EUR/AUD: Confluence Trading

Confluence trading is a combination of one or more trading strategies or techniques that come together and form a high probability buy/sell zone in a certain area in the market.

Market patterns (Elliott Waves, Harmonic, Candlestick patterns, etc.), price action (Support & Resistance, Fibonacci retracements, etc.), and indicators (RSI, Moving Average, Stochastic, etc.) are technical strategies/techniques used when trading a confluence setup.

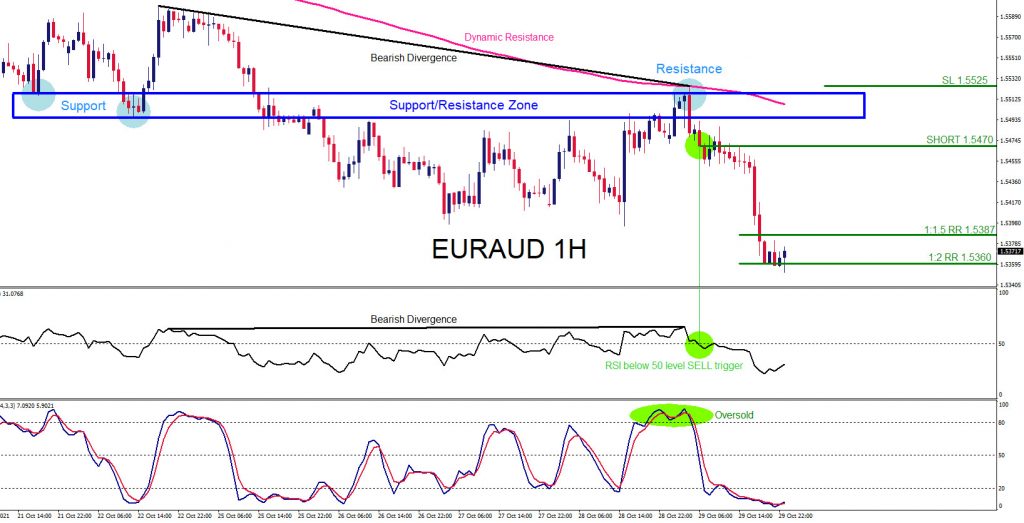

On Oct. 29, 2021, we advised that the EUR/AUD pair was going to move lower.

EUR/AUD One-Hour Chart for Oct. 29, 2021

Trade Setup

- Termination of blue wave (ii) correction signaling a move lower.

- Price respects Support/Resistance Zone (Blue).

- Price respects Dynamic Resistance 200 MA (Pink).

- RSI Bearish Trend Continuation Divergence (Black).

- Stochastic (Overbought).

We entered the trade on the RSI sell trigger at 1.5470 with a Stop Loss at 1.5525 and targets at the 1:1.5 RR minimum and a full target at the 1:2 RR. The EUR/AUD pair moved lower and the price hit the 1:2 RR target at 1.5360 from 1.5470 for +110 pips (+2% gain risking 1% on every trade) on Oct. 29.

A trader should always have multiple strategies all lined up before entering a trade. Never trade off of one simple strategy. When multiple strategies all line up, it allows a trader to see a clearer trade setup.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more

I recommend knowing how a business is doing, how much profit, market share, and if they have just made some fantastic advance, as motivation to buy,sell,or pass. Knowledge beats emotions the vast majority of times.