EU-China Trade Talks To Shape Tariff Impact

China and the EU will start trade talks amid tensions over possible punitive tariffs. The outcome could determine the extent to which the current anti-dumping investigations hit the targeted industries or whether the trade disputes could have a more damaging economic impact.

The trade rhetoric is intensifying as China grapples with increasing allegations of subsidy-driven overcapacity.

After the US announced last month that it would impose tariffs of 100% on imported Chinese electric vehicles (EVs) from 1 August 2024, Turkey followed suit with an additional 40% tariff, or at least $7,000 per vehicle, on combustion engines and hybrids from China, which will come into force on 7 July. Now, the EU has announced a decision on its anti-dumping investigation, initiated in October 2023, to impose additional provisional tariffs of up to 38.1% on electric cars from China from 5 July at the latest, if no prior agreement is reached between the EU and China before then.

China wasted no time in responding. On 17 June, it initiated an anti-dumping investigation into exports of pork and its by-products from the EU, which is set to conclude by 17 June 2025, but could be extended by six months if necessary. In January, China announced the launch of an anti-dumping investigation into brandy from the EU, which should be concluded before January 5, 2025, although it is rumoured that tariffs might be announced as early as August.

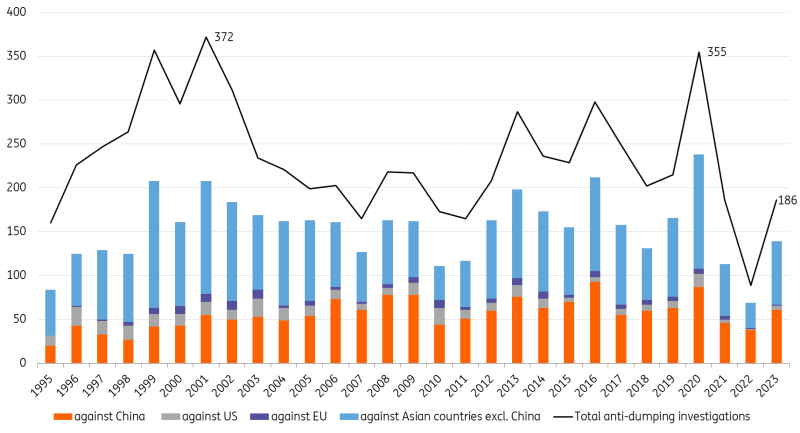

Anti-dumping investigations surge in 2023 amid trade tensions

Anti-dumping investigations are not unusual and follow a standardised World Trade Organization process. In 2023, 186 new anti-dumping investigations, under the WTO rules, had been initiated, up by 97 compared to 2022, but still below the historical average of 233. Most anti-dumping investigations were targeted against China in 2023 with a total number of 61, accounting for 33%. Seven investigations were launched by the EU into Chinese biodiesel, erythritol, titanium dioxide or mobile access equipment exports, amongst others. In total, 86 anti-dumping measures were applied last year, 47 against China. Following an anti-dumping investigation into imports of certain polyethylene terephthalate (PET) plastic products from China in March 2023, for example, the EU imposed temporary tariffs ranging from 6.6% to 24.2% in November. In April 2024, these were converted into fixed duties for the next five years.

Number of anti-dumping initiations since 1995

Source: WTO, ING

What is dumping?

Dumping usually refers to the practice of offering an exported product at a lower price than what is charged in the home market. If this is not applicable, either the price charged by the exporter in another country or a calculation based on a) the combination of the exporter’s production costs, b) other expenses and c) normal profit margins, can be used to determine the existence of dumping.

Under WTO rules, anti-dumping proceedings can be sanctioned by the application of anti-dumping measures, whereby the importing country must demonstrate a clear causal link between the dumped imports and the damage suffered by the domestic industry. All interested parties can present evidence for or against the case made. If the anti-dumping investigation is positive, anti-dumping measures will enter into force for five years and expire automatically after the date of imposition, unless it can be proved that dumping is likely to continue or recur.

China investigates two markets: pork and cognac…

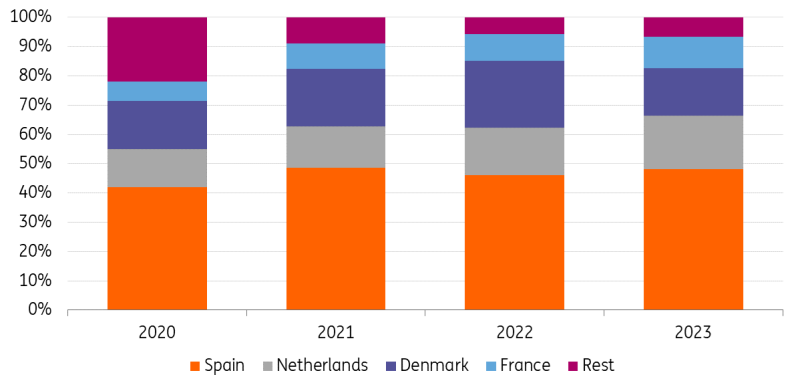

China has started to investigate two potential anti-dumping cases against the EU itself: pork and cognac. In 2023, China imported €2.5 billion worth of pork and its by-products (such as offal) from the EU, 48% of which came from Spain, followed by the Netherlands (18%), Denmark (16%), and France (11%), according to Eurostat data. In total, these four countries accounted for 93% of all EU pork exports. These goods make up only 1.1% of total EU exports to China. However, for countries which have a higher percentage of pork exports, for instance, Spain (16.1% of total exports to China) and Denmark (7.8%), tariffs could have a more negative impact.

