Euro Area Inflation Unexpectedly Hits Record High One Day Ahead Of ECB Decision

Euro area inflation surprised markets on Wednesday, coming in far hotter than expected and rising to a new record high, piling even more pressure on the ECB's Christine Lagarde to do something when it makes its announcement tomorrow, instead of just pretending Europe's inflation is some bizarre transitory outlier that will magically normalize this year.

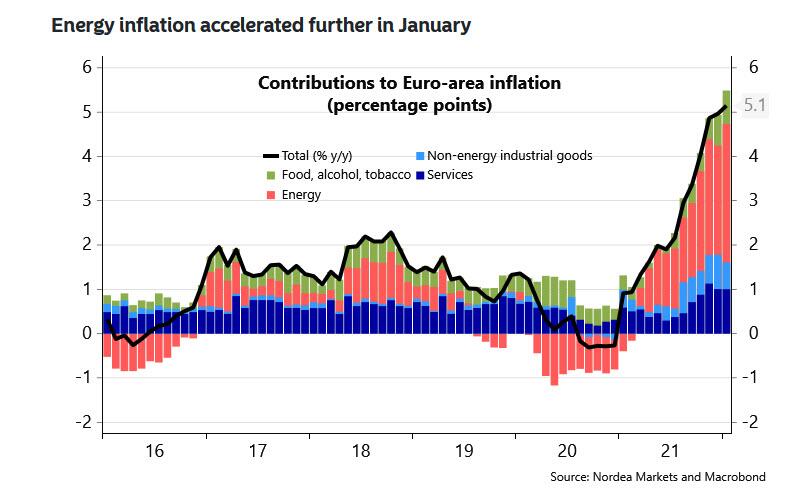

The cost of living for the 16 nations that share the euro currency rose 19bps to 5.1% in January, despite expectations for a sharp drop to 4.4% from December's (previous record) 5.0%. Core inflation which excludes energy, food, alcohol, and tobacco fell 28bps to 2.34, just off their recent all-time highs. Energy inflation and food, alcohol, and tobacco inflation increased more than expected.

(Click on image to enlarge)

The breakdown by main expenditure categories in the Euro area showed that services inflation was stable at 2.4%, and non-energy industrial goods inflation fell 0.6pp to 2.3%. Of the non-core components, energy inflation rose 2.7pp to 28.6%, while food, alcohol and tobacco inflation rose 0.4pp to 3.6%.

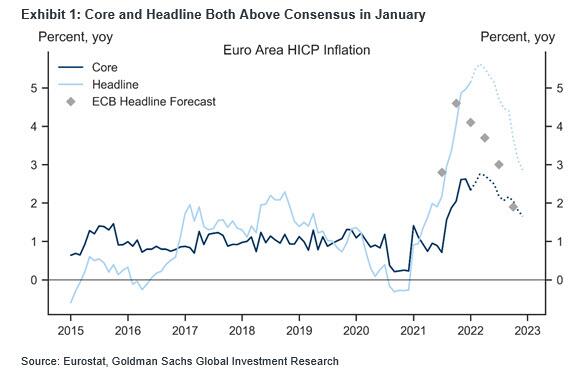

The consensus expected both numbers to decline due to technical reasons. As Nordea explains, the dramatic change in weights inside the consumption basket in January 2021 and the base effect from a temporary VAT cut in Germany in 2H 2020, which took inflation numbers up in January 2021, were now removed from the annual inflation numbers and were expected to take inflation down from December. However, headline inflation rose marginally and given that the decline was smaller than expected in core inflation it seems that the inflationary pressures are indeed accumulating faster than expected.

One positive surprise came again from energy. The oil price has risen in January and the gas price has continued at highly elevated levels. Thus, energy inflation accelerated to 28.6% and it continued to contribute more than a half of the headline inflation. Although energy inflation is mostly transitory, the longer it lasts the stronger its second-round effects on wages and prices are likely to be.

There are signals that also the wider price pressures are stronger than expected. Although the non-energy industrial goods price inflation showed some signs of cooling off (partly due to temporary reasons), the monthly changes in service prices have continued to be strong. For example, in France the average monthly change in service prices over the past 3 months indicate higher annual numbers are in a pipeline and in Germany, service price inflation in monthly terms actually accelerated further in January, according to our estimates.

In the Southern European countries, wider price pressures are gaining pace gradually. According to the national definition, core inflation increased to 2.4% in Spain and remained unchanged at 1.5% in Italy.

Looking ahead, Goldman writes that having updated its core and headline inflation forecast - which completely missed the bounce in headline prices this month - the bank now expects both to peak in March of this year at 2.7%yoy and 5.6%yoy respectively. Goldman then expects Euro area core inflation to fall to 1.7%yoy and look for headline inflation of 2.9%yoy in December of this year.

Then again, this won't be the first time Goldman has been dead wrong in timing the peak of a "transitory" inflation.

In response to the surprisingly high inflation data, the euro jumped to a session high versus the dollar, trading at 1.1309...

(Click on image to enlarge)

... while 10Y Bund yields crossed decisively into the green after trading in negative territory every since April 2019.

(Click on image to enlarge)

The red hot inflation print will make tomorrow's ECB announcement especially interesting, with markets now pulling forward their estimate for the first-rate hike to July:

- TRADERS BRING FORWARD BETS ON 10BPS ECB RATE HIKE TO JULY: BBG

As a result, the market will closely watch whether ECB President Christine Lagarde will come out with changes to previous statements that a rate hike is “very unlikely” in 2022, or whether there will be a tweak in the ECB’s assessment over the “transient” nature of the current spike in inflation.

One thing that is certain is that the ECB is set to concentrate on inflation, geopolitical risks, the recent rise in bond yields, and its implications for financing conditions, although according to Nordea, "it is too early for the ECB to change its stance on its meeting tomorrow, but the hawks most likely got more ammunition from the January inflation data."

However, given that the ECB has constantly underestimated inflation lately, it will be interesting to hear Lagarde’s formulation of the ECB’s view of inflation returning to below target next year. The most likely outcome is that the ECB will still retain its baseline view, as it wants to see more data on especially wage developments, but it cannot deny the upside risks. However, even the discussion of upside risks is likely to feature stronger in the monetary policy account than this week’s communication.

Another key question will be how independent monetary policy can be set in the region, at a time when banks like the U.S. Federal Reserve are entering a forceful tightening cycle.

“Inflation continues to surprise to the upside, the U.S. Fed looks set to raise rates up to six times this year, starting on 16 March,” said Holger Schmieding, a chief economist with Berenberg Bank, in a research note. “Against this backdrop the debate at the European Central Bank will likely become even more controversial than before.”

Another item high on the agenda, according to CNBC, will be the tensions between Russia and Ukraine, including any potential implications.

“If tensions deepen, resulting in disruptions in energy supply to Europe, we expect the ECB to turn increasingly dovish, focusing on the impact of growth and financial stability, despite likely higher energy inflation in the short term,” explained Anatoli Annenkov, an ECB watcher with Societe Generale, in a note.

More broadly, the ECB will probably underscore that it still has no idea what is going on, and will "accept the fact" that there is still significant uncertainty surrounding the inflation outlook.

“There were 17 uses of the word ‘uncertainty’ in the December [ECB] press conference, up from none in October, and the December accounts mentioned ‘exceptionally high uncertainty’ around inflation,” said DB chief economist Mark Wall.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

core CPI is lower than the US despite europe paying much more for natural gas. Due to gas leaks and fires and PUC, So. CA is suddenly paying over $1.25/KWH for electric; was already the highest in USA at $.30KWH. I pay.11 KWH for renewable public power in Oregon.

Good points.