Elliott Wave Technical Analysis: Westpac Banking Corporation

Today's Elliott Wave analysis provides an updated perspective on the Australian Stock Exchange (ASX) focusing on WESTPAC BANKING CORPORATION (WBC).

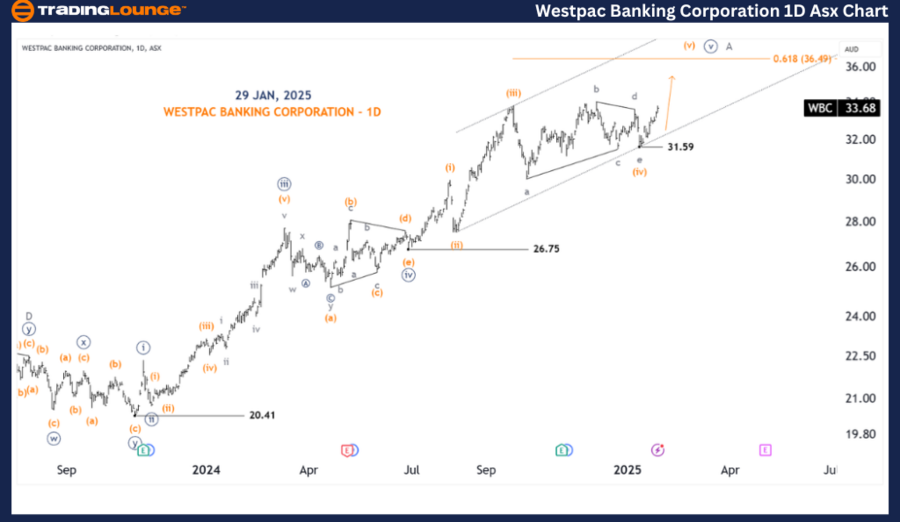

Our analysis indicates that ASX: WBC may have completed a Triangle pattern, suggesting an upward movement. This evaluation also highlights key price levels to help traders determine whether this scenario remains valid, when it is invalidated, and when a bullish confirmation trend is likely to emerge.

ASX: WESTPAC BANKING CORPORATION - WBC (1D Chart, Semilog Scale)

- Function: Major Trend (Minute degree, navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave (v) - orange of Wave ((v)) - navy

Details:

Our analysis identifies a Triangle pattern, with the fourth wave recently completing at a low of 31.59. This setup is followed by the (v) - orange wave, which has begun unfolding in an upward direction. The target price is projected to reach around 36.49 or as high as the upper edge of the channel.

For this scenario to remain valid, the price must stay above 31.59.

- Invalidation Point: 31.59

ASX: WESTPAC BANKING CORPORATION - WBC (4-Hour Chart)

- Function: Major Trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave (v) - orange

Details:

The Triangle formation appears to have completed, with the price pushing above the end of wave d - grey. In the short term, the price is expected to move towards the nearest target at 0.618 Fibonacci ratio of wave (v) to wave (i).

- Invalidation Point: 31.59

Conclusion:

Our Elliott Wave analysis for ASX: WESTPAC BANKING CORPORATION - WBC provides key insights into current market trends, helping traders make informed decisions. By identifying critical price levels that validate or invalidate our wave count, we enhance confidence in our forecast.

By integrating these technical factors, we deliver a professional and objective perspective on market trends, equipping traders with actionable insights for effective decision-making.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Unlocking ASX Trading Success: Scentre Group - Tuesday, Jan. 28

Elliott Wave Technical Analysis: Fortinet Inc. - Tuesday, Jan. 28

Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Tuesday, Jan. 28

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.a0916430b611054dd7df5579f657a496.png)