Elliott Wave Technical Analysis: Car Group Limited

ASX: CAR GROUP LIMITED – CAR

Today’s Elliott Wave analysis updates the outlook for CAR GROUP LIMITED – CAR, listed on the Australian Stock Exchange (ASX). We anticipate upward movement in CAR shares, with the current correction (Wave 4) nearly complete, setting the stage for a potential advance through Wave 5.

ASX: CAR GROUP LIMITED – CAR

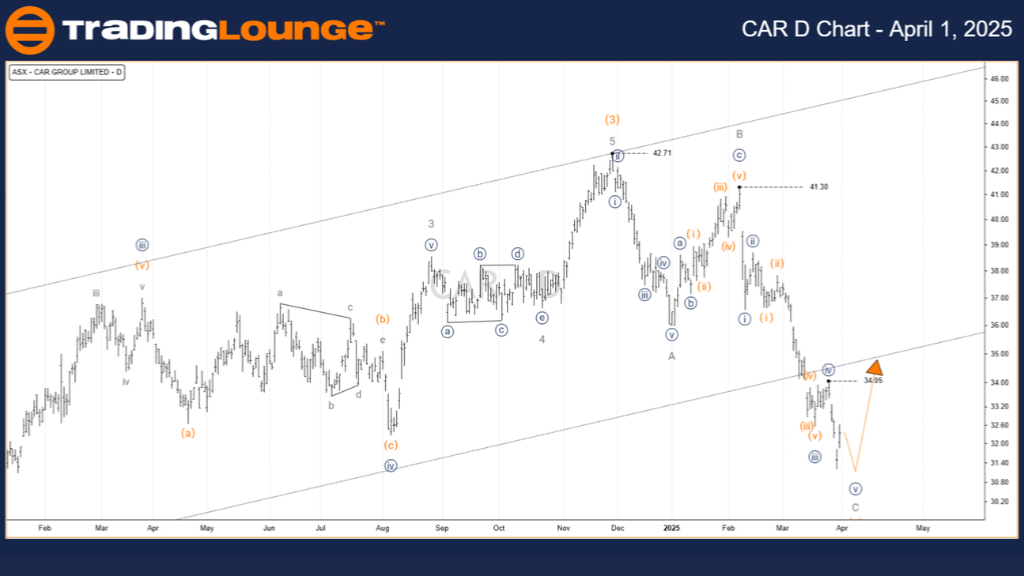

1D Chart (Semilog Scale) Technical Overview

- Function: Major Trend (Intermediate Degree – Orange)

- Mode: Motive

- Structure: Impulse

- Current Wave Position: Wave C (Grey) of Wave (3) (Orange)

Details:

Wave (3) (Orange) concluded near $42.71. The market is now correcting through Wave (4) (Orange), forming an A-B-C Zigzag (Grey). This wave is nearing completion and a move higher via Wave (5) (Orange) is expected.

-

Invalidation Point: $41.30

ASX: CAR GROUP LIMITED – CAR

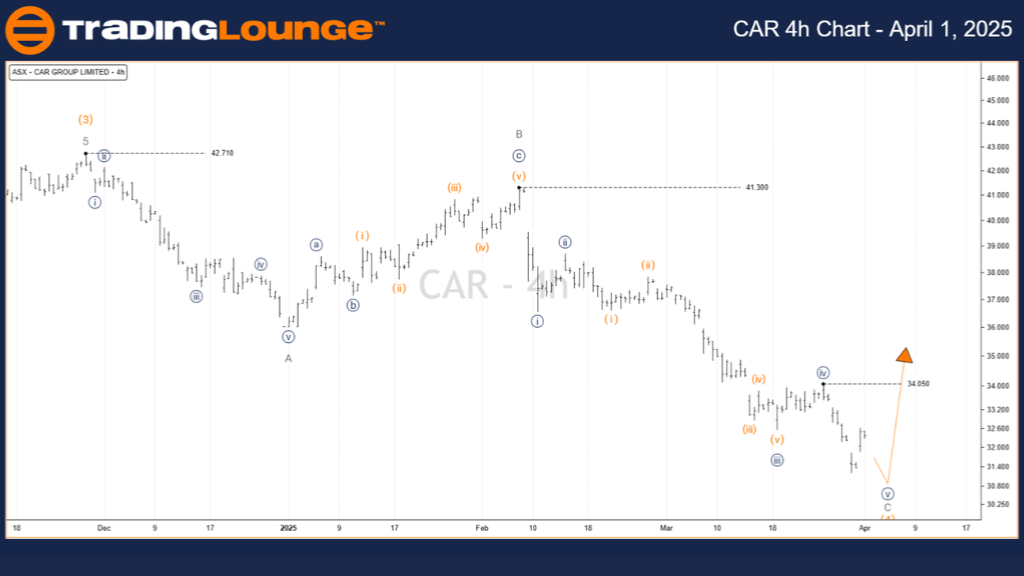

4-Hour Chart Technical Overview

- Function: Major Trend (Minor Degree – Grey)

- Mode: Motive

- Structure: Impulse

- Current Wave Position: Wave ((v)) (Navy) of Wave C (Grey) of Wave (4) (Orange)

Details:

Following the $41.30 high, the C wave (Grey) is unfolding downward in a five-wave structure. The final leg, Wave ((v)) (Navy), appears close to completion. A move above $34.05 would be an early signal that Wave (5) (Orange) is beginning.

- Invalidation Point: $41.30

- Confirmation Point: $34.05

Conclusion

This Elliott Wave analysis outlines both medium and short-term scenarios for CAR GROUP LIMITED – CAR. Specific price points like $41.30 and $34.05 serve as key validation or invalidation levels, improving the accuracy of our forecast. Our goal is to provide professional insights that help traders understand and navigate current market conditions effectively.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Unlocking ASX Trading Success: Insurance Australia Group Limited - Monday, March 31

Elliott Wave Technical Analysis: Nvidia Corporation

Elliott Wave Technical Analysis: Nasdaq Index - Monday, March 31

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more