Deal Or No Deal? The Journey To Get There? That’s Still A Grinder

Image Source: Pexels

MARKETS

Choppy, range-bound, and forgettable — that's how you'd describe today’s session heading into the weekend. But step back, and it's been a strong week across the board: stocks popped, bonds caught a bid, the dollar firmed up, and even Bitcoin flexed — all while the legacy media keeps playing down any real progress on U.S.-China trade talks. If you want to take Beijing’s denials at face value, be my guest — but markets clearly aren't buying that narrative.

The main sideshow today? More handwringing over whether trade talks are actually happening. Here's a shocker: real diplomacy doesn’t get faxed out for confirmation. Backchannels exist for a reason. And guess what? Whether there was a “meeting” or a “non-meeting” doesn’t even matter anymore; it’s perception. Stocks continue to grind higher; tech is leading the way.

My view is simple: Take the win and run to the bank with it !! Never trust rallies in a bear market.

WEEKLY RECAP

Markets ripped higher this week, riding what felt like a first-quarter timeout in the trade war. After stumbling out of the gate Monday, Wall Street found its footing fast once the White House hit the brakes on the “Fire Powell” sideshow. Trump walked it back, saying he had no plans to can the Fed Chair after all. Meanwhile, thin whispers floated around about dialling down the monster tariffs or carving out exemptions—no real movement, of course. Let’s be honest—when you’re charging north of 100% on imports, that’s not a tariff, that’s an economic blockade. And when the two sides can’t even agree whether they’ve picked up the phone, you know this is going to be a brutal, dragged-out street fight. As the old market adage goes: buckle up—it’s going to be a long, bumpy road ahead.

Still, the S&P 500 squeezed out almost a 4% gain, clawing back to the best levels since what I’ll call Reciprocal Tariff Day (because sorry, there’s no way I’m calling it "Liberation Day"). A few sessions ago, we were staring down the worst April since the 1930s. Now? The indexes are down a pedestrian 2% for the month. Outside of equities, the rest of the tape was a snore. FX barely moved. Treasuries sat glued after last week’s reset, with 10-year yields pinned around 4.3%—right back to pre-election levels. Lots of noise, very little signal.

The macro calendar was a sideshow too, but the IMF did drop its latest outlook—and hacked global GDP forecasts in the process. No shocker: they finally slashed 2025 growth to 2.8% (we’re even lower at 2.6%), and 2026 to 3.0% (versus our 2.7%). Reminder: the old "normal" for global growth is closer to 3.5%, and the IMF is always a few steps too optimistic. China took a heavy body blow—growth was cut in half to 4.0% this year and next. But the absolute carnage was in North America. Since January alone, the IMF has cut the U.S. growth forecast by 0.9 percentage points to 1.8%, Canada by 0.6 percentage points to 1.4%, and Mexico by 1.7 percentage points to -0.3%. Frankly, even those cuts are still too polite.

On the ground, the hard data still looks decent, but it’s a mirage. March retail sales were boosted by front-running—people rushing to buy before tariffs took full effect. Meanwhile, consumer and business sentiment are taking a hit. Michigan sentiment just cratered to a 45-year low. Companies are finally starting to talk—airlines, trucking firms, you name it. They’re all flagging demand softening fast. The real reckoning comes next week with Q1 GDP, ISM Factory, and payrolls. That’s when fantasy meets reality, and frankly, it would be political suicide for the White House to ignore “ Barcode Diplomacy.”

So why are investors still navigating blindly through this mess? Simple: they’re betting that the storm will clear if Trump eases the tariffs just enough. Sure, China talks are like a knife fight, but the White House is pushing the "we’re making progress" narrative with Japan and Korea. Count me as a skeptic. Most likely, we’ll end up somewhere unpleasant but manageable: a 10% universal tariff baseline, with additional charges applied to autos, metals, pharmaceuticals, and chips. China (and a few others) will face severe penalties for overcapacity and what are considered security issues. It won’t be pretty, but at least it provides something the market can model. The journey to get there? That’s still a meat grinder.

