ECB Holds Rates Steady, Cuts Growth & Inflation Outlooks

Image Source: Pixabay

As completely expected, The ECB held policy steady, reiterating its guidance on future moves unchanged:

“Based on its current assessment, the Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal. The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary.”

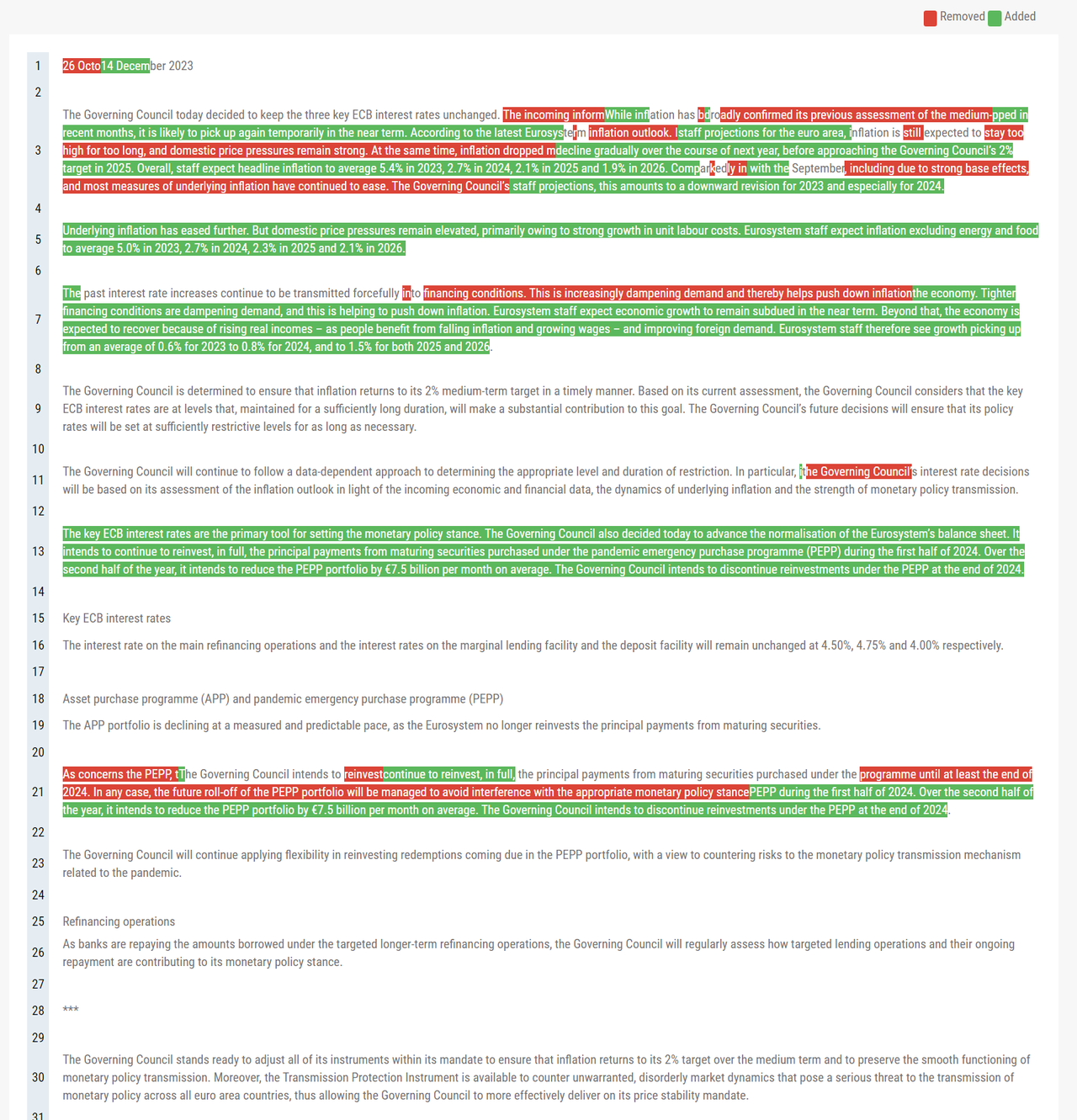

Also as expected, the ECB accelerated its balance-sheet reduction by allowing some bonds maturing from its pandemic portfolio to roll off before the end of next year, which is bearish for bonds. Here’s what the ECB says exactly:

“Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion per month on average. The Governing Council intends to discontinue reinvestments under the PEPP at the end of 2024.”

It had previously envisaged reinvesting the principal payments from maturing securities “until at least the end of 2024”.

