Bank expects EUR/USD to rise to 1.22 over a 12-month period. For its part, Morgan Stanley sees the potential for EUR/USD to rise to 1.23 by the second quarter of 2026 before receding to 1.16 by the end of 2026. They anticipate further net losses to 1.14 by the end of the following year.

The movement of the technical indicators on the daily chart is still in the bearish territory: the 14-day Relative Strength Index (RSI) is around a reading of 47, below the neutral line of 50, and at the same time, the MACD indicator lines are still on their downward slope. Over the same timeframe, the 1.1800 psychological resistance will remain the key to changing the overall trend to ascending.

US Monetary Policies and Their Impact on Currency Prices

Regarding the factors influencing currency prices: Following the US jobs data and Federal Reserve minutes, expectations for a Fed rate cut at the December monetary policy meeting saw a further decline, which supported the US currency. In this regard, Danske Bank commented: "We still see EUR/USD on an upward trajectory in the medium term, supported by narrowing interest rate differentials, a recovery in the European asset market, reduced global demand for restrictive policies, continued tailwinds from hedge ratio adjustments, and reduced confidence in US institutions."

Overall, a high degree of uncertainty remains regarding the US Federal Reserve's policy in the medium term. Regarding the future of the bank's policies, UBS Bank commented: "The appointment of a new Fed Chairman could also change policy expectations, potentially leading to lower US interest rates than currently expected. Additionally, the continuation of the US double deficit means the country must continue to attract external funding, which could put further pressure on the US Dollar, especially in the scenario mentioned above."

Trading Advice:

Do not be deceived, as EUR/USD gains are still limited and unstable and need more stimulus to become stronger and sustained.

More By This Author:

Gold Analysis: Will Gold Prices Continue To Rise?Gold Analysis: Gold Index Will Remain Supported By Uncertainty

EUR/USD Analysis: Will We See New Selling Pressure?

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more