European Stocks Drop As Yields Tick Higher, EU Stocks, DAX

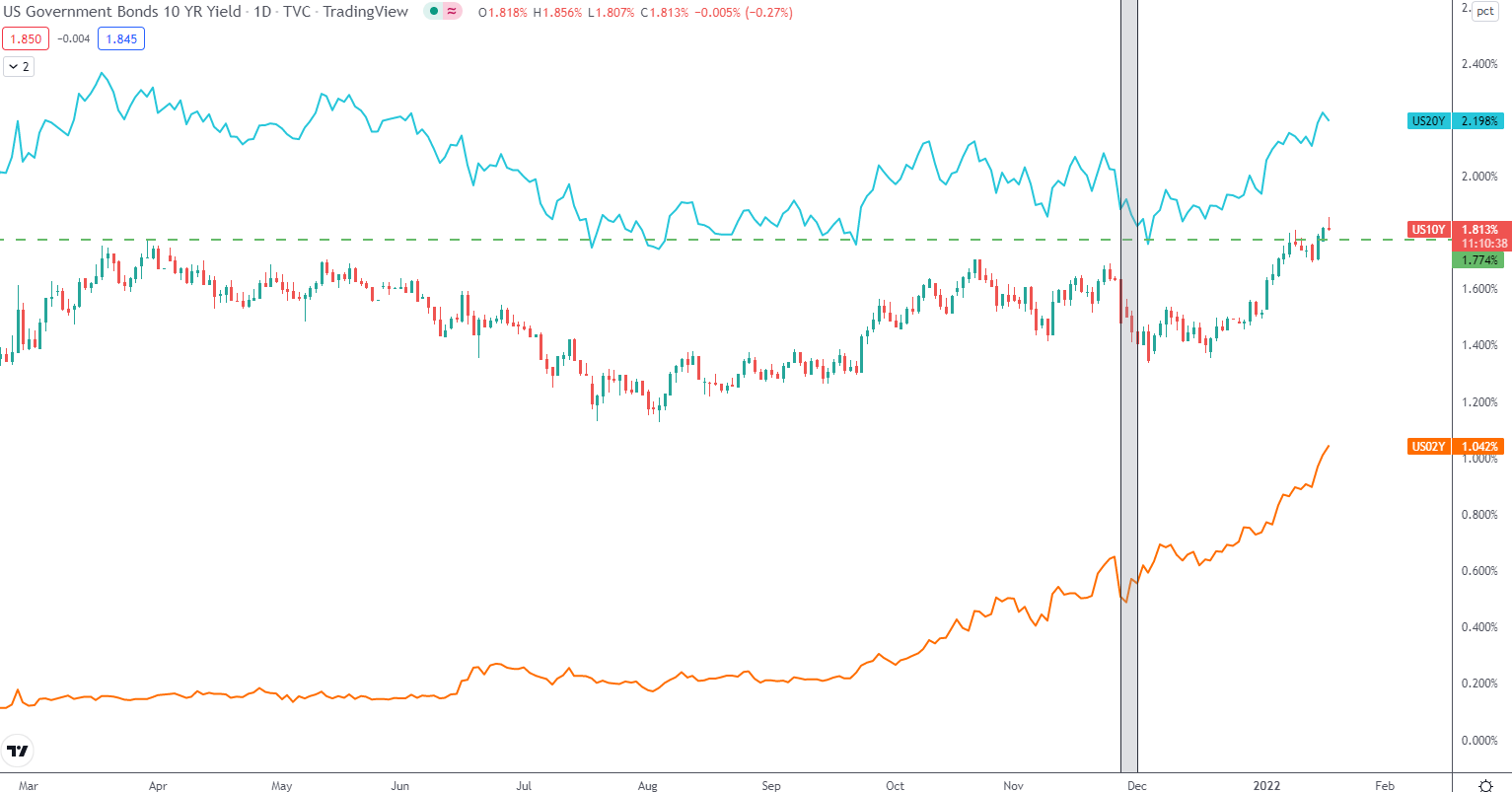

European stocks followed the Asian market lower in early trade on Tuesday, as higher, short to medium term yields in the US and Germany reinforced the market expectation of a ‘hawkish’ Fed and multiple rate hikes in 2022.

The big mover was the US 2 year (most responsive to near term rate expectations) as it surpassed the 1% mark for the first time since the start of the pandemic. In fact, the US 2 year yield last traded around the 1% handle in February of 2020, just before the start of the global lockdowns. The German 10 year bund trades slightly lower this morning around -0.03 but largely continues on its upward path towards zero.

