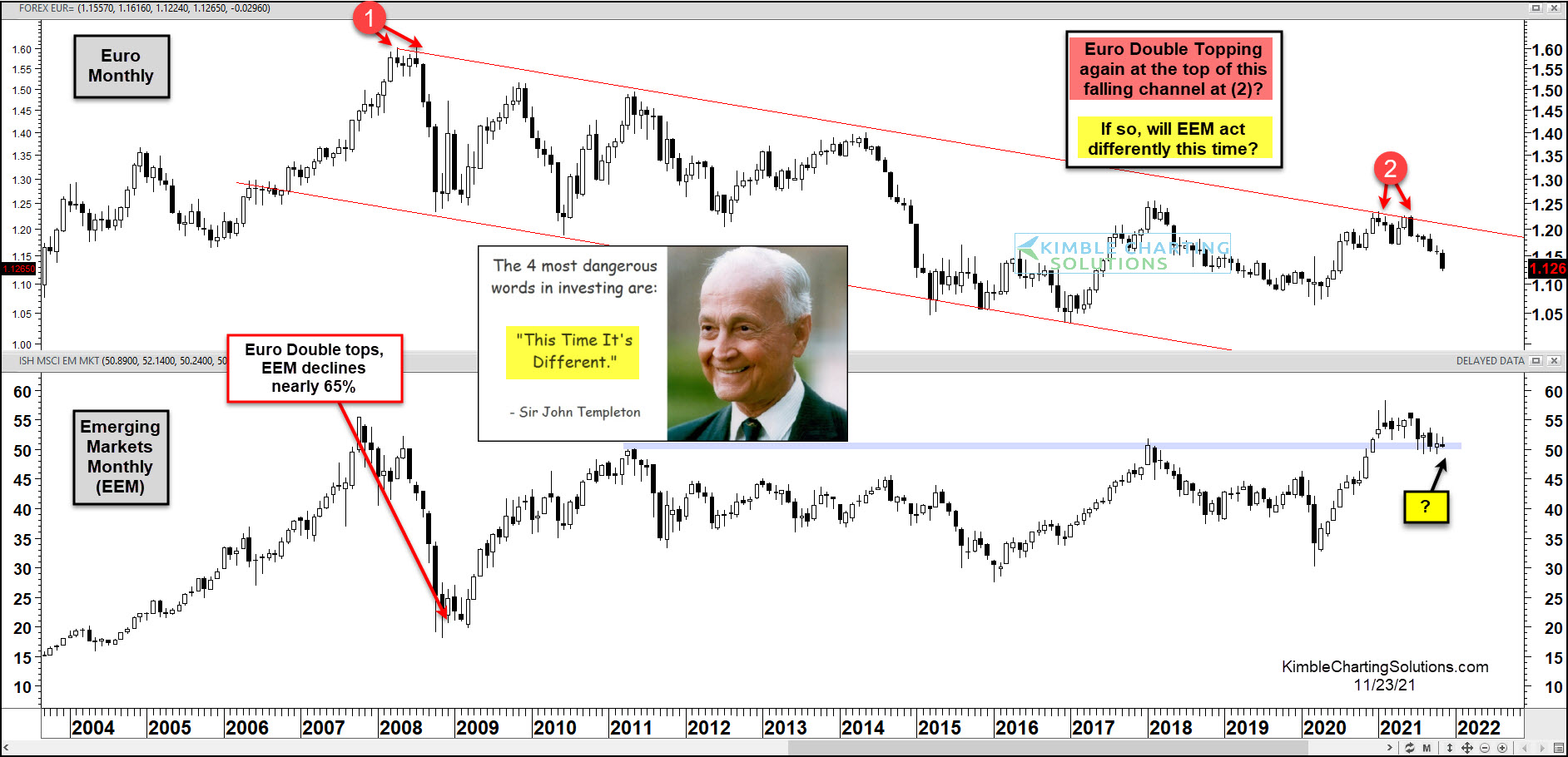

Euro Currency Decline Could Hit Emerging Markets (EEM) Hard

The Euro currency is sliding and international markets are taking notice.

(Click on image to enlarge)

Of course, this is coming as the US Dollar rallies… and all this means pain for the Emerging Markets and its trading ETF (EEM).

In today’s chart 2-pack, we compare the Euro to the Emerging Markets (EEM) over the past 2 decades (on a “monthly” basis).

As you can see, the Euro has been in a declining channel for the past 13 years. And the channel started with an ominous double top pattern at (1). That double top also triggered a huge decline (-65%) in the Emerging Markets ETF (EEM).

Fast forward to this year, and the Euro has double topped once again at (2). This has sent the Emerging Markets lower and now has EEM testing critical price support.

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.