Euro Weakens For Second Day, Greenback Rebounds On Fed Guidance And Strong US Data

Image Source: Pixabay

- EUR/USD extends losses for a second day as the US Dollar firms.

- The US Dollar Index rebounds to 97.50 after briefly touching fresh year-to-date lows at 96.22 post-Fed.

- Stronger US data added to Dollar momentum as Jobless Claims fell to 231K, while the Philadelphia Fed index surged to 23.2.

The Euro (EUR) trades on the back foot against the US Dollar (USD) on Thursday, with EUR/USD extending its decline for the second straight day as renewed Greenback strength weighs on the pair.

At the time of writing, EUR/USD is trading around 1.1784, down nearly 0.25% on the day. Meanwhile, the US Dollar index, which tracks the value of the Greenback against a basket of six major currencies, is edging higher after reversing sharply from fresh year-to-date lows of 96.22 touched in the immediate aftermath of the Federal Reserve’s (Fed) interest rate decision. The index is now hovering near 97.50.

On Wednesday, the Fed delivered its first rate cut since December, lowering the federal funds rate by 25 basis points to the 4.00%-4.25% range. While the move was widely expected and largely priced in, markets quickly shifted focus to the updated dot plot and Fed Chair Jerome Powell’s press conference.

The median dot for 2025 interest rates drifted lower, implying around 50 bps of additional easing by year-end to a target range of 3.50-3.75%, though a sizable minority of officials saw just one or no more cuts. Projections for 2026 and 2027 shifted lower as well, pointing at 3.4% and 3.1%, respectively, before stabilizing at 3.0% in the longer run.

At his press conference, Fed Chair Powell described the decision as a “risk management cut,” stressing that monetary policy is “not on a preset course” and will be guided “meeting by meeting.” He underlined that the balance of risks has shifted compared with earlier this year, with softer employment offsetting lingering inflation pressure. While reiterating the Fed’s commitment to restoring inflation to 2%, Powell emphasized there was “no widespread support” for a larger 50 bps cut and said the central bank does not feel the need to move quickly on rates.

Powell’s cautious tone helped the US Dollar rebound as traders scaled back expectations for a rapid easing cycle. Thursday’s US economic releases added to the Dollar’s momentum. Initial Jobless Claims fell to 231K in the week ending September 13, better than the 240K expected, while the previous week was revised higher to 264K from 263K. In addition, the Philadelphia Fed Manufacturing Survey for September surged to 23.2, sharply above the 2.3 expected and a rebound from -0.3 in August.

US Dollar Price Today

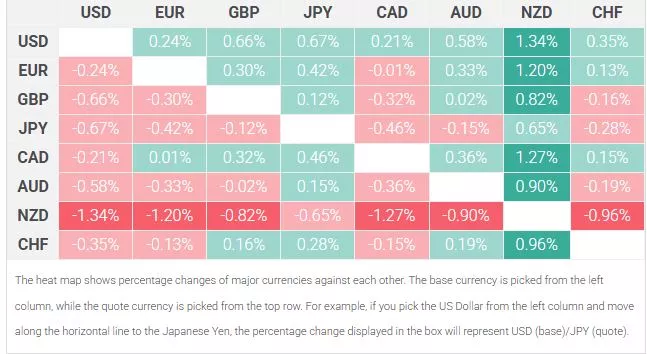

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

More By This Author:

EUR/USD Picks Up From Lows As Risk Appetite Weighs On Dollar's RecoveryGold Steadies After Intraday Dip As Fed Rate Cut Decision Looms

Gold Corrects From Record Highs, Fed Interest Rate Decision To Steer Direction