Euro Braces For ECB And Draghi, US Dollar Eyes CPI Data

Markets will have a perilous day as the ECB prepares to announce its much-awaited rate decision and whether it will reintroduce unorthodox easing measures. Soon-to-be replaced central bank President Mario Draghi will be holding his last press briefing as head of the European Central Bank. Will he be able to meet the market’s lofty expectations and tell them he will do “whatever it takes”, or will he crush easing bets and send traders flailing?

ECB AND DRAGHI: WHATEVER IT TAKES, OR JUST SIMPLY WHATEVER?

Eurozone inflation has been under pressure amid regional geopolitical shocks against the backdrop of a slowing global economy plagued by the US-China trade war. These factors have pressured price growth and prompted the ECB to shift from considering raising rates to now not only cutting but also possibly reintroducing its quantitative easing program after just having weaned markets off of it in December.

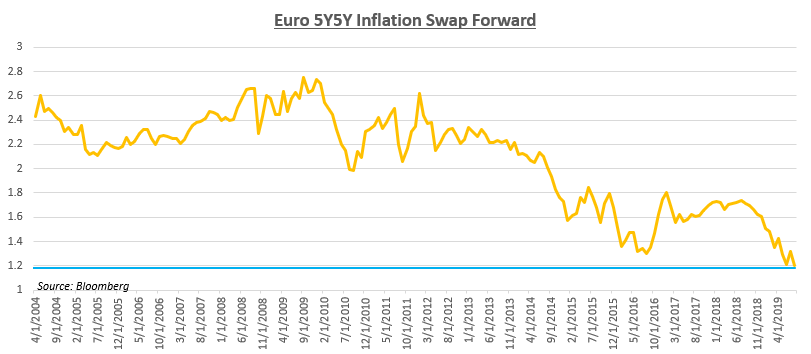

Looking at a monthly chart, the 5Y5Y Euro inflation forward swap is currently at its lowest level ever, hovering at around 1.206. Inflationary prospects are clearly not looking good and deteriorating fundamentals are not inspiring capital inflow into the Euro. German bunds are hovering in negative territory, and the global market for negative-yielding bonds continues to swell beyond $14 trillion as traders anticipate rate cuts ahead.

US CPI DATA: UNDERWHELMING READING MAY BLOAT UNREALISTIC EASING EXPECTATIONS

Markets will be closely watching the publication of US CPI data, likely with built-in hopes that the report will underwhelm and provide even more impetus for the Fed to implement accommodative monetary policy. It might also then amplify the market’s swollen rate cut bets, potentially setting equity markets up for failure when the Fed fails to meet the market’s aggressive expectations.

Such has been the pattern for most of 2019, most notably was during the July FOMC meeting where despite delivering a 25 basis-point cut, the US Dollar rose at the expense of equities. Chairman Jerome Powell cooled market expectations by reiterating his position that the Fed is data-dependent and will adjust policy in accordance to the prevailing economic circumstances that fall under the purview of its mandate.

Chart of the Day: European Inflation is not Looking Too Hot