Easy Money Has Cost A Ton

For three decades, the theory was that ultra-low interest rates allow borrowers to save on interest costs. In reality, low rates prompt most to borrow more and go deeper into debt.

Last year, Bank of Canada (BoC) research acknowledged that thirty years of lower interest rates had worked to inflate home prices and attract capital from productive investment to non-productive speculation in financial assets.

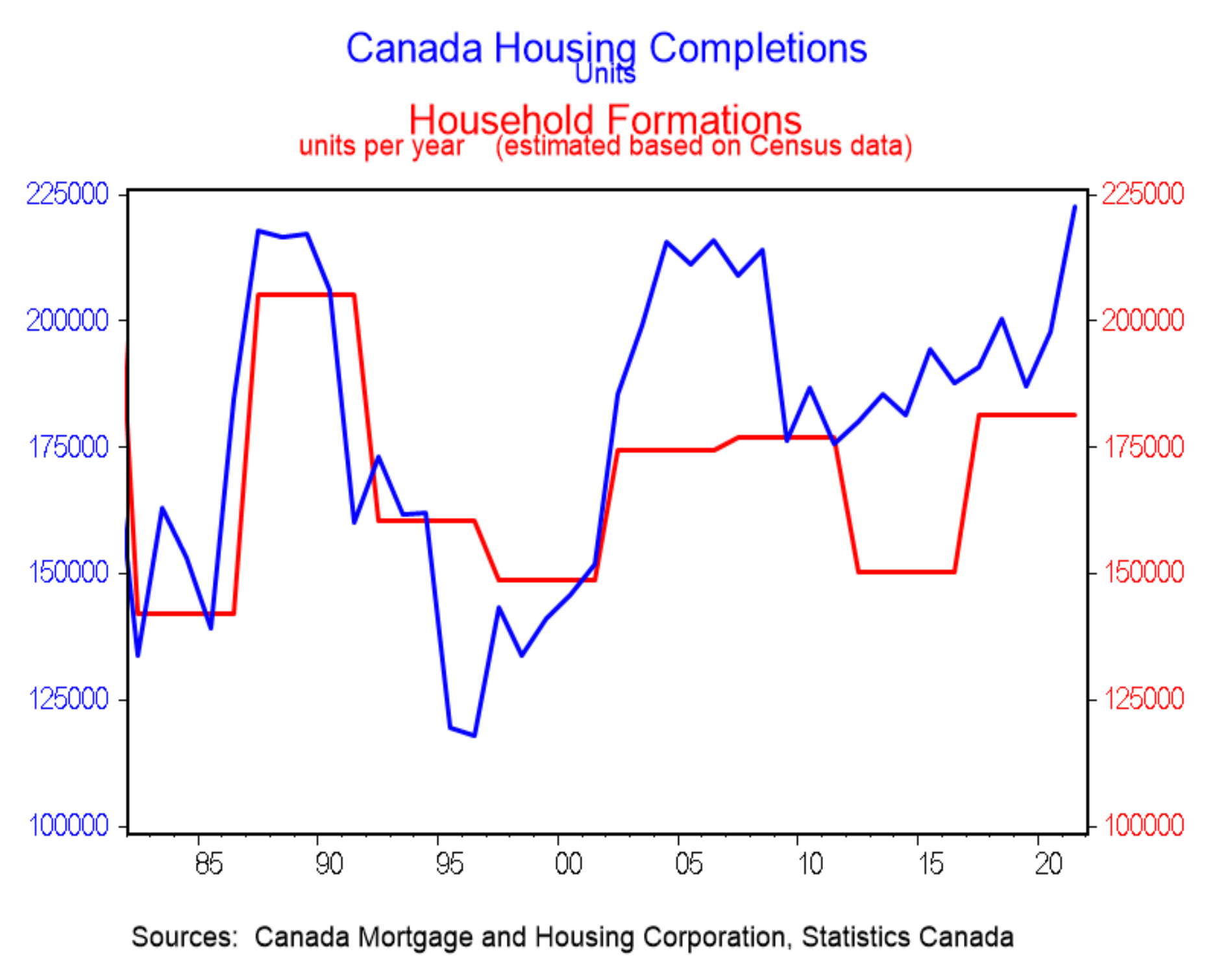

What about the ‘Canada is short housing supply’ trope? Also wrong (household formation in red versus housing units completed in blue below since 1980. See Canada’s housing supply has outpaced household formation for two decades:

New data from the national statistics agency challenges the narrative of Canada’s housing supply shortage. “Canadian Census data on private dwellings occupied by usual residents suggest that household formations have consistently lagged new housing supply for the better part of two decades, even accounting for some likely underestimation of formations,” said Sal Guatieri, a senior economist at BMO.

His calculations show household formations average just over 181,000 in the five years leading to 2021. In contrast, last year the market saw nearly 223,000 newly completed homes, as home prices continued to accelerate. Over the past 5 years, he estimates a surplus of 92,000 homes — eclipsing demolitions, less than half that number on the high estimate.

It will take a combination of lower home prices and higher incomes to enable the household formation needed to sop up our excess housing supply. That’s going to take some years, not just months.

More By This Author:

Bottoming Is A ProcessWhat Happens In China, Doesn’t Stay In China

Average Canadian Home Sale Price Down 18 Percent Since February

Disclosure: None.