EUR/GBP Price Analysis: Struggles At 0.8700, Prints Two-Month High As ECB Meeting Looms

Image Source: Unsplash

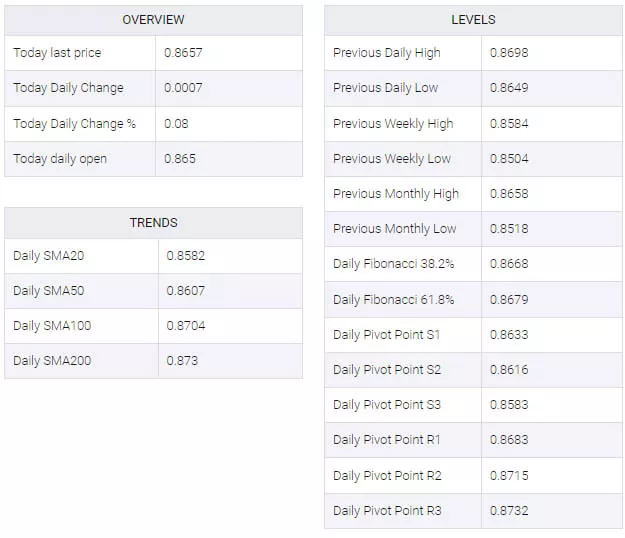

- The EUR/GBP currency pair failed to decisively break above the 100-day and 200-day EMAs at 0.8664 and 0.8679, respectively, after hitting a two-month high at 0.8700.

- If the EUR/GBP pair pulls back, support levels would emerge at the 50-day EMA at 0.8619, the 0.8600 point, the 20-day EMA at 0.8594, and the July 10 high at 0.8584.

- A break above 0.8700 would set sights on the next resistance at the May 11 high of 0.8734, followed by the resistance trendline from the year-to-date high at 0.8978, around the 0.8740/50 area.

The EUR/GBP currency pair finished Friday’s session almost flat, failing to decisively break above the 100-day and 200-day Exponential Moving Averages at 0.8664 and 0.8679, respectively, after the cross hit a new two-month high at 0.8700. Moving into the weekend, the EUR/GBP pair was seen trading at 0.8650 with gains of 0.03%.

EUR/GBP Price Analysis: Technical Outlook

With the EUR/GBP currency pair unable to breach the 0.8700 figure, the euro remained exposed to selling pressure. However, next week’s upcoming monetary policy meeting of the European Central Bank (ECB) could lend a lifeline, causing the currency pair hover around the recent exchange rate, as such previously occurred on Thursday and Friday.

If the EUR/GBP pair experiences a pullback, the first support would be the 50-day EMA at 0.8619, followed by the 0.8600 mark. If the cross extends its drop past those two levels, it’s almost certain that it would drop past the 0-day EMA at 0.8594, with sellers eyeing the July 10 high at 0.8584, followed by the year-to-date low of 0.8504.

Conversely, if the EUR/GBP currency pair breaks above 0.8700 level, the duo's next resistance level would be the May 11 high at 0.8734, followed by a resistance trendline drawn from the year-to-date high at 0.8978, which passes at around 0.8740/50. A breach of the latter would expose the 0.8800 mark.

EUR/GBP Price Action – Daily Chart

EUR/GBP Technical Levels

More By This Author:

Gold Price Forecast: XAU/USD Threatens 100-Day SMA Ahead Of FOMC DecisionUSD/CHF Consolidates Around 0.8660 As Fed Policy Comes Under Spotlight

US Dollar Price Analysis: Bulls Eye A Run Towards 101.50s While In Bullish Territory

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more