US Bond Yields (2 year. 10 year and 20 year)

(Click on image to enlarge)

Source: Tradingview, prepared by Richard Snow

Elsewhere, in the Euro Stoxx 50 Index, sectors such as tech, real estate and financials trade in the red this morning with the one unsurprising standout being the energy sector, trading up by nearly 0.5% on the day.

Euro Stoxx 50 (FEZ) Sector Summary

(Click on image to enlarge)

Source: Refinitiv, prepared by Richard Snow

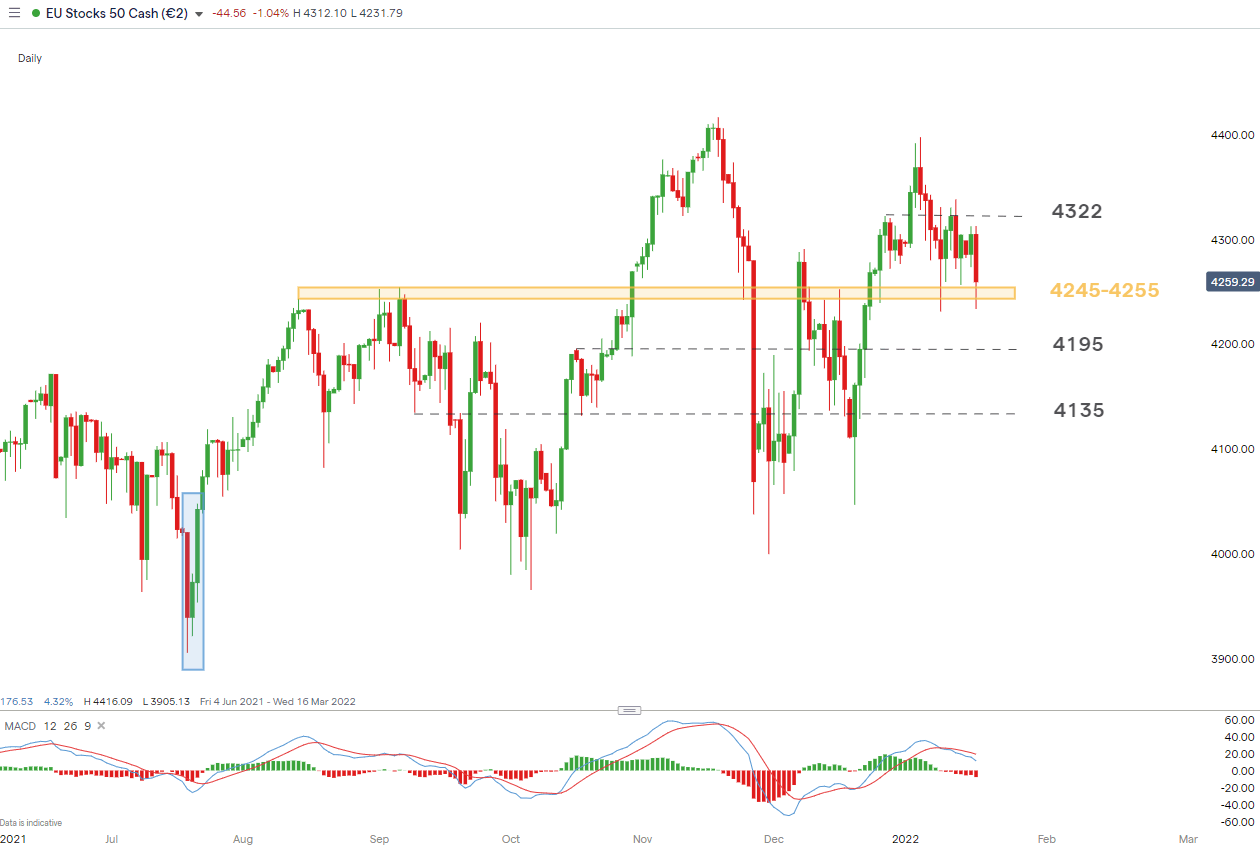

EU Stocks 50 Technical Analysis

The broad-based equity sell-off thus far looks rather tame for the time being. There has already been a sizeable pullback from the daily low as it failed to break and hold below the zone of support (4245 – 4255) however, the daily close will ultimately reveal whether a bounce or break is most favored.

- Support: (4245 – 4255), 4195, 4135

- Resistance: 4322

Euro Stocks 50 Daily Chart

(Click on image to enlarge)

Source: IG, prepared by Richard Snow

Disclaimer: See the full disclosure for DailyFX here.