Monday, July 22, 2019 1:00 PM EDT

The lack of market driving news and the pending ECB meeting on Thursday has seen volatility well contained across FX markets this week. We don’t expect that to last.

Whilst there is some speculation that ECB could ease this week, we believe it to be more likely they’ll use Thursday’s meeting to lay the groundwork to act in September. Whether this will turn out to be rate cut, asset purchases or a combination of the two remains to be seen, but there could be an upside surprise for the Euro if ECB fails to deliver any guidance on Thursday. Which is essentially what happened following their June meeting.

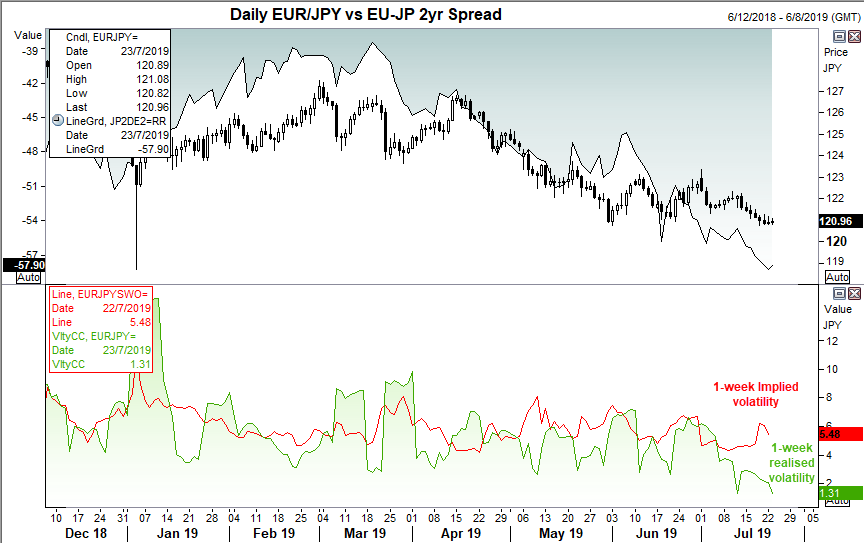

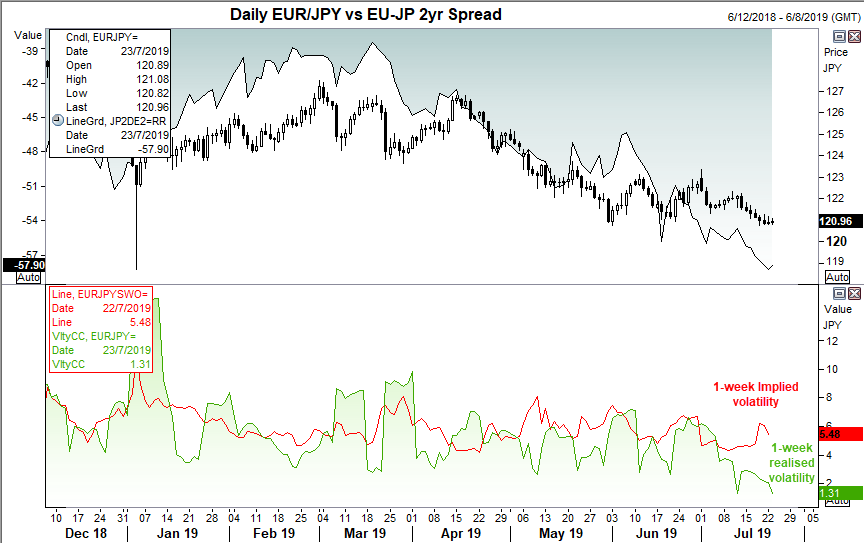

(Click on image to enlarge)

We’re keeping an eye on EUR/JPY around this meeting, which has stalled above key support. Prices are compressing at the lows and essentially stuck within a 50-pip range, seeing realized volatility at extremely low levels whilst 1-week implied volatility remain elevated (ie. markets are expecting some action). Whichever way volatility takes prices on the day, our core bias remains bearish, given its established downtrend which is being led by lower yield differentials (EU-JP 2yr spread).

(Click on image to enlarge)

The trend remains bearish beneath the 112.32 high. The 20 and 50-day eMA’s point lower and we’d see any orderly retracement from support as a potential opportunity to fade into the move, in line with the bearish trend. Of course, a caveat here is we’d step aside if we see a clear burst of bullish from the lows but the trend remains bearish beneath the 112.32 high.

A break lower brings the 120 area into focus. Not only as it’s an obvious round number, but the weekly and monthly S2 levels generated from pivot points are around this level, making it a high probability level of support in our view.

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to Forex.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.

less

How did you like this article? Let us know so we can better customize your reading experience.