In total, China imported over €5.8 billion worth of pork and its by-products, according to Chinese customs data. Yet, for China, additional tariffs remain manageable as China is the world’s leading pork producer, followed at a distance by the EU, and as imports of pork and offal only account for some 5% of China's total pork consumption.

EU exports of pork and its by-products to China by country share (%)

Source: Eurostat, ING; EU trade since 1988 by HS2-4-6 and CN8, value in Euros

Regarding China's investigation into cognac, France was responsible for 99.3% of the import value of all Chinese imports of spirits obtained through distilling grape wine or grape marc (e.g., Cognac, Grappa, Brandy, or Armagnac), worth $1.7 billion (c.€1.6 billion, USD/EUR as of the end of December 2023).

…with potentially intensifying trade retaliation mainly affecting Germany and Slovakia

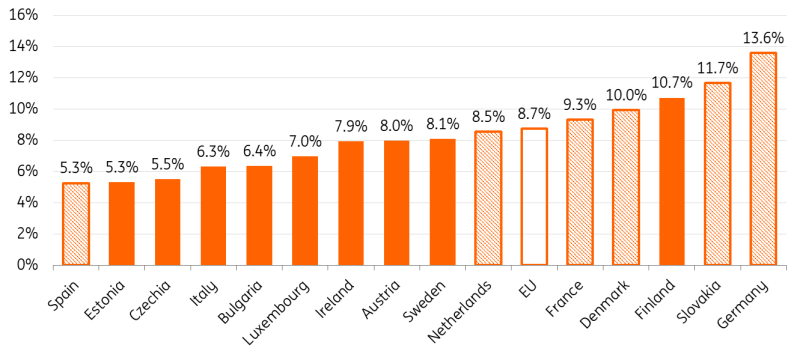

Escalating trade rhetoric can easily degenerate into a full-blown trade war. For China, the EU market is an enormously important sales market, ranking second after ASEAN. But also for the EU, China remains an important export destination; Germany had the highest share for China in its extra-EU exports with 13.6%, followed by Slovakia with 11.7%, while the EU’s overall share stood at 8.7% in 2023.

Share of extra-EU exports from EU countries to China in 2023 (%)

Source: Eurostat, ING. Highlighted countries: particularly affected by the ongoing anti-dumping investigations

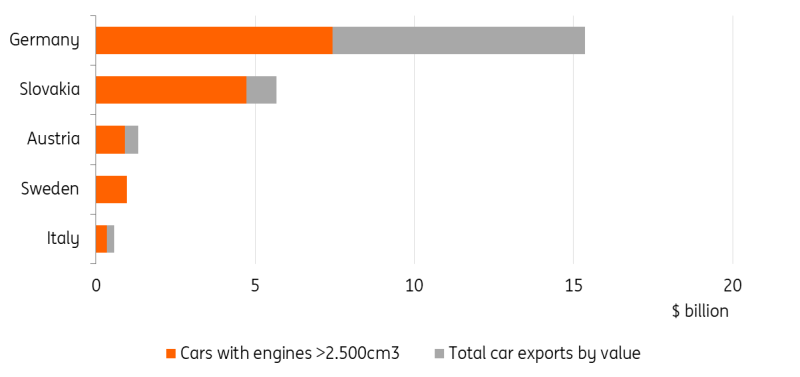

This also shifts the focus back to cars. The threat of rising tariffs on cars with engines exceeding 2.5 litres exported from the EU to China is concerning for Germany and Slovakia, in particular.According to Chinese customs data, Germany (mainly sedans) and Slovakia (SUVs) exported passenger cars (with engines exceeding 2.5 litres) worth $7.4 billion and $4.7 billion, respectively, in 2023 (c.€6.7 billion and c.€4.3 billion, respectively, USD/EUR as of the end of December 2023), targeting 48.4% and 83.3% of both countries' total car export value.[1] For both countries, car exports are the most valuable export product to China.

Western car manufacturers would not only be affected by potential additional tariffs on cars exported to China but also by the planned additional EU tariffs. The market share of Chinese-made cars in EU battery-electric car sales reached over one-fifth (21.7%) but with only 7.6% stemming from Chinese brands which manufacture in China, while 14.1% stem from Western brands exporting to the EU themselves, according to ACEA data. This means that the proposed additional tariffs of 21% are also not in the interest of certain Western companies that manufacture some of their EV models in China and ship them back home, also given the recent slowdown of EV sales in the Western world.

Passenger car imports by China from the EU by largest export countries ($ billion)

Source: China customs statistics (HS-4 8703 and HS-8 87032361-87032422), ING

Following a trip to Asia by German Vice-Chancellor and Economics Minister Robert Habeck, who held talks with China's Trade Minister Wang Wentao, among others, and in close coordination with the EU Commission, China and the EU announced the start of concrete trade talks. A welcome first baby step in an environment where the big blocs are trying to shield their economies. The next few weeks could decide whether the trade talks prove fruitful or whether the dispute could lead to a more dampening effect on the economy. Given the different interests of the EU members, it will not be easy to find common ground.

[1] Chinese customs statistics differ to some extent from Eurostat data with Chinese customs data specifically identifying cars with engines >2.500cm3

More By This Author:

Rates Spark: Words Don’t Solve Fiscal ProblemsCNB Preview: Past And Future Inflation Perceptions Set The Pace Of Easing

FX Daily: Investors Struggle To Stay Bearish

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more