Elliott Wave Technical Review: KOSPI Composite Index

KOSPI Composite Elliott Wave Analysis – Trading Lounge

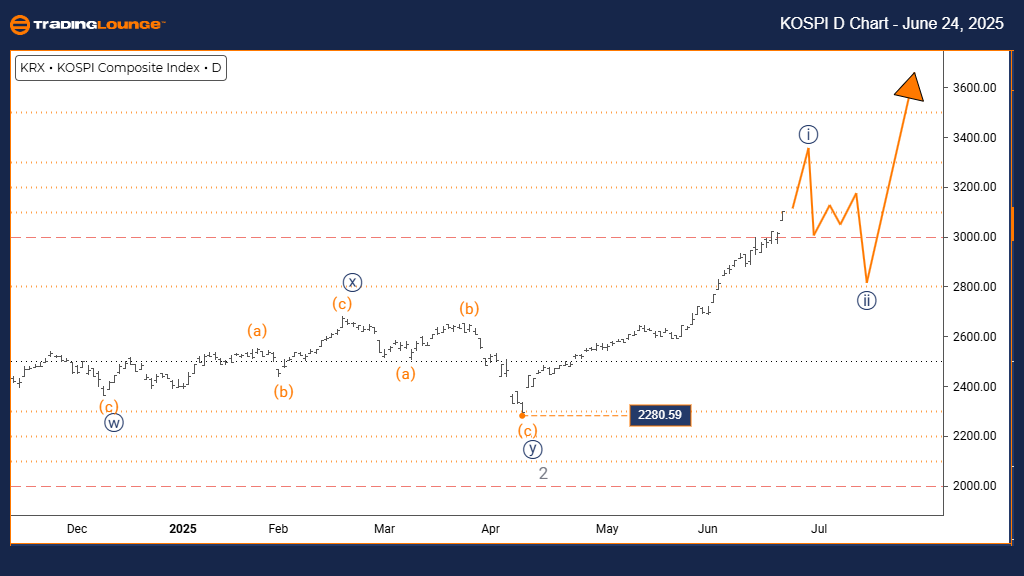

KOSPI Composite – Daily Chart

Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS:

Gray Wave 2 appears to be complete. Navy Blue Wave 1 of 3 is now forming.

Wave Cancel Invalid Level: 2280.59

The daily Elliott Wave chart of the KOSPI Composite shows a bullish trend. The index is moving impulsively, indicating strong momentum. Navy Blue Wave 1 is currently active, developing within the broader Gray Wave 3.

The completion of Gray Wave 2 marks the start of Navy Blue Wave 1, suggesting a new upward leg in the trend. The next expected movement is Navy Blue Wave 2, which typically follows Wave 1 as a corrective pullback before resuming upward movement.

The key level to monitor is 2280.59. A break below this would invalidate the current count and require reassessment. Unless breached, the pattern supports a continued uptrend.

The technical setup indicates KOSPI may experience continued gains. The impulsive structure reflects strong buying activity and supports a bullish outlook as Gray Wave 3 progresses.

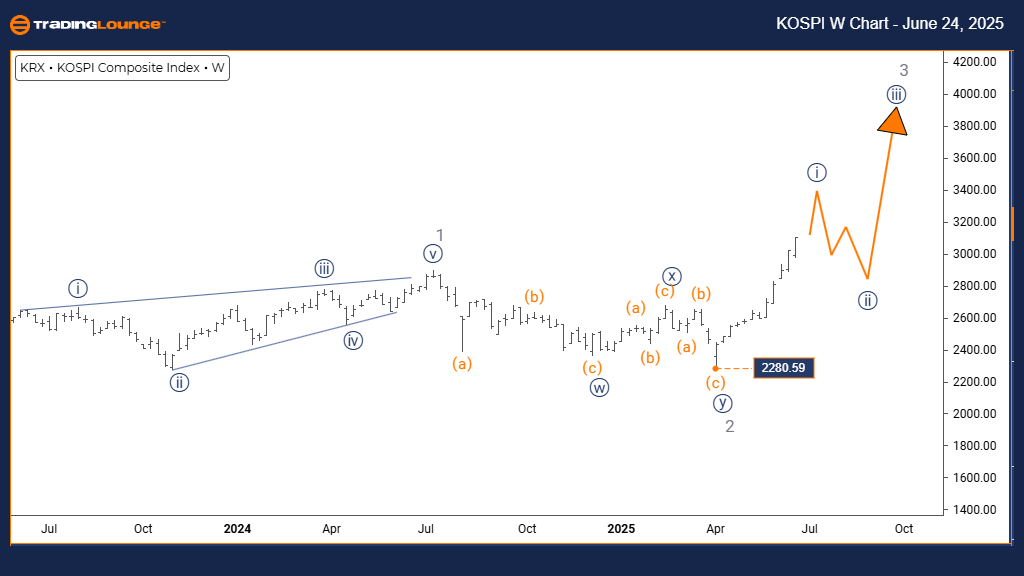

KOSPI Composite – Weekly Chart

Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS:

Gray Wave 2 has likely ended. Now, Navy Blue Wave 1 of 3 is advancing.

Wave Cancel Invalid Level: 2280.59

The weekly Elliott Wave analysis confirms the bullish trend in KOSPI. With impulsive movement active, Navy Blue Wave 1 is forming within Gray Wave 3. This setup signals the beginning of a potentially large new uptrend.

The completed Gray Wave 2 confirms the transition into Navy Blue Wave 1. This phase is usually strong and fast-moving. Once Wave 1 completes, Wave 2 is expected as a corrective phase.

A critical level to watch remains 2280.59. Falling below it would void the current analysis. Until then, the trend favors continued upward development within Gray Wave 3.

The chart suggests a solid uptrend may be underway. Robust institutional interest and impulsive price action support the case for sustained gains in the medium to long term.

Technical Analyst: Malik Awais

More By This Author:

Unlocking ASX Trading Success: Northern Star Resources Ltd - Tuesday, June 24

Elliott Wave Technical Analysis: Theta Token Crypto Price News For Tuesday, June 24

Elliott Wave Technical Analysis: Copper - Monday, June 23

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more