EUR/CAD: Trading The Move Lower

On Jan. 13, 2022, I posted to social media: “EUR/CAD: Watch for a move lower. Watch for selling opportunities. As long as price stays below 1.4387, the pair will move lower towards the 1.4230 area.“

Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market.

Market patterns (Elliott Waves, Harmonic, Head and Shoulders, etc.), price action analysis (Support & Resistance, Supply & Demand Zones, Candlestick analysis, etc.) and indicators (RSI, Moving Average, Stochastic, etc.) are technical strategies/techniques used when trading a confluence setup. The charts below show a confluence trade setup that signals toward which side to take the trade.

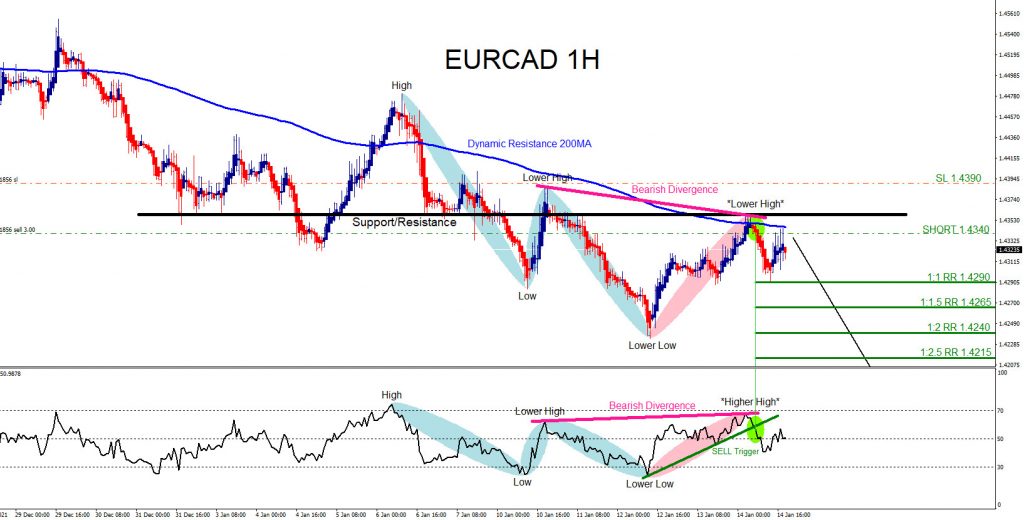

Sell Trade Setup

- The RSI indicator illustrates a bearish trend reversal divergence (pink).

- Price respects the dynamic support 200-MA (blue).

- Price respects the support/resistance level (black).

- RSI triggers a Sell signal on the break below the trend line (green).

EUR/CAD One-Hour Chart for Jan. 14, 2022

I entered the sell trade at 1.4340 with a stop loss at 1.4390 and targets at the 1:1–1:1.5 RR minimum area. The EUR/CAD pair moved lower, blowing past the minimum target area. On Jan. 18, 2022, the price hit the 1:2.5 RR target at 1.4215 from 1.4340 for +125 pips (+2.5% gain when risking 1% on every trade).

EUR/CAD One-Hour Chart for Jan. 18, 2022

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more