FOREX MARKETS

The Convexity is in The Data Now, Not the Rhetoric. (See Nuts & Bolts Below)

The dollar’s in a slow-motion unwind, and anyone looking through the right lens can see why. After riding high for over a decade on U.S. exceptionalism, the cracks are finally showing. It's not just sentiment anymore—relative growth dynamics are shifting hard. Europe, led by a surprise German fiscal blowout, is holding up better than expected, while the U.S. is staring down the barrel of a major downgrade. Forecasts have been slashed: U.S. GDP expectations gutted from 2.5% to 1.3%, while Europe barely flinched. The global growth gap that kept the dollar bid since the GFC is reversing, and that’s only half the story.

The real dollar drag? Two to three trillion dollars' worth of unhedged USD assets sitting in global portfolios, rotting on the vine. If even a slice of that gets hedged or repatriated, it’s a tidal wave of dollar selling that could last months—maybe years. Early signs say it's starting. These aren’t hot money flows you see flickering on daily screens—this is C-suite risk management shifting underneath the surface, slow but relentless.

Fair value models are still flashing warning lights. The dollar is anywhere from 10% to 15% overpriced relative to trade-weighted history. DXY hovering around 99.60 today looks rich when just a few years ago, during the COVID cleanup, we were camped out between 85 and 90 without blinking. Structurally, there's room for more bleeding. And that’s before the hedging tsunami hits full force.

The smart flows? Still selling dollars. The conviction isn’t about politics or sentiment swings—it's about relative growth, slowing U.S. momentum, and eventually, real rate differentials flipping against the buck. Timing it perfectly is a mug’s game, but the path is pretty straightforward: a soft U.S. economy triggers the Fed to blink, carry unwinds, and dollar support crumbles under its own weight. The convexity is in the data now, not the rhetoric.

Right now, short USDJPY looks like the cleanest expression of the move. Japan's sitting on piles of unhedged U.S. exposure, repatriation is picking up, and if U.S. stocks wobble—or the economy catches a real downdraft—dollar-yen will go with it. Shorting USDJPY around 143–145 ( I started at 142.50 and layering in every 50-75 pips) looks savvy, both tactically and structurally. You get flow dynamics, equity-risk correlations, and relative rate pressure all lining up.

Biggest risk? The Fed flips hawkish hard—but even last week's slightly tougher Powell stance couldn’t save the dollar. That tells you all you need to know. The market isn’t trading Fed soundbites anymore; it’s trading real growth cracks. Watch the incoming data, not the chatter. If hard data starts breaking, the dollar’s floor won’t just give way—it’ll fall straight through.

Until then, it’s a headline-driven tape: tariffs, White House noise, occasional Fed theatre. But the real trade—the real move—is already in motion. Hope might be the story they’re selling. Flow is the story the market is writing.

NUTS & BOLTS (Economic Overview)

The direction of travel is obvious now, even if the final landing zone isn’t — and you can bet the White House economists are reading the same doom loop we are. This week gave us even more proof that the economy’s losing altitude. The Conference Board’s Leading Economic Indicators tanked another 0.7 points in March, marking the fourth straight monthly drop and the biggest hit since October 2023. These indicators aren’t noise — they’ve flagged almost every major cycle turn, and they typically lead by about seven months. Consumer expectations, stocks, new orders, even credit spreads — everything that matters is rolling over. This isn’t a soft patch. It’s the real drag starting to pull through the system.

And now the so-called service sector "resilience is cracking too. Services account for 86% of U.S. jobs and almost 80% of GDP — but the S&P flash PMI just slipped again, falling from a rock-solid 56.8 in December to a shaky 51.4 in April. Barely clinging to expansion territory. First quarter GDP growth is stuck at an ugly 0.4% annualized, and the consumer — who was supposed to be the last man standing — is looking more like a deer in headlights. Equipment spending can’t plug the hole left by a spooked consumer and a surge in imports. Bottom line: while we’re not flashing full-on recession yet, the setup is getting worse by the week.

