EUR/JPY Price Analysis: Subdued Around 143.40, As Bulls Prepare For An Assault To 145.00

Image Source: Pixabay

- The EUR/JPY currency pair registered gains of around 2.22% in the week after facing solid resistance around 143.60.

- The pair has been in consolidation within a 130 pip range circa the 143.00 psychological barriers.

The EUR/JPY currency pair hit a fresh weekly high at 143.67, but it reversed some of those gains as it rested comfortably above Thursday’s high ahead of the weekend. The EUR/JPY duo exchanged hands at around 143.40 after dropping to a low of 142.91.

The EUR/JPY pair began the week at around the 200-day Exponential Moving Average (EMA) at 140.32 before rallying sharply towards the 142.38 Tuesday high. Since that day, the EUR/JPY duo consolidated at around the 142.35-143.65 area, unable to crack either side of the range.

On Friday, the EUR/JPY pair pierced the top of the range, but buyers were unable to hold to its gains and caused a retracement in the pair. Therefore, the EUR/JPY neutral-to-upward bias has remained intact.

If the EUR/JPY pair were to break the top of the range, the next supply area would be 144.00. Once broken, the EUR/JPY duo might rally and test a five-month resistance trendline near 144.50/60. That could propel EUR/JPY bulls toward the psychological 145.00 barrier.

Contrarily, if the pair were to fall below 142.30, it might test the 142.00 figure. A breach of the latter would open the door for a move lower to the 141.70/80 area, with the 20-, 50-, and 100-day EMAs resting inside the range, followed by a fall to the 200-day EMA at 140.44.

EUR/JPY Daily Chart

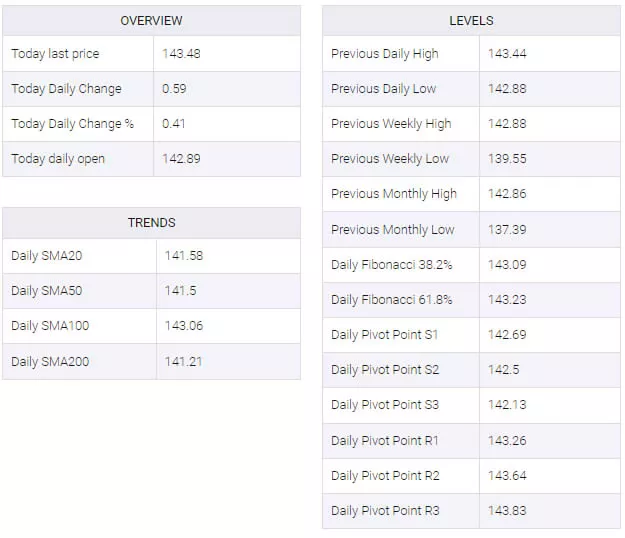

EUR/JPY Key Technical Levels

More By This Author:

USD/CAD Refreshes YTD Peak, Surpasses 1.3500 Amid Siding Oil Prices And Stronger USDAUD/USD Price Analysis: Bears And Bulls About To Standoff At Key 0.6850s

AUD/USD Price Analysis: Bulls Are Forced To The Edge Of The Abyss

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more