December’s ECB Cheat Sheet: A Reality Check For Ultra-Dovish Expectations

The ECB will almost surely keep rates on hold at the December meeting. The question is to what extent it will align with the market's aggressive pricing for rate cuts in 2024. We suspect it will fall short of endorsing ultra-dovish expectations. There is some upside room for EUR rates and the battered euro.

(Click on image to enlarge)

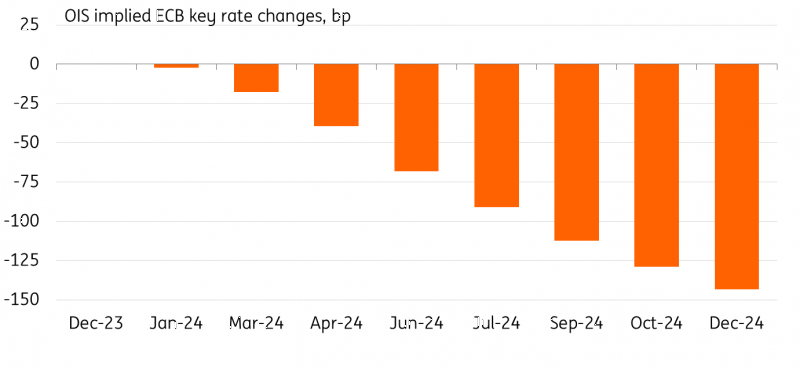

Heading into the European Central Bank's December meeting, there is growing evidence that the Governing Council is split about the messaging being presented to markets. The generally arch-hawk Isabel Schnabel dropped strong dovish hints by ruling out rate hikes this week, and markets are now pricing in 135bp of cuts in the next 12 months. We see a good chance that the overall message at this meeting will fall short of endorsing aggressive rate cut expectations. Above are the market implications in various scenarios. Our full ECB preview can be found here.

A still-cautious ECB may not validate aggressive front end pricing

A reassessment of inflation expectations has been in the lead in driving rates lower and raising the expectations of first rate cuts at the end of the first quarter next year. From next summer onwards, market indications point to anticipated headline inflation fixes below 2%. Indeed, the 2Y inflation swap has dropped to 1.8%.

It is easy to overlook that at the same time, core inflation is currently still running at an elevated 3.6% year-on-year, giving the ECB enough reason to remain cautious. However, the pushback against aggressive market pricing has been half-hearted at best, with officials’ remarks having put cuts in the first half of next year clearly into the realm of possibility. But whether they're likely is a different question. The ECB may well decide to let the data be the judge – but at the same time, it remains more reluctant to extrapolate to the extent that the market does. Its own inflation forecast may come down next week, but potentially not to the degree that markets are discounting.

We see a good chance that the rally in front end rates – which currently discounts a 75% probability of a cut next March – stalls, if not unwinds to some extent. The longer end may see less upward pressure, though. In the extreme, the Governing Council coming across as overly hawkish and brushing off the faster disinflationary momentum could push markets into the belief that a policy mistake is in the making.

ECB rate expectations

(Click on image to enlarge)

ING, Refinitiv

Lagarde can throw a lifeline to the unloved euro

The idiosyncratic decline of the euro has been one of the key themes in FX lately, with the common currency being the worst-performing currency so far in G10. The aggressive dovish repricing of ECB rate expectations has been the main driver, and the comments by Isabel Schnabel right before the pre-meeting quiet period have fuelled the bearish narrative further.

With 125bp of cuts priced in by October and markets actively considering a start to the easing cycle already in March, it's difficult to see a bigger dovish repricing happening at this stage. That would suggest the euro does not have to fall much further from the current levels. Still, if only short-term rate differentials are taken into account, a decline to the 1.06 area in EUR/USD would not be an aberration. What is already halting the euro slump is the upbeat risk sentiment, which favours pro-cyclical currencies like the euro and caps the upside for the safe-haven dollar.

We expect the ECB to continue its transition to a dovish narrative, but that will – in our view – happen at a slower pace than what markets are implying. We see tangible risks that the the central bank will push back against aggressive dovish speculations at this meeting, and the market may be forced to unwind some of those rate cuts bets, offering room for a EUR/USD rebound. That said, a EUR/USD recovery would struggle to extend much longer after the meeting due to the short-term EUR-USD swap spreads still pointing to a lower exchange rate.

More By This Author:

Asia Week Ahead: Inflation From China And India, A BSP Pause And Australian Unemployment

The Commodities Feed: Oil Demand Risks Linger

FX Daily: Yen Back In The Spotlight

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more