The labor market’s throwing out mixed signals — but look closer and it’s leaning soft. Layoff announcements are spiking hard — 275,000 jobs cut according to Challenger, up 204% from a year ago, highest since COVID panic. Most of the blood is still in the public sector (DOGE cuts mostly), but cracks are widening. Initial jobless claims are hanging steady for now at 222k, but forward momentum is dead. Next week’s payrolls should be telling — we’re looking for a sharp drop to 130k jobs, a rise in unemployment to 4.3%, and a shorter workweek at 34.1 hours. That’s classic slowdown tape if it lands.

And the real drag on everything? Trade policy chaos. As long as tariffs are clouding supply chains and torching margins, businesses aren’t going to make bold moves. Capex freezes, hiring stalls, inventories pile up. The Fed knows it too. Powell can’t cut yet — not while inflation’s getting an artificial tariff-driven pop — but sitting still while the economy slows is no one’s idea of "mission accomplished." They’re boxed in, and they know it. We’re staring at stagflation light, and the Fed’s best hope is that the consumer rolls over slowly enough to buy them time and cool inflation.

Until the tariff smoke clears, this market remains ensnared in the headlines, rumour mill, and chasing every trivial White House soundbite. Hope is still alive — for now. But deep down, anyone who's been through a few cycles knows exactly where this is heading. The real drag isn’t a missed print or a Fed misstep — it’s the slow, grinding uncertainty that's freezing the economy from the inside out.

FED INDEPENDENCE UNDER THE MICROSCOPE

Fed Challenger Slams Powell’s Legacy, Blames ‘Systematic Errors’ for Policy Failures

Meet your new shadow Fed chair. Kevin Warsh just made it crystal clear he’s stepping into the spotlight as Powell’s inevitable replacement. Expect to see a lot more of him in the coming days as he becomes de facto Chair in waiting. Warsh didn’t just throw shade at the current Fed — he lit it up. Speaking at a Group of 30 event, he torched the central bank for "systematic errors" and letting inflation run wild, accusing it of drifting from its job into general-purpose government activism. In Warsh's words, since the 2008 panic, the Fed’s gone from lender of last resort to enabler of every fiscal blowout Washington could dream up.

He slammed the $7 trillion balance sheet for propping up a reckless Congress, subsidizing massive deficit spending with artificially cheap debt. In plain English: Warsh is calling the Fed a co-conspirator in America's fiscal mess, not a neutral guardian of price stability. And he’s not wrong.

The real kicker? Warsh is positioning himself as both the market’s hard-nosed inflation cop and Trump’s cleanup hitter. He blasted the Fed’s side gigs on climate change and “inclusion” agendas, saying they distracted from the real mandate — inflation and stability. He even gave Powell a little backhanded credit for belatedly bailing from the global ESG networks — but it’s clear Warsh sees that move as too little, too late.

The political setup is now obvious. Trump has already floated the idea of firing Powell, only to walk it back — classic Trump, keeping the option alive while letting markets chew on the possibility. Treasury Secretary Bessent has already signaled the replacement search gears up this fall. Warsh and Kevin Hassett are the clear frontrunners. Between the lines? If the economy buckles or inflation flares again, Powell’s leash gets yanked. Warsh steps in.

Markets aren't stupid — they’re already pricing in the slow erosion of Fed independence. That’s why equities and the dollar got clipped last week when Trump cranked up the heat. Warsh says he believes in the Fed's "operational independence" — but he made it brutally clear: that doesn’t mean central bankers are pampered princes who get a free pass when they blow the mandate. When outcomes are bad, serious heat needs to come their way.

Big picture? Warsh’s moment is coming fast. If Powell flinches, if inflation stays sticky, or if Trump needs a public scalp to reframe the economy into election season, the call's already been made. The only question is how clean — or how bloody — the handoff will be.

My Take On The Modern Day Fed

Dusting off my almost full-fledged economist hat—yeah, I ditched the postgrad dream after Year Two for the siren call of the trading room—let’s get something straight: the modern central bank’s real job isn’t to lead markets, it’s to mop up the mess left by vote-chasing politicians running bloated Keynesian playbooks. They juice demand, distort supply, and inevitably light the inflation fire. Then, like clockwork, the Fed lumbers in with its dull toolbox—rate hikes, QE, tightening, easing—trying to “correct” what was never a market-based misfire to begin with. And when the inevitable blowback hits? Fiscal policy skates free. The Fed gets the blame.

