Euro Shed Some Of The Week’s Gains As Eurodollar Bids Softened On Friday

Image Source: Unsplash

- The euro struggled to gain momentum on Friday, paring back the week’s performance.

- A slew of ECB talking points this week have bid down rate cut hopes.

- Next week’s economic calendar will be light on Eurozone data.

The euro softened on Friday, as it was seen backsliding against the majority of its currency peers as dovish talking points from the European Central Bank (ECB) weighed on rate cut hopes. Next week will see limited Eurozone data releases, with mid-tier Industrial Production and final Harmonized Index of Consumer Prices (HICP) data due in the first half of the week.

A consensus miss on the US Producer Price Index (PPI) was driving headlines on Friday, as producer-level inflation receded faster than expected. Slumping producer inflation kicked market expectations of Fed rate cuts into overdrive heading into the week’s final trading hours.

Market Movers: Euro Broadly Weaker in Friday Trading Amidst Dour Outlook

- The euro was down against most of the major currency bloc on Friday, declining 0.15% against the US dollar.

- ECB's President Lagarde: Rates have probably reached peak, EU not in recession.

- Multiple ECB officials hit the wires this week, easing back market hopes of rate cuts.

- The ECB’s Economic Bulletin begrudgingly admitted the Eurozone was in a “technical recession,” with a soft landing scenario all but guaranteed.

- US annual PPI inflation rose to 1% in December vs. the 1.3% reading expected.

- MoM US PPI in December held at -0.1%, in-line with November’s -0.1% (revised downward from 0.0%), missing the market forecast of 0.1% growth.

- Annualized core PPI also missed the mark, declining to 1.8% from November’s YoY figure of 2.0% and coming in below the median market forecast of 1.9%.

- Easing PPI inflation sparked a pop in Federal Reserve (Fed) rate cut expectations.

- Markets once again see 160 basis points in Fed rate cuts through 2024, up from 154 bps.

Euro Price This Week

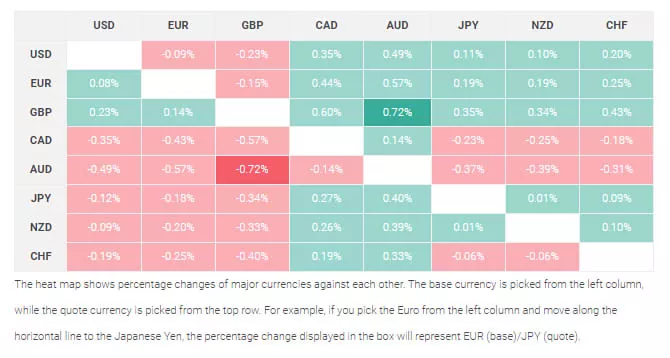

The table below shows the percentage change of euro against listed major currencies this week. The euro was the strongest against the Australian dollar.

Technical Analysis: EUR/USD Lower on Friday in Chunky Trading

The EUR/USD currency pair kicked off Friday’s trading near 1.0980, going back and forth in a rough intraday range as the pair grappled with bids near the 1.0950 mark. Intraday action continued to get hamstrung on the 200-hour Simple Moving Average (SMA). Near-term chart action appeared to be getting drawn into the mid-range.

According to daily candles, the pair was seemingly doing well, up nearly 5% from October’s bottom bids near 1.0450. Despite a pullback toward the 200-day SMA, a bullish cross of the 50-day and 200-day SMAs looked to be building out a near-term price floor around 1.0900.

Continued selling pressure may drive the pair back into the long-term 200-day SMA near 1.0850. The challenge will be to drag the EUR/USD duo down to the last swing low near 1.0750. Bidders will be looking for topside momentum to carry the pair back into late December’s swing high near 1.1150.

EUR/USD Hourly Chart

(Click on image to enlarge)

EUR/USD Daily Chart

(Click on image to enlarge)

More By This Author:

EUR/GBP Trades Neutral, Bears Still In ChargeUSD/CAD Price Analysis: Retraces Its Recent Gains, Edges Lower To Near 1.3350

WTI Soars To Near $74.50 As Supply Concerns Deepen After US Airstrikes On Houthi Group

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more