DLS And DFJ: Two International ETFs For This Post-Powell Market

Image Source: Unsplash

Federal Reserve Chair Jerome Powell admitted there is little clarity for policy at this time, and this week’s cut may serve as insurance against slower economic growth. Two funds I like are the WisdomTree International SmallCap Dividend ETF (DLS) and WisdomTree Japan SmallCap Dividend ETF (DFJ), explains Brian Kelly, editor of MoneyLetter.

Powell said risks to the Fed’s dual mandate — subdued inflation and maximum employment — are both currently leaning to the negative. The Fed also indicated two more interest rate cuts were on the table for the last three months of this year.

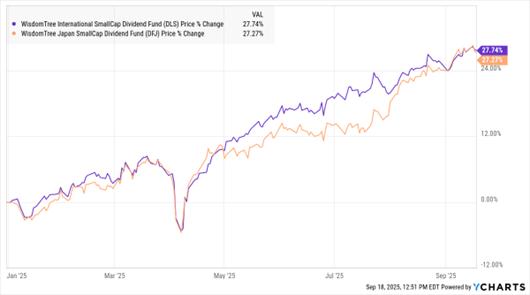

DLS, DFJ ETF Chart (Year-to-Date Percentage Change)

Data by YCharts

Our global stock markets were all higher for the reporting period. From Sept. 11 through Sept. 17, the S&P 500 was up 1%, the Euro Stoxx 50 edged ahead 0.2%, the Nikkei 225 gained another 2.2%, and the Shanghai Composite was up 1.7%.

Our trades in the Japanese market in our Venturesome models three weeks ago have paid off so far, as those stocks have risen due to several supporting factors. DLS invests in dividend-paying, small-cap stocks in the industrialized world outside the US and Canada. Meanwhile, DFJ focuses on dividend-paying small cap companies in Japan.

Finally, despite a cooling labor market, the US economy remains resilient. August retail sales — which were above expectations — are a good indication that the consumer remains mostly healthy. Easing by the Fed adds some important support. It may be wise to maintain your current asset allocations.

My recommended action would be to consider buying the DLS and DFJ funds.

About the Author

Brian Kelly has enjoyed a long career in newsletter publishing and has maintained involvement with MoneyLetter continuously since 1984. He has been a member of the MoneyLetter Investment Committee for over 30 years.

As vice president and product manager for IBC/Donoghue Inc., and IBC USA (Publications) Inc., Mr. Kelly was responsible for all aspects of the MoneyLetter group of products including planning, marketing, fulfillment, customer service, and public relations.

More By This Author:

BMY: A Contrarian Play In An Era Of AI-Related EuphoriaFDX: A Beaten-Down Package Play For A Potential Year End Rally

EPD: A Higher-Yielding, Well-Managed MLP

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more