Demographics Is King

Summary

- Demographics is a hidden economic engine.

- Africa's youth demographics will propel it to growth.

- Qualcomm and GE are attractively poised to take advantage of this growth.

Why do nations prosper? This has been a question that has vexed philosophers for generations and has spawned many theories and indeed the study of economics was forged in the heat of this examination.

My intention today with this article is to highlight an element that is not always widely seen or misunderstood by investors and this element is demographics.

Further, I will then begin to highlight some of the ways thinking about demographics can help investors make better-investing decisions.

Demographics is at its core a study of populations or characteristics of populations for the purpose of drawing statistical data to be used in decision making especially by government entities as through demographic data, they can forecast demand for public services and begin to make advance preparation.

Demographics is also a useful tool for private sector actors as well because within the data, one finds a treasure trove of information that can give indications of future patterns in spending and consumption that can give advanced warning of impending opportunities.

Certainly, we live in a very technologically advanced world but it is a still built on certain economic principles which at its core depends on people to drive it forward.

A famous example is China who leveraged its demographic dividend to become a manufacturing powerhouse to drive its economic growth. China’s demographic advantage was successful because it also coupled it to a very strong geopolitical strategy which is still unfolding and centres on the export of its people, goods, and services around the world.

Therein lies the secret to demographics, if leveraged within a coherent strategy then it can pay dividends for those who can harness it.

Demographics of Youth

A key part of demographics is the youth population. For any vibrant civilization to prosper, there must be young people to work, start businesses and families in order to drive the economy forward and to pay for the care that needs to be given to the elderly and the infirm.

In the article below, the World Economic Forum estimates that there will be a $224 trillion pension deficit by 2050 and made some key recommendations on how this gap can begin to be addressed.

While these were all sensible ideas, they do not really take into account the fundamental essence of pensions which are threefold. Firstly, it is about how much is saved, secondly, over what time period and thirdly where is the excess savings going to be invested profitably in a negative interest rate world.

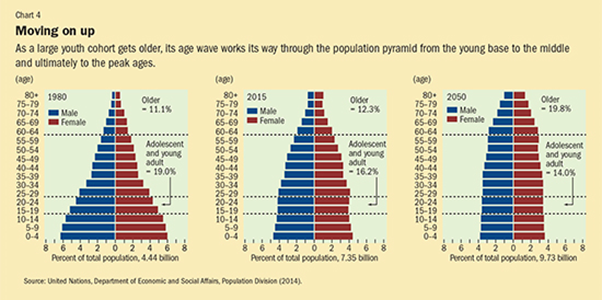

This picture above us is very revealing as it forecasts that by 2050, the age structure of our world will be more balanced which will place more strain on the younger workers going forward. The demographic threat to developed nations

This article concurs by concluding that is no necessarily about absolute population growth or decline but rather about productivity as if we have more elderly people then younger people at work will have to each increase their productivity so living standards can be maintained.

Going forward, we will see this becoming a very big drag on economic growth because it takes much more investments of time and resources to achieve progress in nations with more elderly populations.

It is said that a picture can say a thousand words and this picture clearly says a lot to policymakers and also to us about investors about the way demographics will shape global productivity and wealth going forward.

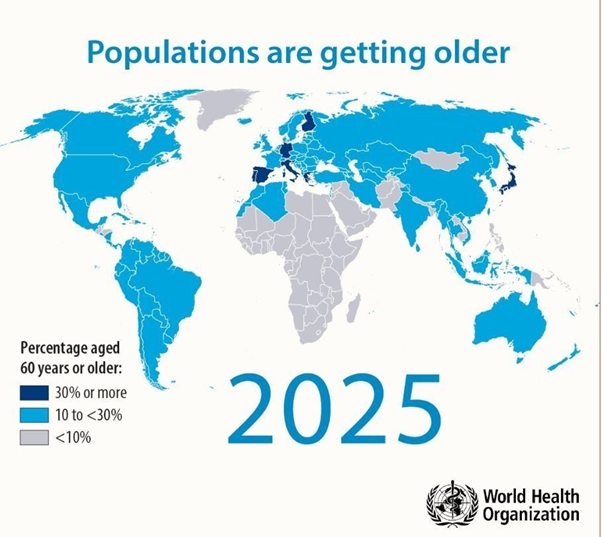

What we see in this picture is how the world will look within less than a decade with Africa having the most youthful population in the world, this has huge positive implications for global investors which will be listed below.