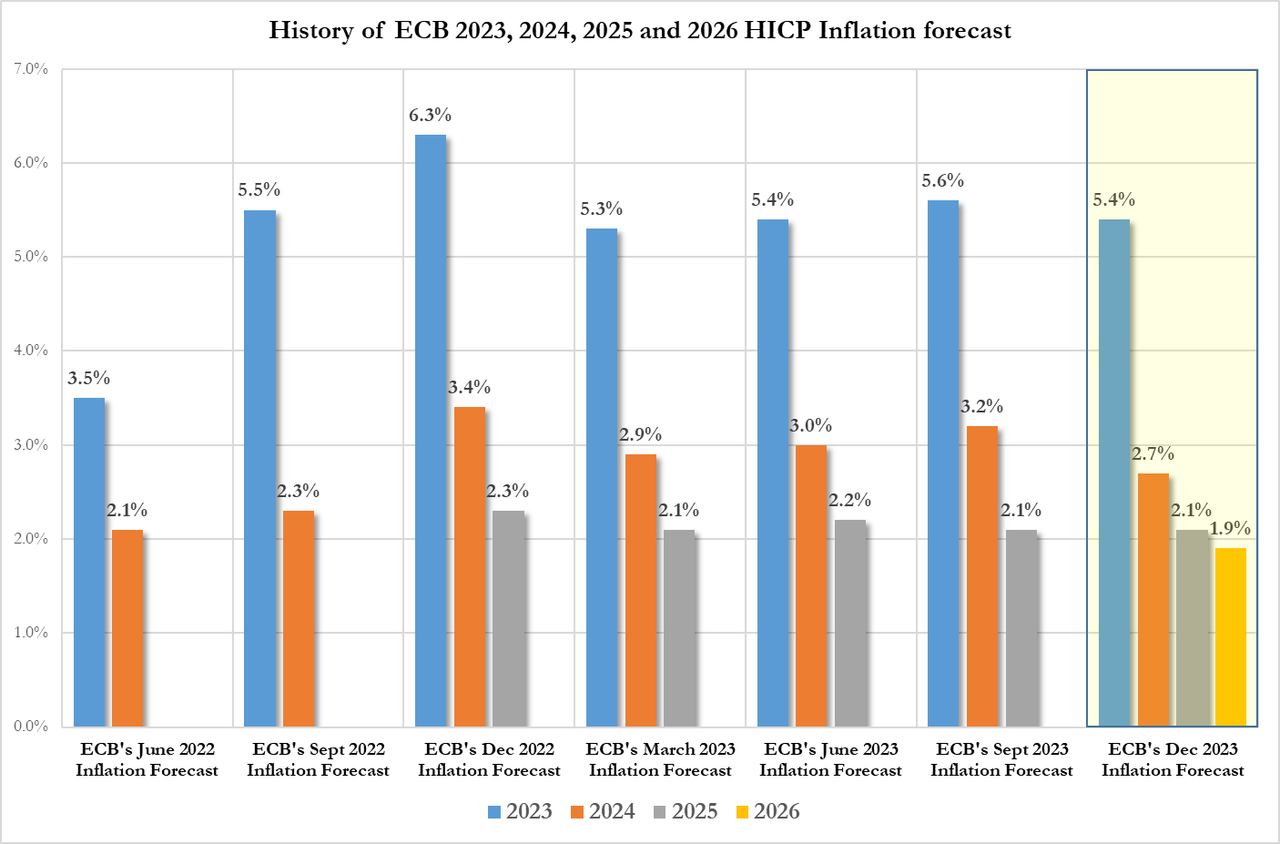

But The ECB slashes its inflation outlook:

- ECB Sees 2023 Inflation at 5.4%; Prior Forecast 5.6%

- ECB Sees 2024 Inflation at 2.7%; Prior Forecast 3.2%

But, The ECB warned that while inflation has dropped in recent months, it is likely to pick up again temporarily in the near term.

Additionally, The ECB lowered its economic growth forecasts:

- Sees 2023 GDP at 0.6%; Prior Forecast 0.7%

- Sees 2024 GDP at 0.8%; Prior Forecast 1.0%

- Sees 2025 GDP at 1.5%; Prior Forecast 1.5%

- Sees 2026 GDP at 1.5%

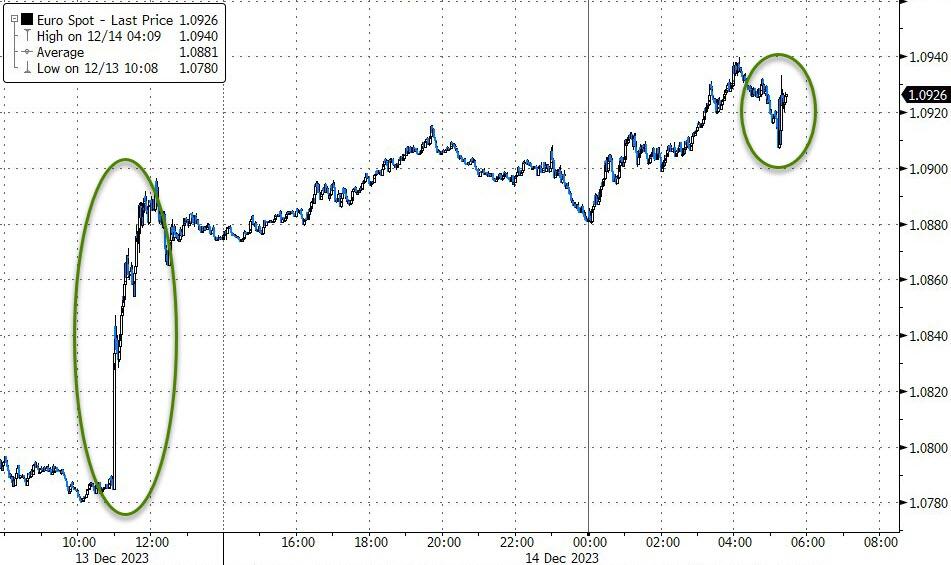

However, it appears, relative to The Fed, this is 'hawkish' and the Euro is holding overnight gains...

There are no real changes in money market pricing over 2024 ECB rate cuts. A total of 154 basis points are priced in, compared with 156 basis points before the statement. The chance of a March cut is steady at around 80%.

Will Christina Lagarde's jawbone a dovish bias?

Read the full redline below:

(Click on image to enlarge)

More By This Author:

Fed 'Dovish Pivot' Sparks Panic-Bid In Bonds, Stocks, & GoldCore Producer Price Inflation Tumbles To 2.0% - Near 3 Year Lows

McLayoffs Incoming: McDonalds Embracing Google's AI For Online Ordering

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more