Now here’s the meat: economics isn’t some high priesthood decoded by PhDs running DSGE models in a dark room. It’s just the brutal business of allocating scarce resources—capital, labour, materials—where they’re actually needed. Anyone who thinks a panel of government-appointed central planners, whether they’re waving a Keynesian flag or a Friedmanite one, can consistently outperform real-world price signals is deluding themselves.

Mercantile markets ( not to be confused with stock markets) have already built the only working mechanism we’ll ever have: price. Not just an academic model, not just a policy memo. Prices are the real-time, real-world reflection of human needs and scarcity. The Fed’s models don’t discover truth; they chase it, often late, often wrong. That’s not some bug in the system—it’s the system itself. And pretending otherwise is the biggest con job in modern macro.

CHART OF THE WEEK

Why has the euro been strengthening

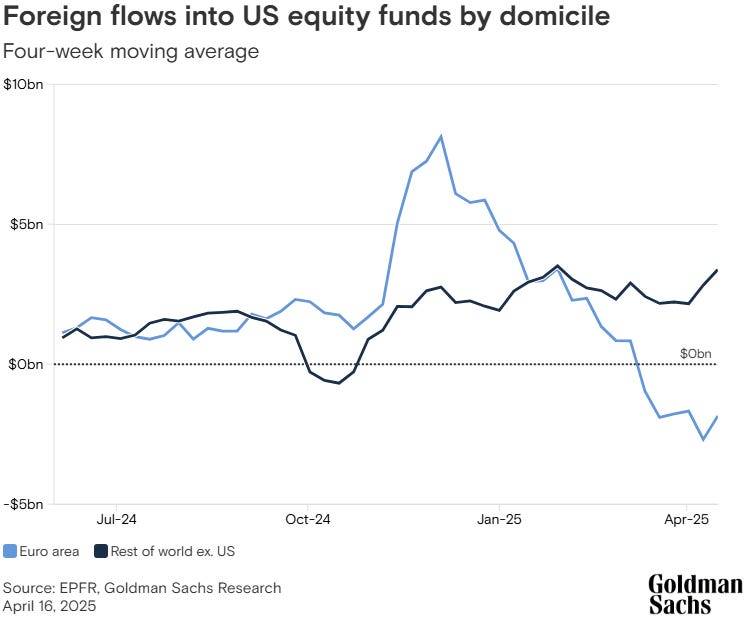

The global tape is starting to reprice fast. Tariffs, slowing U.S. growth, and rising policy risk are forcing investors to rethink a decade of blind faith in U.S. outperformance. The euro’s grind higher against the dollar isn’t just about interest rate differentials anymore — it’s the other side of a bigger trade: a slow erosion of the "Buy America" reflex that’s been running hot since the post-GFC recovery.

European investors — who’ve been massive buyers of U.S. assets over the past decade — are hitting the brakes. With U.S. equities losing their shine and recession risks creeping higher, the FX risk tied to holding dollar-denominated assets is starting to look a lot less appealing. The logic is simple: why stay long USD exposure if U.S. returns aren't compensating you for the currency drag anymore?

Fund flows are already showing early signs of a shift — not a panic dump, but a quiet tightening of new allocations. And that’s how real devaluations start: slow, persistent flow pressure, not one big crash. Nobody’s talking about a disorderly exit — yet — but if the incremental demand for U.S. assets keeps drying up while repatriation kicks in, the dollar’s long-standing valuation premium is going to bleed down quarter by quarter.

This isn’t about some textbook "risk-off" event — it’s about a structural reweighting in portfolios that spent the last decade overexposed to U.S. exceptionalism. The more growth gaps close, the more the dollar loses its bid. Flow tells the real story — and the flow is starting to turn.

More By This Author:

New York Close : Fed Waller Blinks, Trump Winks, And The Rally Finds Room To Run

Sticky Tape, Slippery Truths: The Melt-Up That’s All Optics, No Anchor

From Doomfest To Moonshot: Risk Ignites On Trade Whispers