EUR/GBP Records Modest Gains Amidst Low Liquidity Conditions On Good Friday

The EUR/GBP advances for two straight days and hits a four-day high of around 0.8790 on a subdued trading session in observance of the Good Friday holiday. The EUR/GBP is trading at 0.8782, registering minuscule gains of 0.04%.

The cash market is closed due to a holiday. However, the US futures market is open, and equities have responded optimistically to the latest round of US economic data and edged higher. The US Nonfarm Payrolls March report was solid, though a whisker below estimates of 240K, at 236K. Some of the highlights of the report came above estimates. The Participation Rate climbed to 62.6%, above forecasts of 62.4%, while the Unemployment Rate remained unchanged at 3.6% YoY. Average Hourly Earnings dipped to 4.2% YoY, below the 4.3% foresaw.

Aside from this, a light Eurozone (EU) and United Kingdom (UK) economic dockets left traders adrift to data from the United States (US).

On Thursday, the European Central Bank (ECB) economist Philip Lange flagged the risk of further rate hikes. He said, “If the baseline we developed before the banking stress holds up, it will be appropriate to have a further increase in May.” Lane added that they would be data-dependant “about assessing whether that baseline still holds true at the time of our May meeting.”

Meanwhile, Worldwide Interest Rate Probabilities (WIRP) show odds for a 25 bps rate hike by the European Central Bank at 90%. Following that, another 25 bps rate increase is expected, and no movement for Q4.

EUR/GBP Technical Analysis

(Click on image to enlarge)

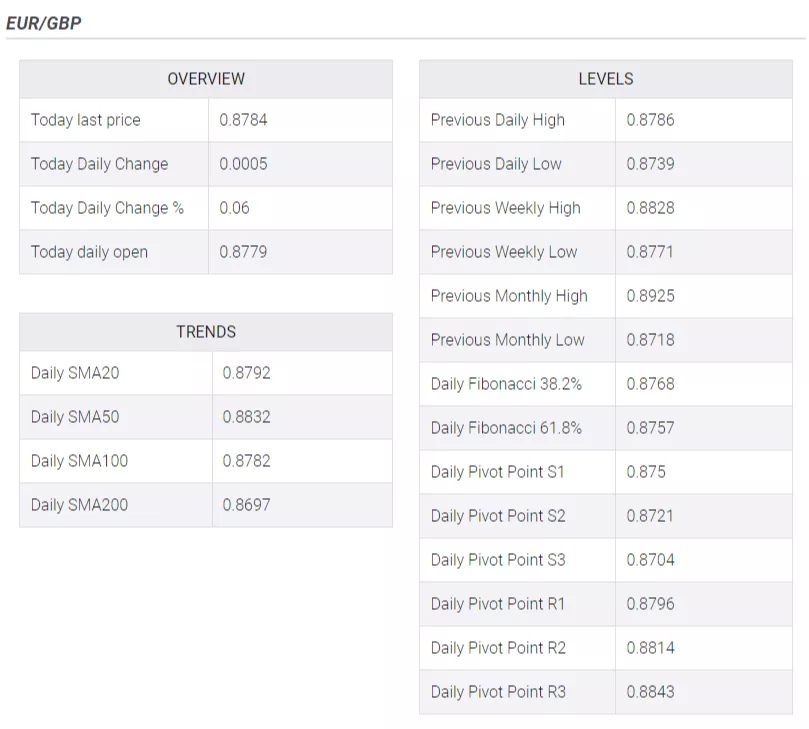

The EUR/GBP daily chart suggests the pair would end the week trading sideways, capped to the upside, by the confluence of the 20 and 50-day Exponential Moving Averages (EMAs) at 0.8791 and 0.8803, respectively. For a bullish resumption, the EUR/GBP must reclaim 0.8805, so the pair could test the March 30 high at 0.8828, followed by March 23 cycle high at 0.8865.

On the downside, the EUR/GBP price action is capped by the 100-day EMA at 0.8779. Once broken, the EUR/GBP could dip towards April 6 low at 0.8739, followed by the 200-day EMA at 0.8714, before dropping to 0.8700.

EUR/GBP Technical Levels

More By This Author:

USD/JPY Surges To A 3-Day High On Sluggish US Nonfarm Payrolls Report

USD/JPY: Well-Set For Weekly Loss Near 131.50, Kuroda’s Retirement Speech, US NFP In Focus

GBP/USD Consolidates Its Recent Gains To Multi-Month Top, Stuck In A Range Around 1.2500

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more