EURGBP : Trading The Rally Higher

Since the start of May 2020 we at ElliottWave-Forecast have been advising our members that the EURGBP pair was going to rally higher. I published an article in May 2020 and another article start of June 2020 calling for the EURGBP move higher.

On June 9 2020 I posted on social media Stocktwits/Twitter @AidanFX“Added 2nd LONG EURGBP at 0.8908 with Stop Loss at 0.8863“.

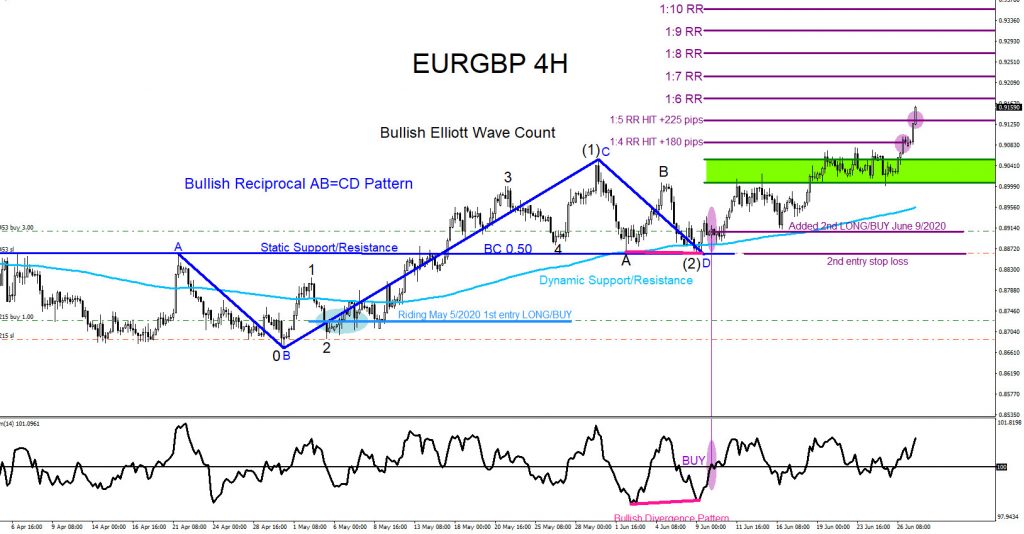

The chart below was also posted on social media StockTwits/Twitter @AidanFX June 9 2020 showing that a bullish market pattern (blue) formed and triggered buyers to get in the market at the BC 0.50% Fib. retracement level. A bullish divergence pattern (pink) also formed and was clearly visible which also signalled for the move higher. Dynamic (light blue) and static (dark blue) support/resistance confluence added more confirmation the pair would rally higher. Momentum indicator also crossed above the 100 level confirming the BUY. I called for traders to BUY EURGBP June 9 2020 and only a move below the point D of the blue bullish market pattern would invalidate the BUY trade setup. Stop loss was set below the blue point D, targeting the minimum purple 1:4 RR target and higher targets.

EURGBP 4 Hour Chart June 9 2020

EURGBP continues higher and on June 29 2020 price reaches the 1:5 RR target at 0.9133 from 0.8908 2nd BUY entry for +225 pips. For now as long as wave (2) holds we expect the pair to continue higher and hit more targets above. If you followed me on Twitter/Stocktwits @AidanFX you too could have caught the EURGBP move higher.

EURGBP 4 Hour Chart June 29 2020

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

moreComments

No Thumbs up yet!

No Thumbs up yet!