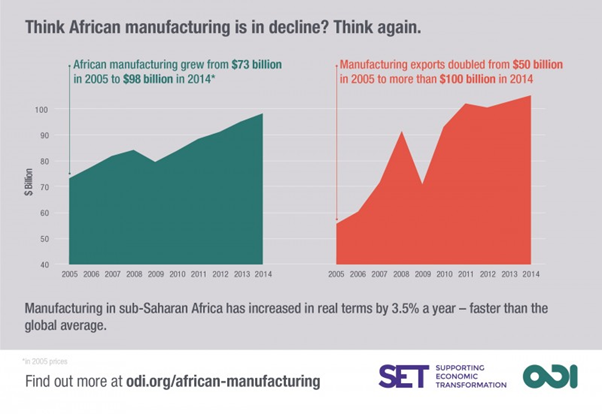

Firstly, global manufacturing is beginning to shift towards Africa, the chart below shows a progressive increase in manufacturing and manufacturing exports from Africa. What this tells us is that Africa will increasingly be the location of choice for global companies setting up factories.

This article studied whether Africa can indeed become the new global manufacturing hub but found that with exceptions such as Ethiopia, Africa is not yet competitive enough compared to places like Bangladesh.

However, it is worth noting that Africa is coming from a low base especially in terms of infrastructure, healthcare, and education, therefore the manufacturing revolution will be at the nexus of all of these converging factors.

Secondly, technology is helping young people leap over challenges of time and space in Africa. Foresight Africa viewpoint - Rethinking African growth and service delivery: Technology as a catalyst

In this article, the authors are urging the readers to rethink long-held assumptions of growth and progress in Africa because technology is quietly disrupting every sector and is scaling up rapidly.

It also redefines economic growth trajectory by arguing that it is in the ability to transform, utilize, and process digital sources of value that will help countries derive the greatest comparative advantages.

If this prediction proves to be true especially with the emphasis on digital assets and stores of value then with its tech-savvy young population, Africa will leapfrog many nations including developed nations because it can adopt and scale technology quickly without the drag of expensive and cumbersome legacy systems that drain costs and reduce competitiveness.

Even within the aforementioned manufacturing sector, the type of manufacturing we will see in Africa will be different from the Asian model because it will be focused from the beginning on high tech value-added products.

Thirdly, consumer markets in Africa will continue to grow robustly over the next few decades.

This is especially the case for the retail and eCommerce sector where we are likely to see significant growth going forward.

However, in terms of how investors can safely enter, I will suggest two key sectors which will be the foundation for further growth in other sectors.

The first is power generation and the second is wireless technology. Advances in these two sectors are very critical and the two companies that I see truly benefiting from Africa’s growth are General Electric GE and Qualcomm QCOM.

Qualcomm’s knowledge in wireless technology in Africa and especially its key relationships with partners like MTN positions it for strong growth going forward within the digital space.

I believe this will be an unfolding story, especially over the next five years with the growth in Africa adding significant revenues to the company.

The second company is General Electric for Africa’s power generation. GE already has a long history in Africa but it will now really be coming to the fore because it provides complete power solutions especially with its Smart Grids and expertise on renewable energy which will become increasingly important in Africa.

Even more importantly, GE can present itself as a credible alternative to the large Chinese energy companies operating throughout Africa. Despite its current challenges, it still remains a strong company.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.